Volvo 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk management

– an important part of our operation

All business operations involve risk – managed risk-taking is a

condition of maintaining a sustained favorable profi tability.

involves adjusting production capacity and

operating expenses.

Intense competition

Continued consolidation in the industry is

expected to create fewer but stronger com-

petitors. Volvo’s products face substantial

competition, which may have a significant

impact on the prices Volvo receives for its prod-

ucts and on the Group’s future sales volume.

Our major competitors are DaimlerChrysler,

Paccar, Navistar, MAN, Scania, Caterpillar,

Komatsu, Cummins and Brunswick. In recent

years, new competitors have emerged in Asia,

particularly in China. These new competitors

are mainly active in their domestic markets, but

are expected to increase their presence in

other parts of the world.

Our brands are well-known and strong in

many parts of the world. For the Volvo Group, it

is important that all brands in the Group are

developed and supported. Strong brands com-

bined with an attractive product portfolio make

it possible for Volvo to be competitive.

Prices for commercial vehicles

may change

The prices of commercial vehicles have, at

times, changed considerably in certain markets

over a short period. This instability is caused by

several factors, such as short-term variations in

demand, shortages of certain component

products, uncertainty regarding underlying

economic conditions, changes in import regu-

lations, excess inventory and increased com-

petition. Overcapacity within the industry can

occur if there is an economic downturn in the

Group’s major markets or worldwide, potentially

leading to increased price pressure.

The financial result of the business depends

on our ability to quickly react to changes in

demand and particularly to adapt production

levels, reduce production and operating

expenses, and deliver competitive new prod-

ucts and services.

The commercial vehicles industry

is subject to extensive government

regulation

Regulations regarding exhaust emission levels,

noise, safety and levels of pollutants from pro-

duction plants are extensive within the industry.

These regulations are subject to change, often

making them more restrictive. The costs to

comply with these regulations can be signifi-

cant for the commercial vehicles industry.

Most of the regulatory challenges regarding

products relate to reduced engine emissions.

The Volvo Group is a significant player in the

commercial vehicle industry and the world’s

largest producer of heavy-duty diesel engines.

The product development capacity within the

Volvo Group is well consolidated to be able to

focus resources for research and development

to meet tougher emission regulations. Future

product regulations are well known, provided

that they are not changed and the product

development strategy is well tuned to the intro-

duction of new regulations. The new regula-

tions regarding product emissions are strin-

gent, but our current assessment is that they

are manageable for the Volvo Group.

Volvo has had production facilities in numer-

ous countries worldwide for many years. A

worldwide production standard for environ-

mental performance has been introduced,

enabling production plants to achieve best

industry standard.

>>> Risk may be due to events in the world and

can effect a given industry or market. Risk can

be specific to a single company. At Volvo we

work daily to identify, measure and manage risk

– in some cases we can influence the likelihood

that a risk-related event will occur. In cases in

which such events are beyond our control, we

strive to minimize the consequences.

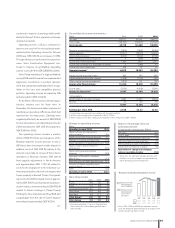

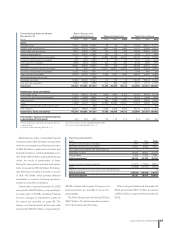

We have chosen to classify the risks to which

the Volvo Group is exposed into three main cat-

egories: External-related risk, Financial risk

and Operational risk.

External-related risk

The commercial vehicles industry

is cyclical

Historically, the Volvo Group’s markets have

undergone significant changes in demand as

the general economic environment has fluctu-

ated. Investments in infrastructure, major

industrial projects, mining and housing con-

struction all impact the Group’s operations,

since its products are central to these sectors.

Economic trends in Europe and North America

are particularly important for the Volvo Group,

since a significant portion of the Group’s net

sales are generated in these markets.

The cyclical demand for the Group’s prod-

ucts has, at times, restricted, and may in the

future temporarily restrict, the ability of the

Volvo Group to manufacture and deliver orders

in a timely manner. A prolonged delay in the

Group’s ability to deliver ordered products on a

timely basis at a time when its competitors are

not experiencing the same difficulty could

adversely affect the Group’s market shares.

To cope with the peaks and troughs in

demand, we need to act appropriately in the

various stages of the business cycle. This

56 Board of Directors’ Report 2006