Volvo 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

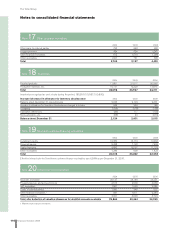

106 Financial information 2006

The Volvo Group

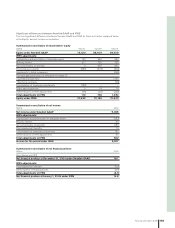

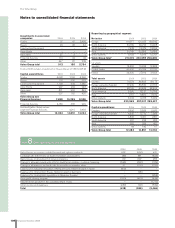

Reporting by business segment

The Volvo Group’s operations are organized in eight business areas:

Volvo Trucks, Renault Trucks, Mack Trucks, Buses, Construction

Equipment, Volvo Penta, Volvo Aero and Financial Services. In add-

ition to the eight business areas, there are other operations consist-

ing mainly of business units that are designed to support the business

areas’ operations. The business units include Volvo Powertrain, Volvo

3P, Volvo IT, Volvo Logistics and Volvo Parts.

Each business area, except for Financial Services, has total

responsibility for its operating income, operating capital and operat-

ing cash fl ow. The Financial Services business area has responsibil-

ity for its net income and total balance sheet within certain restric-

tions and principles that are established centrally. The supervision

and coordination of treasury and tax matters is organized centrally to

obtain the benefi ts of a Group-wide approach. The legal structure of

the Volvo Group is based on optimal handling of treasury, tax and

administrative matters and, accordingly, differs from the operating

structure.

The business units are designated to support the business areas

and are therefore not reportable business segments. In Volvo’s

external fi nancial reporting, the fi n ancial results within the business

units Powertrain and Parts are distributed to the respective business

segments. As the three truck brands share product development,

production and other activities in business units such as Volvo 3P

and Volvo Powertrain and also share certain infrastructure in distri-

bution such as dealers, the truck brands are reported as one busi-

ness segment.

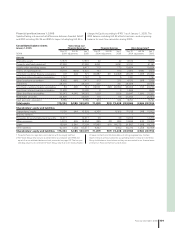

Net sales 2004 2005 2006

Trucks 136,879 155,396 166,306

Buses 12,722 16,589 16,856

Construction Equipment 29,360 34,816 40,564

Volvo Penta 9,057 9,776 10,485

Volvo Aero 6,925 7,538 8,048

Other and eliminations 7,228 7,076 5,876

Volvo Group excl

Financial Services 202,171 231,191 248,135

Financial Services 9,598 7,549 8,969

Eliminations (693) 1,819 1,731

Volvo Group total 211,076 240,559 258,835

The above sales fi g ures include internal sales in the following

amounts:

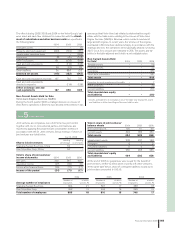

Notes to consolidated financial statements

Note 7 Segment reporting

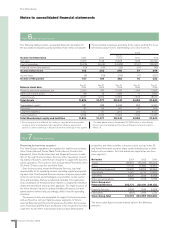

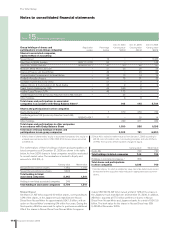

Note 6Associated companies

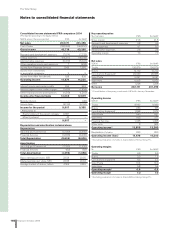

The following table presents summarized fi n ancial information for

the associated companies partly owned by Volvo. Volvo consolidate

the associated companies according to the equity method. For more

information about Volvo’s shareholding, see notes 9 and 15.

2006

Nissan

Income statement data 2004 2005 Diesel1 Other Total

Net sales 5,750 7,133 15,488 7,245 22,733

Cost of operations (5,575) (6,914) (14,874) (7,167) (22,041)

Financial income and expense (10) (16) (22) (21) (43)

Income before taxes 165 203 592 57 649

Income taxes (8) (19) (310) (17) (327)

Income of the period 157 184 282 40 322

Dec 31 Dec 31 Dec 31 Dec 31 Dec 31

Balance sheet data 2004 2005 2006 2006 2006

Property, plant and equipment, net 2,099 792 10,292 1,093 11,385

Other non-current assets 88 15 7,984 11 7,995

Current assets 9,637 9,270 10,666 7,494 18,160

Total Assets 11,824 10,077 28,942 8,598 37,540

Shareholders’ equity 981 688 8,334 996 9,330

Provisions 87 55 591 47 638

Long-term liabilities 1,132 171 7,921 206 8,127

Current liabilities 9,624 9,163 12,096 7,349 19,445

Total Shareholders’ equity and liabilities 11,824 10,077 28,942 8,598 37,540

1 Since the acquisition in March, the holding is reported as an associated

company, since Volvo believes that substantial infl uence exists. Volvo

reports its share in earnings of Nissan Diesel with a time-lag of one quarter.

The table above refers to September 30, 2006, which is when Nissan

Diesel was consolidated by Volvo. Nissan Diesel’s fi s cal year is April 1–

March 31.