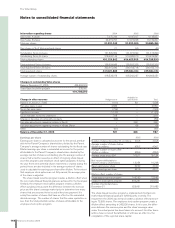

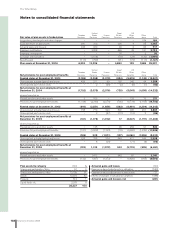

Volvo 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial information 2006 123

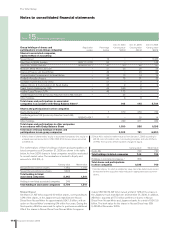

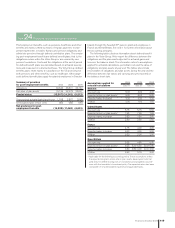

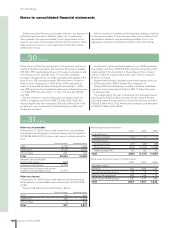

Note 26 Non-current liabilities

The listing below shows the Group’s non-current liabilities in which

the largest loans are distributed by currency. Most are issued by

Volvo Treasury AB. Information on loan terms is as of December 31,

2006. Volvo hedges foreign-exchange and interest-rate risks using

derivative instruments. See Note 36.

Effective interest,

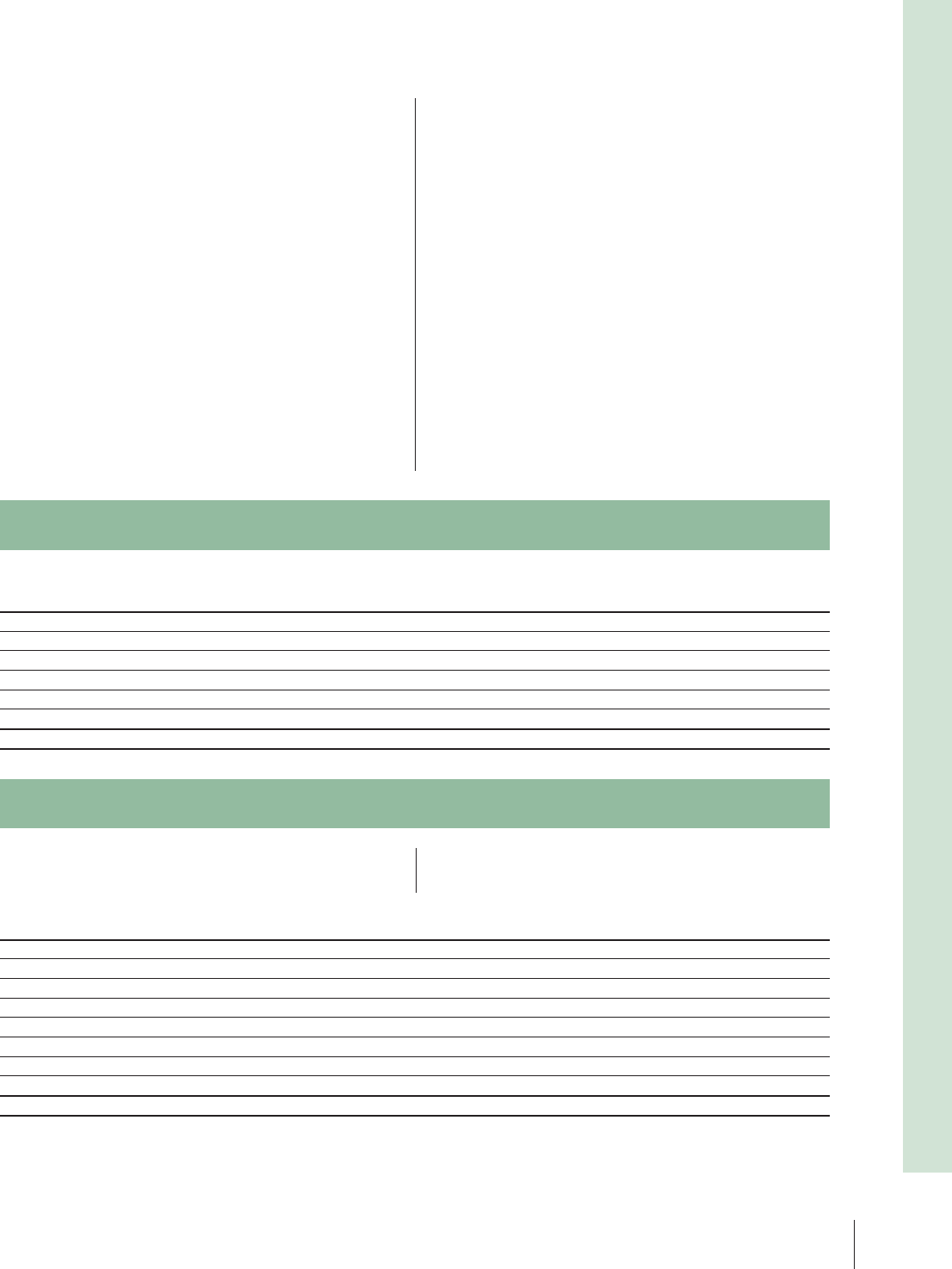

Bond loans Actual interest rate, % rate, Dec 31, 2006, % 2004 2005 2006

GBP 2004/2006 5.18 – 1,905 – –

SEK 1999–2006/2008–2011 2.50–5.20 3.77–7.27 4,798 4,931 8,973

JPY 2001–2005/2008–2011 0.42–1.50 0.85–1.34 542 475 231

CZK 2003–2005/2008–2010 2.69–4.50 2.88–3.19 380 400 389

USD 1998–2006/2008 5.00–5.98 4.97–5.33 2,150 1,788 1,614

EUR 1997–2006/2008–2011 3.56–6.12 2.49–4.10 17,546 19,928 11,623

NOK 2006/2008 3.59 4.40 – – 329

Other bond loans 291 48 20

Total 27,612 27,570 23,179

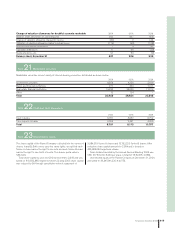

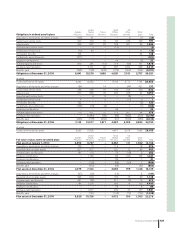

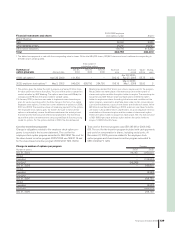

Volvo’s pension foundation in Sweden was formed in 1996 to secure

obligations relating to retirement pensions for salaried employees in

Sweden in accordance with the ITP plan (a Swedish individual pen-

sion plan). Plan assets amounting to 2,456 was contributed to the

foundation at its formation, corresponding to the value of the pen-

sion obligations at that time. Since its formation, net contributions of

1,420, whereof 0 during 2006, have been made to the foundation.

The plan assets in Volvo’s Swedish pension foundation are invested

in Swedish and foreign shares and mutual funds, and in interest-

bearing securities, in accordance with a distribution that is deter-

mined by the foundation’s Board of Directors. At December 31,

2006, the fair value of the foundation’s plan assets amounted to

6,394 (5,925; 4,079), of which 45% (58; 55) was invested in shares

or mutual funds. At the same date, retirement pension obligations

attributable to the ITP plan amounted to 6,560 (6,342; 5,366).

Swedish companies can secure new pension obligations through

balance sheet provisions or pension fund contributions. Furthermore,

a credit insurance must be taken out for the value of the obligations.

In addition to benefi ts relating to retirement pensions, the ITP plan

also includes, for example, a collective family pension, which Volvo

fi n a nces through insurance with the Alecta insurance company.

According to an interpretation from the Swedish Financial Account-

ing Standards Council’s interpretations committee, this is a multi-

employer defi ned benefi t plan. For fi s cal year 2006, Volvo did not

have access to information from Alecta that would have enabled this

plan to be reported as a defi ned benefi t plan. Accordingly, the plan

has been reported as a defi ned contribution plan. Alecta’s funding

ratio is 143.1% (128.5; 128.0).

Volvo’s subsidiaries in the United States mainly secure their pen-

sion obligations through transfer of funds to pension plans. At the

end of 2006, the total value of pension obligations secured by pen-

sion plans of this type amounted to 11,830 (12,962; 10,287). At the

same point in time, the total value of the plan assets in these plans

amounted to 12,226 (10,728; 7,163), of which 60% (60; 64) was

invested in shares or mutual funds. The regulations for securing pen-

sion obligations stipulate certain minimum levels concerning the

ratio between the value of the plan assets and the value of the obli-

gations. During 2006, Volvo contributed 2,858 (2,225; 1,153) to the

pension plans in order to optimize Volvo’s capital structure.

During 2006 Volvo has made extra contributions to the pension-

plans in Great Britain in the amount of 646 (906; 83).

In 2007, Volvo estimate to transfer an amount of not more than

1 billion Swedish kronor to pension plans.

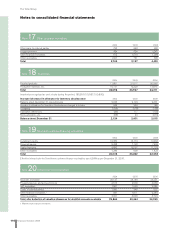

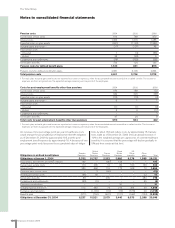

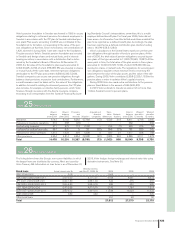

Note 25 Other provisions

Value in Value in Provisions Acquired and Trans- Value in Whereof Whereof

balance balance and divested lation Reclassi- balance due within due after

sheet 2004 sheet 2005 reversals Utilization companies differences fi cations sheet 2006 12 months 12 months

Warranties 6,742 8,163 6,262 (5,789) (13) (530) 318 8,411 4,746 3,665

Provisions in insurance operations 312 388 (26) – – – – 362 – 362

Restructuring measures 571 372 174 (100) – (16) (1) 429 375 54

Provisions for residual value risks 987 931 9 20 (22) (84) (73) 781 539 242

Provisions for service contracts 1,512 1,623 394 (324) 4 (51) 31 1,677 928 749

Other provisions 4,354 4,814 3,554 (3,588) (42) (382) 533 4,889 3,211 1,678

Total 14,478 16,291 10,367 (9,781) (73) (1,063) 808 16,549 9,799 6,750