Volvo 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

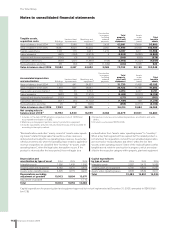

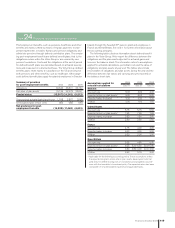

112 Financial information 2006

The Volvo Group

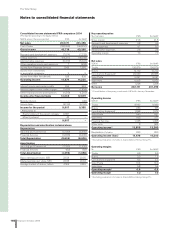

1 Includes on the date of IFRS adoption, acquisition costs of 14,184 and

accumulated amortization of 3,863.

2 Machinery and equipment pertains mainly to production equipment.

3 Includes subsidiaries and joint ventures that previously were accounted for

according to the equity method.

4 Acquisition costs less accumulated depreciation, amortization and write-

downs.

5 Of which is write-down 80 (72, 244).

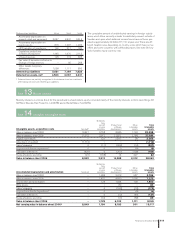

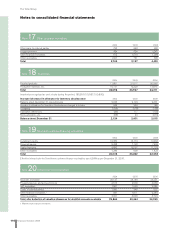

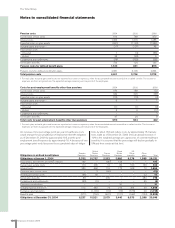

Depreciation and

amortization by type of asset 2004 2005 2006

Intangible assets 1,396 1,409 1,930

Property, plant and equipment 4,182 4,370 4,494

Assets under operating leases 4,425 4,115 4,247

Depreciations excluding

adjustment of goodwill 10,003 9,894 10,671

Adjustment of goodwill – – 1,712

Total 10,003 9,894 12,383

Capital expenditures

by type of asset 2004 2005 2006

Intangible assets 2,287 3,473 3,066

Property, plant and equipment 5,790 6,829 6,357

Assets under operating leases 4,406 4,549 4,611

Total 12,483 14,851 14,034

Capital expenditures for property, plant and equipment approved but not yet implemented at December 31, 2006, amounted to SEK 6.8 bil-

lion (7.8).

Notes to consolidated financial statements

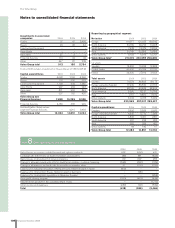

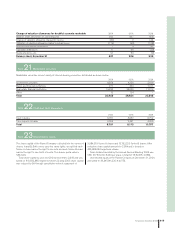

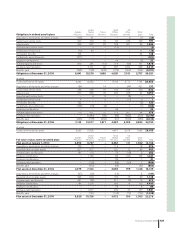

Construction

in progress, Total Assets

including property, under Total

Accumulated depreciation Land and land Machinery and advance plant and operating tangible

and amortization Buildings improvements equipment

2 payments equipment leases assets

Value in balance sheet 2004 6,732 441 24,557 – 31,730 11,465 43,195

Value in balance sheet 2005 7,814 521 28,087 – 36,422 11,160 47,582

Depreciation and amortization

5 704 46 3,744 – 4,494 4,247 8,741

Sales/scrapping (498) (8) (1,976) – (2,482) (3,223) (5,705)

Acquired and divested operations

3 (130) (9) (138) – (277) (224) (501)

Translation differences (321) (31) (1,132) – (1,484) 168 (1,316)

Reclassifi cations and other 23 8 (290) – (259) (2,474) (2,733)

Value in balance sheet 2006 7,592 527 28,295 – 36,414 9,654 46,068

Net carrying value in

balance sheet 2006

4 10,992 3,920 16,399 3,068 34,379 20,501 54,880

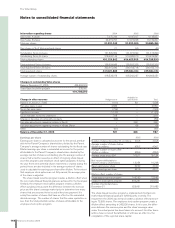

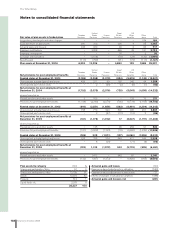

Construction

in progress, Total Assets

including property, under Total

Tangible assets, Land and land Machinery and advance plant and operating tangible

acquisition costs Buildings improvements equipment

2 payments equipment leases assets

Value in balance sheet 2004 16,928 3,988 39,530 2,435 62,881 30,999 93,880

Value in balance sheet 2005 18,547 4,624 45,252 3,067 71,490 31,999 103,489

Capital expenditures 1,031 175 3,941 1,210 6,357 4,611 10,968

Sales/scrapping (483) (106) (2,618) 4 (3,203) (5,686) (8,889)

Acquired and divested operations

3 (164) (3) (218) – (385) (593) (978)

Translation differences (808) (201) (1,889) (164) (3,062) (1,202) (4,264)

Reclassifi cations and other 461 (42) 226 (1,049) (404) 1,026 622

Value in balance sheet 2006 18,584 4,447 44,694 3,068 70,793 30,155 100,948

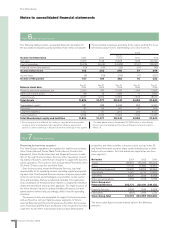

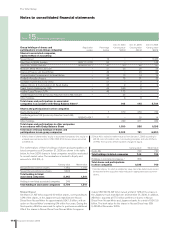

“Reclassifi cations and other” mainly consist of “assets under operat-

ing leases” related to legal sales transactions, where revenue is

deferred and accounted for as operating lease revenue. Assets clas-

sifi ed as inventory will, when the operating lease model is applied for

revenue recognition, be classifi ed from “inventory” to “assets under

operating leases”, when the legal sales transaction occurs. If the

product is returned after the lease period, there will again be a

reclassifi cation from “assets under operating leases” to “inventory”.

When a buy-back agreement has expired, but the related product is

not returned, the acquisition cost and the accumulated depreciation

are reversed in “reclassifi cation and other”, within the line item

“assets under operating leases”. Some of the reclassifi cations within

tangible assets relate to construction in progress, which are reclas-

sifi ed to the respective category within property, plant and equipment.