Volvo 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

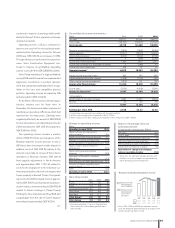

Financial position

The Board of Directors proposes an ordinary dividend of

SEK 25 per share and an extraordinary payment through

a 6:1 share split where the sixth share will be redeemed

by AB Volvo for an amount of SEK 25 per share.

Balance sheet

Total assets in the Volvo Group amounted to

SEK 258.4 billion at December 31, 2006, an

increase of SEK 1.2 billion compared with

year-end 2005. The Group’s total goodwill

amounted to SEK 8.8 billion, reported under

intangible assets. This amount includes an

adjustment of SEK 1.7 billion that was made in

accordance with prevailing accounting rules

in conjunction with the release by AB Volvo of

a valuation reserve for deferred tax receiv-

ables of SEK 2.0 billion in the subsidiary Mack

Trucks Inc. Investments in development costs

amounted to SEK 2.9 billion in 2006, resulting

in a net capitalization amounting to SEK 1.3 bil-

lion, the net value of development costs as of

December 31, 2006 was to SEK 8.2 billion.

The Volvo Group’s assets in operational

leasing remained largely unchanged compared

with December 31, 2005. Sales with buyback

agreements are reported under this item in the

balance sheet, resulting in revenues from a

sale being allocated during the length of a con-

tract as if it were a leasing agreement.

Shares and participations increased during

the year by SEK 5.5 billion through AB Volvo’s

acquisition of shares in Nissan Diesel from

Nissan Motor. In total, AB Volvo owns 19% of

the shares in the company. In addition, AB Volvo

has acquired all 57.5 million preferential shares

in Nissan Diesel from Nissan Motor and

Japanese banks. Combined, these items cor-

respond, after conversion, to 46.5% of the

shares in Nissan Diesel.

The net value of assets and liabilities related

to pensions and similar obligations amounted

to SEK 6.7 billion on December 31, 2006, a

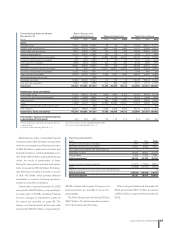

Change in net financial position,

excl Financial Services

SEK bn

December 31, 2005 18.7

Cash flow from operating activities 21.9

Investments in fixed assets

and leasing assets, net (9.3)

Operating cash flow, 12.6

Investments and divestments

of shares, net (5.8)

Acquired and divested operations 0.6

Change in provision for post-

employment benefits 3.3

Dividend paid to AB Volvo’s

shareholders (6.8)

Currency effect 1.0

Other 1.1

Total change 6.0

December 31, 2006 24.7

Impact of exchange rates

on operating income

The impact on operating income from currency

movements was negative by approximately

SEK 1 billion compared with 2005. The prime

reason being the declining US dollar during

2006.

Financial net

The net interest income for 2006 amounted to

SEK 81 M compared to a net interest expense

of SEK 318 M for the preceding year. The

improvement is primarily a result of higher

short-term interest rates in Sweden and lower

cost for the pension liability due to lower pen-

sion liabilities as a result of capital injections to

the Group’s pension foundations.

Other financial income and expenses were

negatively impacted by marked-to-market

revaluation of derivatives used for hedging of

the customer finance portfolio. The negative

revaluation impact was SEK 61 M during 2006

and was a result of declining long-term interest

rates in the US and Canada during the second

half of 2006. During 2005 the revaluation

impact was positive amounting to SEK 251 M.

Income taxes

The income tax expense for 2006 was SEK

3,981 M corresponding to a tax rate of 20%.

During the third quarter of 2006 AB Volvo

reported a tax income of SEK 2,048 M due to

the reversal of a valuation allowance for tax

receivables in Mack Trucks Inc. During 2005

the income tax expense amounted to SEK

4,908 M and a tax rate of 27%.

Income for the period

Income for the period amounted to SEK

16,318 M (13,108) corresponding to a basic

earnings per share of SEK 40.20 (32.22). The

return on shareholders’ equity was 19.6%

(17.8%).

reduction of SEK 4.8 billion compared with the

preceding year. Prepaid pensions amounted to

SEK 2.0 billion, an increase of SEK 1.5 billion

compared with year-end 2005, and were

related to the Volvo Group’s operations in the

US and the UK. A reduction in Post-employ-

ment benefits was primarily the result of

exchange-rate differences and payments

towards pension plans made during the year.

Post-employment benefits valued at SEK 2.9

billion were reported outside of AB Volvo’s bal-

ance sheet, which remained largely unchanged

compared with a year earlier.

The value of the Volvo Group’s inventory

remained largely unchanged on December 31,

2006, compared with the corresponding period

in the preceding year. During the year, finished

products declined by SEK 1.2 billion, while

production and other materials rose by SEK

1.5 billion.

52 Board of Directors’ Report 2006