Vodafone 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11. Acquisitions and disposals (continued)

TelstraClear Limited (‘TelstraClear’)

On 31 October 2012 the Group acquired the entire share capital of TelstraClear for cash consideration of NZ$863 million (£440 million). The primary

reasons for acquiring the business were to strengthen Vodafone New Zealand’s portfolio of xed communications solutions and to create a leading

total communications company in New Zealand.

The results of the acquired entity which have been consolidated in the income statement from 31 October 2012 contributed £136 million

of revenues and a loss of £23 million to the prot attributable to equity shareholders of the Group during the period.

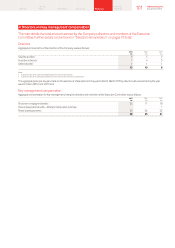

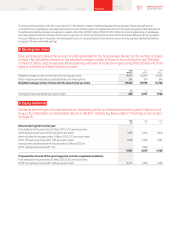

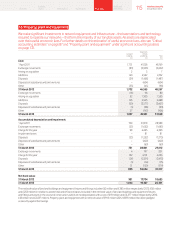

The provisional purchase price allocation is set out in the table below:

Fair value

£m

Net assets acquired:

Identiable intangible assets184

Property, plant and equipment 345

Trade and other receivables 55

Cash and cash equivalents 5

Current and deferred taxation liabilities (19)

Trade and other payables (59)

Provisions (15)

Net identiable assets acquired 396

Goodwill244

Total consideration 440

Notes:

1 Identiable intangible assets of £84 million consist of licences and spectrum fees of £27 million , TelstraClear brand of £3 million and customer relationships of £54 million.

2 The goodwill is attributable to the expected protability of the acquired business and the synergies expected to arise after the Group’s acquisition of TelstraClear. None of the goodwill is expected to be deductible for

tax purposes.

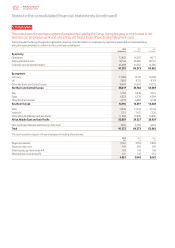

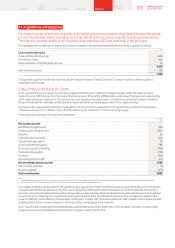

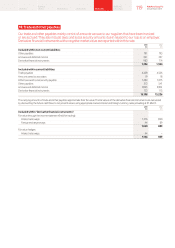

Pro-forma full year information

The following unaudited pro-forma summary presents the Group as if the acquisitions of CWW and TelstraClear had been completed on 1 April

2012. The pro-forma amounts include the results of CWW and TelstraClear, amortisation of the acquired intangible assets recognised on acquisition

and interest expense on the increase in net debt as a result of the acquisitions. The pro-forma information is provided for comparative purposes

only and does not necessarily reect the actual results that would have occurred, nor is it necessarily indicative of future results of operations of the

combined companies.

2013

£m

Revenue 45,289

Prot for the nancial year 601

Prot attributable to equity shareholders 355

Pence

Basic earnings per share 0.72

Diluted earnings per share 0.72

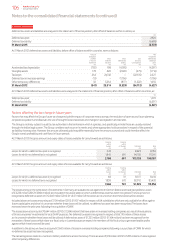

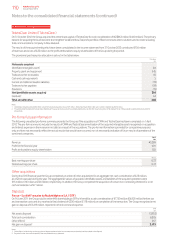

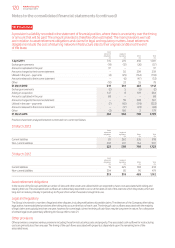

Other acquisitions

During the 2013 nancial year the Group completed a number of other acquisitions for an aggregate net cash consideration of £25 million,

all of which was paid during the year. The aggregate fair values of goodwill, identiable assets, and liabilities of the acquired operations were

£15 million, £16 million and £6 million, respectively. In addition, the Group completed the acquisition of certain non-controlling interests for a net

cash consideration of £7 million.

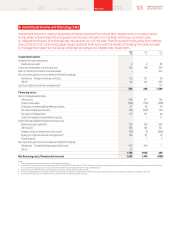

Disposals

France – Société Française du Radiotéléphone S.A. (‘SFR’)

On 16 June 2011 the Group sold its entire 44% shareholding in SFR to Vivendi for a cash consideration of €7,750 million (£6,805 million) before tax

and transaction costs and also received a nal dividend of €200 million (£178 million) on completion of the transaction. The Group recognised a net

gain on disposal of £3,419 million, reported in other income and expense.

SFR

£m

Net assets disposed (3,953)

Total cash consideration 6,805

Other effects1567

Net gain on disposal23,419

Notes:

1 Other effects include foreign exchange gains and losses transferred to the income statement and professional fees related to the disposal.

2 Reported in other income and expense in the consolidated income statement.

Notes to the consolidated nancial statements (continued)

110 Vodafone Group Plc

Annual Report 2013