Vodafone 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

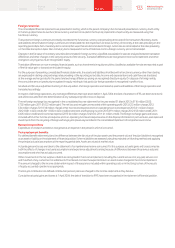

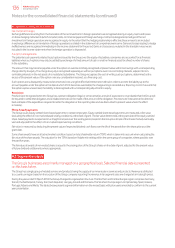

A1. Signicant accounting policies (continued)

Net investment hedges

Exchange differences arising from the translation of the net investment in foreign operations are recognised directly in equity. Gains and losses

on those hedging instruments (which include bonds, commercial paper and foreign exchange contracts) designated as hedges of the net

investments in foreign operations are recognised in equity to the extent that the hedging relationship is effective; these amounts are included

in exchange differences on translation of foreign operations as stated in the statement of comprehensive income. Gains and losses relating to hedge

ineffectiveness are recognised immediately in the income statement for the period. Gains and losses accumulated in the translation reserve are

included in the income statement when the foreign operation is disposed of.

Put option arrangements

The potential cash payments related to put options issued by the Group over the equity of subsidiary companies are accounted for as nancial

liabilities when such options may only be settled by exchange of a xed amount of cash or another nancial asset for a xed number of shares

in the subsidiary.

The amount that may become payable under the option on exercise is initially recognised at present value within borrowings with a corresponding

charge directly to equity. The charge to equity is recognised separately as written put options over non-controlling interests, adjacent to non-

controlling interests in the net assets of consolidated subsidiaries. The Group recognises the cost of writing such put options, determined as the

excess of the present value of the option over any consideration received, as a nancing cost.

Such options are subsequently measured at amortised cost, using the effective interest rate method, in order to accrete the liability up to the

amount payable under the option at the date at which it rst becomes exercisable; the charge arising is recorded as a nancing cost. In the event that

the option expires unexercised, the liability is derecognised with a corresponding adjustment to equity.

Provisions

Provisions are recognised when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that the Group will

be required to settle that obligation and a reliable estimate can be made of the amount of the obligation. Provisions are measured at the directors’

best estimate of the expenditure required to settle the obligation at the reporting date and are discounted to present value where the effect

is material.

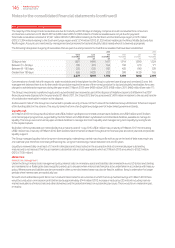

Share-based payments

The Group issues equity-settled share-based payments to certain employees. Equity-settled share-based payments are measured at fair value

(excluding the effect of non-market-based vesting conditions) at the date of grant. The fair value determined at the grant date of the equity-settled

share-based payments is expensed on a straight-line basis over the vesting period, based on the Group’s estimate of the shares that will eventually

vest and adjusted for the effect of non-market-based vesting conditions.

Fair value is measured by deducting the present value of expected dividend cash ows over the life of the awards from the share price as at the

grant date.

Some share awards have an attached market condition, based on total shareholder return (‘TSR’), which is taken into account when calculating the

fair value of the share awards. The valuation for the TSR is based on Vodafone’s ranking within the same group of companies, where possible, over

the past ve years.

The fair value of awards of non-vested shares is equal to the closing price of the Group’s shares on the date of grant, adjusted for the present value

of future dividend entitlements where appropriate.

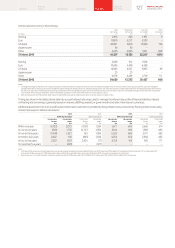

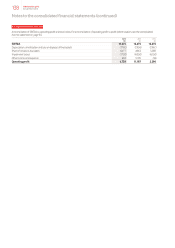

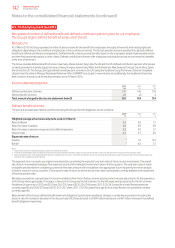

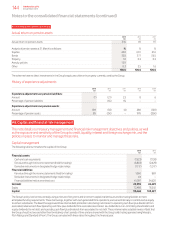

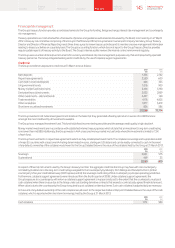

A2. Segment analysis

The Group’s businesses are primarily managed on a geographical basis. Selected nancial data is presented

on this basis below.

The Group has a single group of related services and products being the supply of communications services and products. Revenue is attributed

to a country or region based on the location of the Group company reporting the revenue. Inter-segment sales are charged at arm’s length prices.

During the year ended 31 March 2013 the Group changed its organisation structure. The Northern and Central Europe region comprises Germany,

the UK, the Netherlands, Turkey, the Czech Republic, Hungary, Ireland and Romania. The Southern Europe region comprises Italy, Spain, Greece,

Portugal, Albania and Malta. The tables below present segment information on the revised basis, with prior years amended to conform to the current

year presentation.

Notes to the consolidated nancial statements (continued)

136 Vodafone Group Plc

Annual Report 2013