Vodafone 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Summary of our compensation policies and approach for the 2014 nancial year

In this forward-looking section we describe our principal reward policies along with a description of the elements of the reward package and an

indication of the potential future value of this package for each of the executive directors. In addition we describe our policy applied to the non-

executive directors.

These policies, as well as the individual elements of the reward package, are reviewed each year to ensure that they continue to support our

Company strategy.

Pay for performance

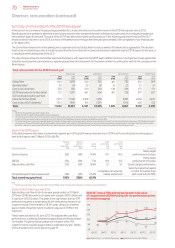

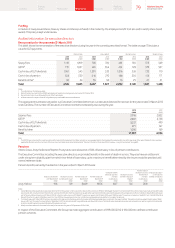

A high proportion of total reward will be awarded through short-term and long-term performance related remuneration. This is demonstrated in the

charts below where we see that at target payout 70% of the package is delivered in the form of variable pay, which rises to over 86% if maximum

payout is achieved. Fixed pay comprises base salary, benets and pension contributions, while variable pay comprises the annual bonus and the

long-term incentive opportunity assuming maximum co-investment and no movement in current shareprice. Cash in lieu of GLTI dividends is not

included in the charts below.

Fixed Variable

Chief Executive Target 28.1% 71.9%

Maximum 12.6% 87.4%

Other Executive Directors Target 30.1% 69.9%

Maximum 13.8% 86.2 %

Fixed (Base salary + pension + benets) Variable (Bonus + LTI)

Alignment to shareholder interests

Share ownership is a key cornerstone of our reward policy and is designed to help maintain commitment over the long-term, and to ensure that the

interests of our senior management team are aligned with those of shareholders. Executives are expected to build and maintain a signicant

shareholding in Vodafone shares as follows:

a Chief Executive – four times base salary;

a other executive directors – three times base salary;

a other Executive Committee members and the large market CEOs – two times base salary;

a other market CEOs – one times base salary; and

a other senior leaders (approximately 220 members) – one-half of base salary.

The CEO, other executive directors, Executive Committee members and the CEO’s of our largest markets have been given ve years to achieve their

goals; others were given up to six years to achieve their goals.

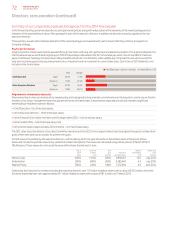

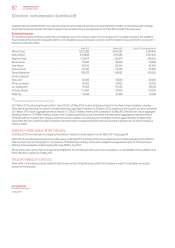

Current levels of ownership by the executive directors, and the date by which the goal should be or should have been achieved, are shown

belowand include the post-tax value of any vested but unexercised options. The values are calculated using a share price at 31 March 2013 of

186.60pence. These values do not include the value of the shares that will vest in June.

Goal as

a % of

salary

Current %

of salary

held

% of

goal

achieved

Number of

equivalent shares

Value of

shareholding

(£m)

Date for goal

to be

achieved

Vittorio Colao 400% 1,170% 292% 6,959,472 13.0 July 2012

Andy Halford 300% 609% 203% 2,285,440 4.3 July 2010

Stephen Pusey 300% 445% 148% 1,372,594 2.6 June 2014

Collectively the Executive Committee including the executive directorsown 17.8 million Vodafone shares, with a value of £33.3 million, whilst the

full senior leadership team own approximately 43.7 million Vodafone shares with a value of £81.5 million at31 March 2013.

72 Vodafone Group Plc

Annual Report 2013

Directors’ remuneration (continued)