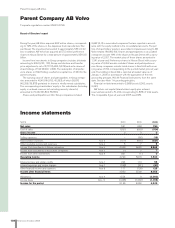

Volvo 2006 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

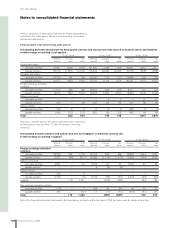

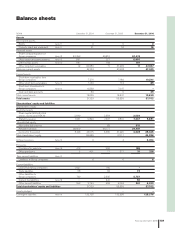

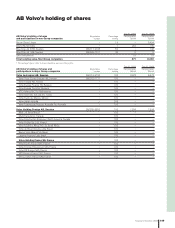

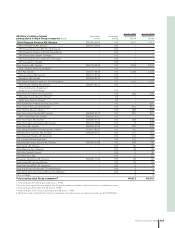

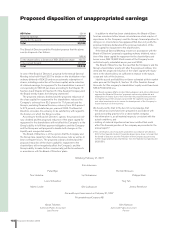

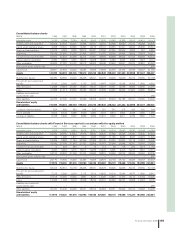

Financial information 2006 145

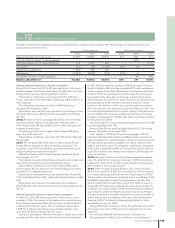

Shares and participations in Group companies

During the fi r st quarter of 2006, 491 was transferred to the newly-

formed company Volvo Automotive Finance (China) Ltd for the Volvo

Group’s future customer-fi nancing activites in China.

Shareholders’ contributions were made with 34 to ZAO Volvo

Vostok, with 300 to Volvo Information Technology AB and with 27 to

Volvo Italia Spa.

The redemption of preference shares in VNA Holding Inc

decreased the holding by 1,053.

Write-downs were carried out at year-end on the holdings in Volvo

Information Technology AB, 32 and Kommersiella Fordon Europa

AB, 160.

2005: All shares in Volvo Lastvagnar AB, 8,678, were received as

dividend from Volvo Global Trucks AB, after which the shares in

Volvo Global Trucks AB were written down by 8,420 and sold inter-

company for book value.

The holding in the service company Celero Support AB with a

book value of 25 was sold.

Shareholders’ contribution was made with 183 to Volvo Financial

Services AB.

2004: The remaining 2% of the shares in Kommersiella Fordon

Europa AB was acquired for 28 by compulsory acquisition. The

acquisition costs of the stockholding increased with 4 and at year-

end the holding was written down by 643.

25% of the shares in VFS Servizi Financiari Spa was acquired

inter-company for 101.

The holdings in seven dormant Group companies with a total book

value of 82 were transferred internally within the Group.

Shareholders’ contributions were made to Alviva AB, 2 and to

Celero Support AB, 10, whereupon the shareholdings were written

down by the corresponding amounts.

Shareholders’ contributions were also made to Volvo Bussar AB,

18, to Volvo Global Trucks AB, 1 and to Volvo Financial Services AB,

345.

Write-downs were carried out at year-end on the holdings in

Sotrof AB, 600, Volvo China Investment Co Ltd, 99 and Volvo Penta

UK, 10.

Shares and participations in non-Group companies

On March 21 2006, AB Volvo acquired 40 million shares, corres-

ponding to 13% of the shares, in the Japanese truck manufacturer

Nissan Diesel from Nissan Motor, with an option on Nissan Motor’s

remaining 6% within four years. The purchase price amounted to

1,505. The holding is reported as an associated company, since

Volvo believes that substantial infl uence exists.

During the third quarter, AB Volvo exercised its option to purchase

an additional 6% of the shares in Nissan Diesel from Nissan Motor

for 496. AB Volvo now owns a total of 19% of the shares in Nissan

Diesel. In addition, AB Volvo has acquired all 57.5 million preference

shares in Nissan Diesel from Nissan Motor and Japanese banks for

a total of 3,493. The purchase price for the preference shares has

been added to the value and is reported as investments in associ-

ated companies. The preference shares that Volvo has acquired may

during the period 2008–2014 be converted to shares in install-

ments. It is the intention of Volvo to convert the preference shares.

After full conversion, the preference shares will represent 165.1 mil-

lion shares that combined with the current holding of 19% will corres-

pond to 46.5% of the votes and capital in Nissan Diesel. The total

purchase consideration for 46.5% of the shares and votes in Nissan

Diesel amounts to 5,494.

During the year, the newly-formed partnership Blue Chip Jet II HB

has been capitalized with 148.

Henlys Group Plc has been liquidated during 2006. The holding

has been fully written down since 2004.

As of January 1, 2005, the Parent Company applies IAS 39

Financial Instruments: Recognition and Measurement, and accord-

ingly all investments in listed companies, except if these investments

are classifi ed as associated companies, should be reported in the

balance sheet at fair value. The revaluation of AB Volvo’s ownership

in the listed company Deutz AG has increased the value by 392 dur-

ing 2006. In addition, the holding has increased by 95 through con-

version into shares.

2005: AB Volvo’s investment in Deutz AG was valuated to market

value. The effect of this transition at January 1, 2005, amounted to

negative 501, after which the value increased by 83 during the year.

Also see Note 1 Accounting principles.

2004: Volvo’s holding of Scania B shares was sold to Deutsche

Bank for an amount of 14,905. As a consequence of the divestment,

the Scania holding was written down in the fourth quarter of 2003.

The transaction was carried out as part of Volvo’s commitment to the

European Commission to divest the Scania shares not later than

April 23, 2004. After the sale Volvo owned 27.3 million A shares in

Scania AB. The holding was revaluated to market value on April 15,

resulting in an income of 915 in 2004. At the Annual General Meet-

ing on April 16, 2004, the Board’s proposal to transfer all A shares

in Scania to Ainax and thereafter to distribute the shares in Ainax to

Volvo’s shareholders was approved. The value of the distribution of

Ainax was 6,310. The shares in Ainax were distributed to Volvo’s

shareholders on June 8, 2004.

During 2004 Volvo’s holding in Henlys Group Plc was fully written

down and a write-down of 95 was thereby charged to the income

statement.

The holding in Bilia AB with a book value of 25 was sold.

The participations in Blue Chip Jet HB were written down by 1.

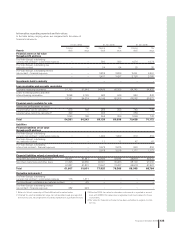

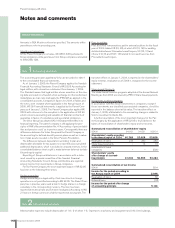

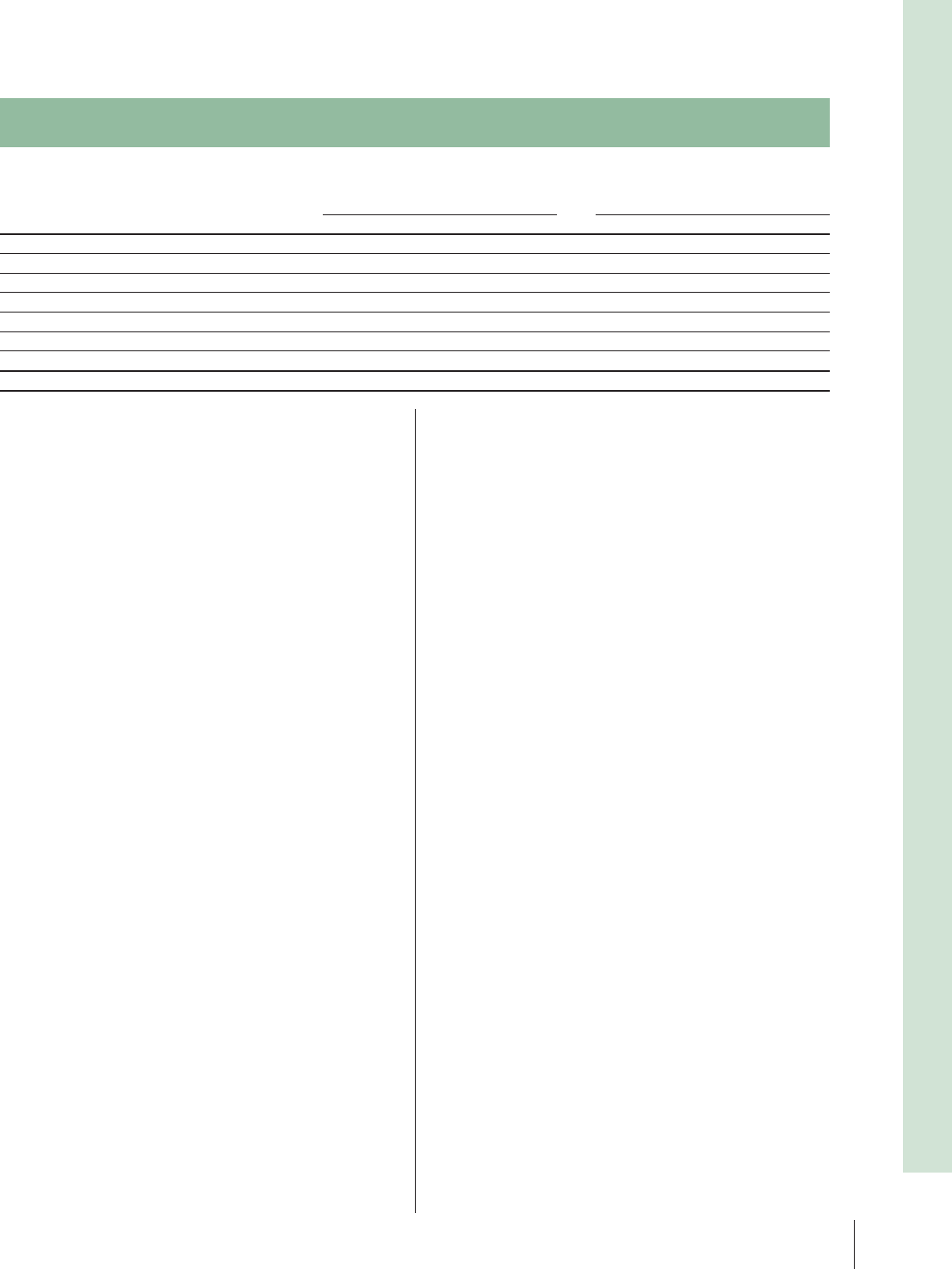

Group companies Non-Group companies

2004 2005 2006 2004 2005 2006

Balance December 31, previous year 41,329 40,393 40,812 813 691 271

Transition effect on shares in listed companies – – – – (501) –

Acquisitions/New issue of shares/Dividends 133 8,682 491 – – 5,737

Divestments (81) (26) (1,053) (25) (2) –

Shareholder contributions 376 183 361 – – –

Write-downs (1,364) (8,420) (192) (97) 0 –

Revaluation of shares in listed companies – – – 83 392

Balance, December 31 40,393 40,812 40,419 691 271 6,400

Note 12 Investments in shares and participations

Holdings of shares and participations are specifi ed in AB Volvo’s holding of shares (pages 149–151). Changes in holdings of shares and

participations are shown below.