Vodafone 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategy (continued)

Consumer2015

Emerging markets1

Emerging markets are important to us – they account for 68% of

ourcustomers and 75% of the total call minutes across our networks.

These markets are likely to become even more relevant due to a

combination of strong population and economic growth, and the

increase in mobile penetration.

123 4

Market context:

Emerging markets such as India and Africa

are already a signicant part of Vodafone.

They account for 30% of the Group’s service

revenue, and our business in India alone

accounts for around half of our base station

sites and voice calls across the Group.

Emerging markets represent a signicant

opportunity for future growth. Almost all

of the 1.5 billion new mobile phone users

by 20152 are expected to come from

emerging markets. Smartphones are also

proving popular in emerging markets, and this

is expected to continue. For example, In India,

the number of smartphone users has grown

already from 11 million in 2010 to 33 million

in 20122.

Towards 2015:

These markets offer very attractive long-

term opportunities from sustained GDP

growth, the scope for widespread mobile

data adoption and the fullment of unmet

needs such as basic nancial services. We aim

to maximise these opportunities through

smart data pricing, the development of low-

cost smartphones and selective innovation

in areas in which we can truly differentiate.

Strengths:

We are a leading operator in our emerging

markets with either a number one or

two revenue market share position in

most countries.

Actions:

Through our ongoing investment we have

built a strong platform of high quality

networks, a broad distribution reach

and attractive add-on services, such

as mobile payments.

Progress:

Emerging markets represent our fastest

growing geographies. During the year service

revenue increased by 8.4%*, including: India

10.7%*, Turkey 17.3%* and Ghana 24.2%*.

Notes:

1 Vodafone’s emerging markets comprise Vodacom, India, Egypt,

Turkey, Ghana, Qatar and Fiji.

2 Refers to calendar year.

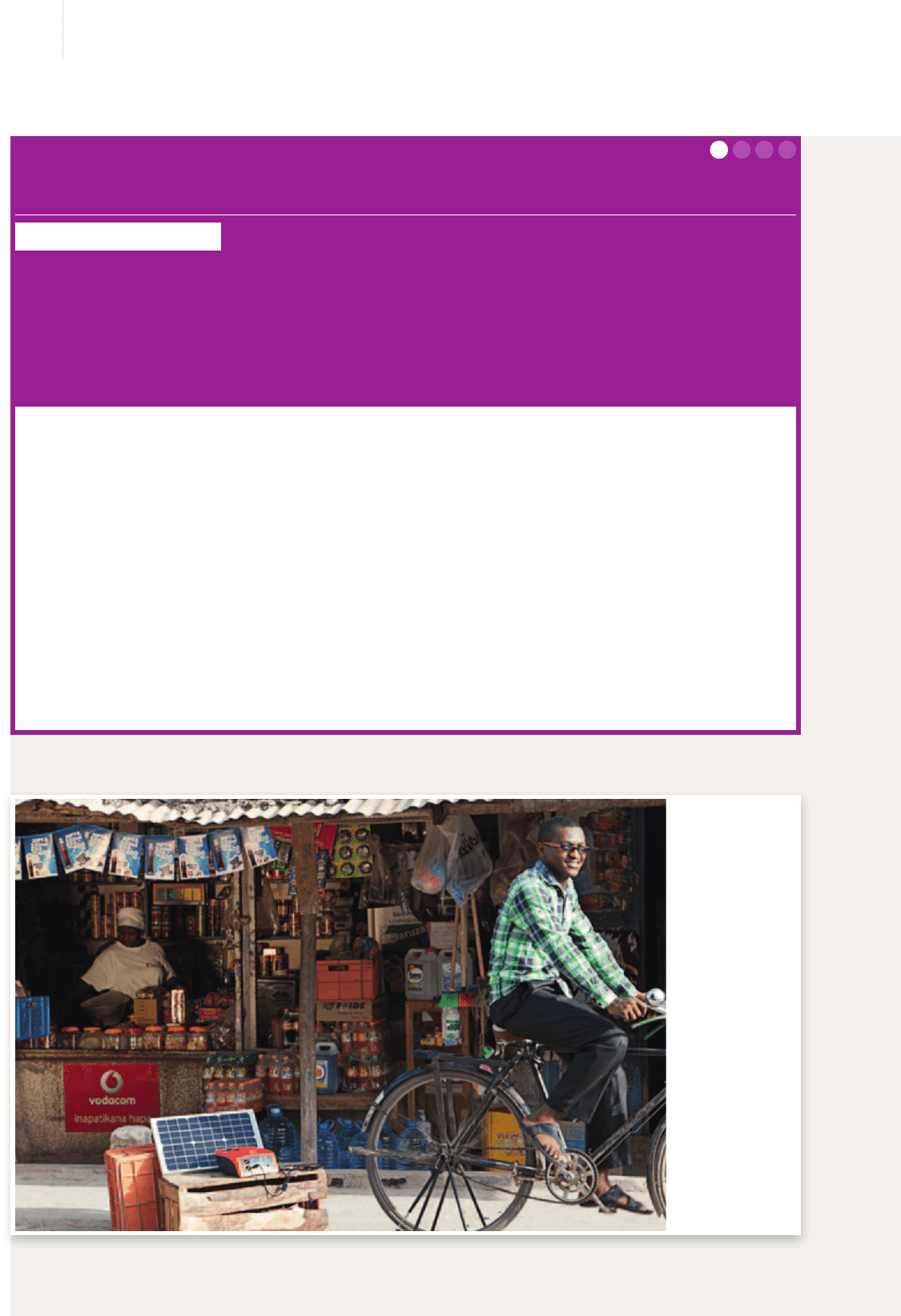

Access to energy

Extending access

to energy in remote

regions without grid

electricity enables

more people to use our

mobile services and

brings wider social and

environmental benets.

Our new solar-powered

solution, ReadySet, is

able to charge up to

eight mobile phones

per day and provide

electric lighting, offering

a greener and cheaper

alternative to kerosene

lamps. Entrepreneurs in

Tanzania use ReadySet

to earn around US$44 a

month, while families in

Kenya use M-Pesa to pay

towards a similar system,

M-Kopa, designed for

home use.

26 Vodafone Group Plc

Annual Report 2013