Vodafone 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

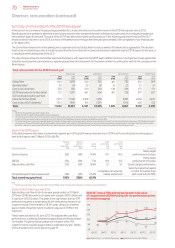

Directors’ interests in the shares of the Company – long-term incentives

Performance shares

GLTI conditional share awards granted to executive directors for the relevant nancial years are shown below. It is important to note that the

guresshown in the rst two columns represent the maximum amount which could vest at the end of the relevant three year performance period.

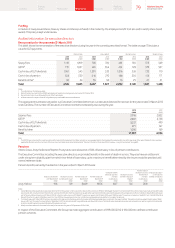

In order to participate in these plans, executives have had to invest personal shares with a combined value of: £3,853,074 (Vittorio Colao); £1,298,585

(Andy Halford); and £1,181,654 (Stephen Pusey). The total value is calculated using the closing trade share price on 31March 2013 of 186.6 pence.

Total interest in

performance shares

at 1 April 2012

or date of

appointment

Shares

conditionally

awarded

during the 2013

nancial year1

Shares

forfeited

during

the 2013

nancial year2

Shares

vested during

the 2013

nancial year2

Total interest

in performance

shares at

31 March 2013 Total value

Market

price at date

awards

granted Vesting date

Number of shares Number of shares Number of shares Number of shares Number of shares £’000 Pence

Vittorio Colao

2009 – Base award 4,564,995 – – (4,564,995) ––117.47 Jun 2012

2009 – Co-investment award 1,817,866 – – (1,817,866) ––117.47 Jun 2012

2010 – Base award 4,097,873 – – – 4,097,873 7,646,631 142.94 Jun 2013

2010 – Co-investment award 2,980,271 – – – 2,980,271 5,561,186 142.94 Jun 2013

2011 – Base award 3,740,808 – – – 3,740,808 6,980,348 163.20 Jun 2014

2011 – Co-investment award 2,720,588 – – – 2,720,588 5,076,617 163.20 Jun 2014

2012 – Base award –2,552,257 – – 2,552,257 4,762,512 179.40 Jul 2015

2012 – Co-investment award –1,958,823 – – 1,958,823 3,655,164 179.40 Jul 2015

Total 19,922,401 4,511,080 – (6,382,861) 18,050,620 33,682,458

Andy Halford

2009 – Base award 2,524,934 – – (2,524,934) ––117.47 Jun 2012

2009 – Co-investment award 1,676,756 – – (1,676,756) ––117.47 Jun 2012

2010 – Base award 2,154,750 – – – 2,154,750 4,020,764 142.94 Jun 2013

2010 – Co-investment award 1,958,863 – – – 1,958,863 3,655,238 142.94 Jun 2013

2011 – Base award 1,887, 254 – – – 1,887,254 3,521,616 163.20 Jun 2014

2011 – Co-investment award 756,036 – – – 756,036 1,410,763 163.20 Jun 2014

2012 – Base award –1,287,625 – – 1,287,625 2,402,708 179.40 Jul 2015

Total 10,958,593 1,287,625 –(4,201,690) 8,044,528 15,011,089

Michel Combes3

2009 – Base award 2,771,771 – – (2,771,771) ––117.47 Jun 2012

2009 – Co-investment award 533,854 – – (533,854) ––117.47 Jun 2012

2010 – Base award 2,370,225 –(2,370,225) –––142.94 Jun 2013

2010 – Co-investment award 1,144,116 –(1,144,116) –––142.94 Jun 2013

2011 – Base award 2,129,901 –(2,129,901) –––163.20 Jun 2014

2011 – Co-investment award 876,531 –(876,531) – – – 163.20 Jun 2014

Total 9,826,398 –(6,520,773) (3,305,625) – –

Stephen Pusey

2009 – Base award 1,872,818 – – (1,872,818) ––117.47 Jun 2012

2009 – Co-investment award 510,879 – – (510,879) ––117.47 Jun 2012

2010 – Base award 1,693,018 – – – 1,693,018 3,159,172 142.94 Jun 2013

2010 – Co-investment award 571,097 –––571,097 1,065,667 142.94 Jun 2013

2011 – Base award 1,550,245 – – – 1,550,245 2,892,757 163.20 Jun 2014

2011 – Co-investment award 612,745 – – – 612,745 1,143,382 163.20 Jun 2014

2012 – Base award –1,057,692 – – 1,057,692 1,973,653 179.40 Jul 2015

2012 – Co-investment award –1,014,705 – – 1,014,705 1,893,440 179.40 Jul 2015

Total 6,810,802 2,072,397 –(2,383,697) 6,499,502 12,128,071

Notes:

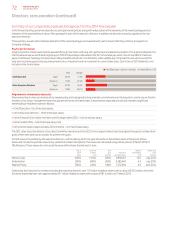

1 The awards were granted during the year under the Vodafone Global Incentive Plan (‘GIP’) using the closing share price on the day before the grant which was 179.40 pence. These awards have a performance period running

from 1 April 2012 to 31March 2015. The performance conditions are a matrix of adjusted free cash ow performance and relative TSR. The vesting date will be in June 2015.

2 Shares granted on 30 June 2009 vested on 30 June 2012. The performance conditions on these awards were a matrix of adjusted free cash ow performance and relative TSR, and the resulting vesting was 100% of maximum.

Theshareprice on the vesting date was 179.25 pence.

3 Michel Combes was employed until 31 October 2012.

The aggregate number of shares conditionally awarded during the year to the Executive Committee, other than the executive directors, was

13,360,023 shares. The performance and vesting conditions on the shares awarded in the year are based on a matrix of adjusted free cash ow

performance and relative TSR.

80 Vodafone Group Plc

Annual Report 2013

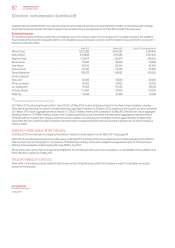

Directors’ remuneration (continued)