Volvo 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cooperations and acquisitions

AB Volvo became major

shareholder in Nissan Diesel

On February 20, 2007,

Volvo made a public

offer to acquire the

Japanese truck man-

ufacturer Nissan

Diesel. The offer,

which is supported by Nissan Diesel’s Board of

Directors, means that Volvo offers JPY 540 in

cash per share and the total value of Volvo’s

offer amounts to SEK 7.5 billion. Volvo already

owns a 19% holding in Nissan Diesel and pref-

erence shares which can be converted to an

additional 27.5%, after full dilution.

Volvo’s offer for Nissan Diesel represents a

premium of 32% based on the average prices

during the past three months. The offer is open

through March 23 and is not conditional upon a

lowest level of acceptance, but is dependent on

the necessary approvals from the anti-trust

authorities. Volvo anticipates that payment can

be made for acquired shares on or about March

29, 2007. If the offer for Nissan Diesel is imple-

mented, Volvo will have paid a total of SEK 13

billion for all shares, corresponding to JPY 469

per share.

In 2005, Nissan Diesel sold approximately

42,000 trucks and buses. In Japan, Nissan Diesel

holds a market share of about 24% in heavy

trucks and 15% in the medium-heavy segment.

“Nissan Diesel’s products and know-how

represent a valuable complement to the

Group’s truck business. Nissan Diesel

holds a solid position in Japan and the rest

of Asia where the Volvo Group foresees

substantial growth potential.”

Leif Johansson

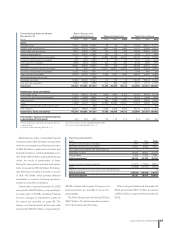

Significant eventsThe Volvo Group 2006

The year 2006 was eventful, with extensive

product launches and major changes in the

industrial system, particularly toward the end

of the year. Despite this, we posted the best

year in history, in terms of sales and earnings.

Net sales1, SEK billion

05

231.2

06

248.1

03

174.8

02

177.1

04

202.2

Operating income1,

SEK billion

05

18.2

06

22.1

03

2.5

02

2.8

04

14.7 2

In the Board of Directors’ Report through

page 85, Financial Services is reported in

accordance with the equity method.

1 As from 2004 figures are reported in accordance with IFRS. Previous

years are reported in accordance with the then prevailing Swedish GAAP.

See note 1 and 3.

2 Excluding adjustment of goodwill.

Board of Directors’ Report

46 Board of Directors’ Report 2006