Volvo 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 Financial information 2006

The Volvo Group

Notes to consolidated financial statements

tects the underlying position against changes in the fair value.

Financial instruments used for the purpose of hedging future cur-

rency fl ows are accounted for as hedges if the currency fl o ws are

considered highly probable to occur.

– For fi n ancial instruments used to hedge forecasted internal

commercial cash fl ows and forecasted electricity consumption, the

fair value is debited or credited to a separate component of equity to

the extent the requirements for cash-fl ow hedge accounting are ful-

fi l l ed. To the extent that the requirements are not met, the unrealized

gain or loss will be charged to income statement. Gains and losses

on hedges are reported at the same time that the gains and losses

arise on the items hedged and are recognized in consolidated share-

holders’ equity.

– For fi n ancial instruments used to hedge interest and currency

risks on loans, Volvo previously applied through and including 2004

hedge accounting in accordance with Swedish GAAP. The differ-

ence between the carrying value according to Swedish GAAP and

the fair value according to IFRS as of January 1, 2005, was charged

against the income statement over the remaining time of the hedged

instrument. Under the more complex rules in IAS 39, Volvo has cho-

sen not to apply hedge accounting. The difference between carrying

values reported under Swedish GAAP and fair values to be reported

under IFRS pertains to unrealized interest-rate gains and losses

attributable to the period between the reporting date and maturity

dates of the derivatives. The unrealized gains and losses will be

charged to the fi nancial net in the income statement.

– Volvo applies hedge accounting for certain net investments in

foreign operations. The current result for such hedges is reported in

a separate component in shareholders’ equity. In the event of a

divestment, the accumulated result from the hedge is recognized in

the income statement.

Research and development expenses

Volvo applies IAS 38, Intangible Assets, for reporting of research

and development expenses. In accordance with this accounting rec-

ommendation, expenditures for development of new products, pro-

duction systems and software shall be reported as intangible assets

if such expenditures with a high degree of certainty will result in

future fi n ancial benefi ts for the company. The acquisition value for

such intangible assets shall be amortized over the estimated useful

life of the assets. The rules means that high demands are estab-

lished in order for these development expenditures to be reported as

assets. For example, it must be possible to prove the technical func-

tionality of a new product or software prior to this development being

reported as an asset. In normal cases, this means that expenditures

are capitalized only during the industrialization phase of a product

development project. Other research and development expenses are

charged to income as incurred.

Depreciation, amortization and impairments of tangible

and intangible non-current assets

Volvo applies historical costs for valuation of intangible and tangible

assets. Loan expenses during the acquisition period for a non-cur-

rent asset are expenses. Depreciation is based on the historical cost

of the assets, adjusted in appropriate cases by write-downs, and

estimated useful lives.

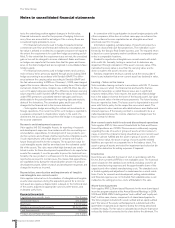

Depreciation periods

Capitalized type-specifi c tools 2 to 8 years

Operational leases 3 to 5 years

Machinery 5 to 20 years

Buildings and Investment property 25 to 50 years

Land improvements 20 years

Product and software development 3 to 8 years

In connection with its participation in aircraft engine projects with

other companies, Volvo Aero in certain cases pays an entrance fee.

These entrance fees are capitalized as an intangible asset and

amortized over 5 to 10 years.

Information regarding estimated value of investment property is

based on discounted cash fl ow projections. The estimation is per-

formed by the Group’s Real Estate business unit. The required return

is based on current property market conditions for comparable prop-

erties in comparable locations.

Goodwill is reported as intangible non-current assets with inde f-

inite useful life. Annually, testing is carried out to determine any

impairment through calculation of the asset’s recovery value. If the

calculated recovery value is less than the carrying value, a write

down is made to the asset’s recovery value.

Similarly, impairment testing is carried out at the closing date if

there is any indication that a non-current asset has declined in value.

Leasing – Volvo as the lessee

Volvo evaluates leasing contracts in accordance with IAS 17, Leases.

In those cases in which the fi n ancial risk and benefi ts that are

related to ownership, so called fi nance lease, are in signifi cant

respects held by Volvo, Volvo reports the asset and related obliga-

tion in the balance sheet at the lower of the leased asset’s fair value

or the present value of minimum lease payments. The future leasing

fees are reported as loans. The lease asset is depreciated in accord-

ance with Volvo’s policy for the respective non-current asset. The

lease payments when made are allocated between amortization and

interest expenses. If the leasing contract is considered to be a so

called operational lease the income statement is charged over the

lease contract’s lifetime.

Non-current assets held for sale and discontinued operations

Volvo applies IFRS 5, Non-current Assets Held for Sale and Discon-

tinued Operations as of 2005. Processes are continuously ongoing

regarding the sale of assets or groups of assets at minor values. In

cases in which the criteria for being classifi ed as a non-current asset

held for sale are fulfi lled and the asset or group of assets is other

than of minor value, the asset or group of assets and the related

l iabilities are reported on a separate line in the balance sheet. The

asset or group of assets are tested for impairment and valued at fair

value after deduction for selling expenses if impaired.

Inventories

Inventories are stated at the lower of cost, in accordance with the

fi r s t-in, fi r st-out method (FIFO), or net realizable value. The historical

value is based on the standard cost method, including costs for all

direct manufacturing expenses and the apportionable share of the

capacity and other related manufacturing costs. The standard costs

is tested regularly and adjustment is made based on current condi-

tions. Costs for research and development, selling, administration

and fi n ancial expenses are not included. Net realizable value is cal-

culated as the selling price less costs attributable to the sale.

Share-based payments

Volvo applies IFRS 2, Share-based Payments for the new share-based

incentive program adopted at the Annual General Meetings in 2004,

2005 and 2006. IFRS 2 distinguishes “cash-settled” and “equity-set-

tled”, in Volvo case, shares, components of share-based payments.

The Volvo program include both a cash-settled and an equity-settled

part. The value of the equity-settled payments is determined at the

grant-date, recognized as an expense during the vesting period and

credited to equity. The fair value is calculated according to share price

reduced by dividend connected to the share before the allotment. The