Vodafone 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

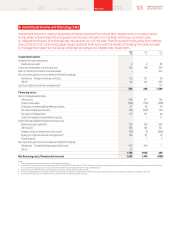

Commentary on the consolidated statement of cash ows

The consolidated statement of cash ows shows the

cash ows from operating, investing and nancing

activities for the year. Cash and cash equivalents

at the end of the nancial year increased 7.2%

to £7.6 billion. We have maintained a robust liquidity

position throughout the year enabling us to service

shareholder returns, debt and expansion through

capital investment. This position has been achieved

through cash generated from operations, dividends

from associates, and borrowings through short-

term and long-term debt issued through the capital

markets. We expect these to be our key sources

of liquidity for the foreseeable future. We also

have access to the committed facilities detailed

on page 157.

Our liquidity and working capital may be affected by a material decrease

in cash ow due to a number of factors as outlined in “Principal risk

factors and uncertainties” on pages 46 to 49. We do not use non-

consolidated special purpose entities as a source of liquidity or for other

nancing purposes.

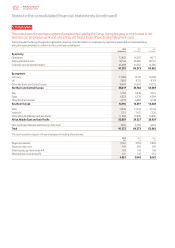

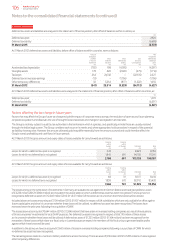

Purchase of interest in subsidiaries and joint ventures,

net of cash acquired

During the year we acquired CWW and TelstraClear for cash

consideration of £1.1 billion and £0.4 billion respectively. Further details

on the assets and liabilities acquired are outlined in note 11.

Purchase of intangible assets

The purchase of intangible assets was primarily in relation to spectrum.

We acquired spectrum in the UK, the Netherlands, Romania, Egypt and

India, totalling £2.5 billion during the year.

Disposal of interests in associates and joint ventures

In the prior year we disposed of our 44% interest in SFR and our 24.4%

interest in Polkomtel for proceeds of £6.8 billion and £0.8 billion

respectively. There were no signicant disposals in the current year.

Disposal of investments

In April 2012 we received the remaining consideration of £1.5 billion

from the disposal of our interests in SoftBank Mobile Corp.

Purchase of investments

The Group purchases short-term investments as part of its treasury

strategy. See note 16.

Dividends received from associates

Dividends received from associates increased by 20.0% to £4.8 billion,

primarily due to dividends received from VZW. The Group received

an income dividend of £2.4 billion (2012: £2.9 billion) and also tax

distributions totalling £2.4 billion (2012: £1.0 billion) during the year.

Proceeds from issues of long-term debt

The Group issued bonds, under its US shelf programme,

in September 2012 and February 2013 of US$2.0 billion (£1.2 billion)

and US$6.0 billion (£3.9 billion) respectively.

Purchase of treasury shares

During the year the Group completed the £4.0 billion share

buyback programme announced in 2011 and also initiated

a £1.5 billion programme on receipt of the income dividend from

VZWin December 2012.

Equity dividends paid

Equity dividends paid during the year decreased by -27.7%, primarily

due to the payment of a special dividend in the prior year. The special

dividend was paid following the receipt of an income dividend from VZW.

Other transactions with non-controlling shareholders

in subsidiaries

In the year ended 31 March 2012 we acquired an additional stake

in Vodafone India.

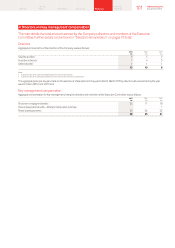

Cash ow reconciliation

A reconciliation of cash generated by operations to free cash ow

and net debt, two non-GAAP measures used by management,

is shown below. Cash generated by operations decreased by -7.4%

to £13.7 billion, primarily driven by lower EBITDA (see page 40). Free cash

ow decreased by -8.1% to £5.6 billion primarily due to lower EBITDA

and higher payments for taxation, partially offset by lower cash capital

expenditure, working capital movements and higher dividends received

from associates and investments.

2013 2012

£m £m %

EBITDA 13,275 14,475 (8.3)

Working capital 318 206

Other 134 143

Cash generated by operations 13,727 14,824 (7.4)

Cash capital expenditure1(6,195) (6,423)

Capital expenditure (6,266) (6,365)

Working capital movement in respect

of capital expenditure 71 (58)

Disposal of property, plant and

equipment 153 117

Operating free cash ow 7,685 8,518 (9.8)

Taxation (2,933) (1,969)

Dividends received from associates

and investments22,420 1,171

Dividends paid to non-controlling

shareholders in subsidiaries (379) (304)

Interest received and paid (1,185) (1,311)

Free cash ow 5,608 6,105 (8.1)

Tax settlement3 (100) (100)

Licence and spectrum payments (2,507) (1,429)

Acquisitions and disposals4(1,723) 4,872

Equity dividends paid (4,806) (6,643)

Purchase of treasury shares (1,568) (3,583)

Foreign exchange (828) 1,283

Income dividend from VZW 2,409 2,855

Other5982 2,073

Net debt (increase)/decrease (2,533) 5,433

Opening net debt (24,425) (29,858)

Closing net debt (26,958) (24,425) 10.4

Notes:

1 Cash capital expenditure comprises the purchase of property, plant and equipment and intangible assets,

other than licence and spectrum payments, during the year.

2 Dividends received from associates and investments for the year ended 31 March 2013 includes

a £2,389million (2012: £965 million) tax distribution from our 45% interest in VZW. In the year ended

31 March 2012 a nal dividend of £178 million was received from SFR prior to completion of the disposal

of the Group’s 44% interest . It does not include the £2,409 million income dividend from VZW received

in December 2012 and the £2,855 million income dividend received from VZW in January 2012.

3 Related to a tax settlement in the year ended 31 March 2011.

4 Acquisitions and disposals for the year ended 31 March 2013 primarily includes the £1,050 million

payment in relation to the acquisition of the entire share capital of CWW and £243 million in respect

of convertible bonds acquired as part of the CWW acquisition, and £440 million in relation to the

acquisition of TelstraClear. The year ended 31 March 2012 primarily included £6,805 million proceeds

from the sale of the Group’s 44% interest in SFR, £784 million proceeds from the sale of the Group’s 24.4%

interest in Polkomtel and £2,592 million payment in relation to the purchase of non-controlling interests

in Vodafone India Limited.

5 Other for the year ended 31 March 2013 primarily includes the remaining £1,499 million consideration for

the disposal of SoftBank Mobile Corp. interests in November 2010, received in April 2012, partially offset

by £322 million in relation to fair value and interest accrual movements on nancial instruments. The year

ended 31 March 2012 primarily included £2,301 million movement in the written put options in relation

to India and the return of a court deposit made in respect of the India tax case (£310 million).

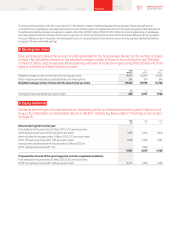

Net debt

Net debt increased by £2.5 billion to £27.0 billion primarily due

to the purchase of CWW and TelstraClear, share buybacks, payments

to acquire spectrum, foreign exchange movements and dividend

payments to equity holders, partially offset by cash generated

by operations, the remaining consideration from the Group’s disposal

of SoftBank Mobile Corp. and the £2.4 billion income dividend

from VZW.

The nancial commentary on this page forms part of the business review and is unaudited.

97 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information