Vodafone 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with him a depth of insight into internet

businesses built up over nearly 20 years

as a pioneer in the industry.

Sir John Buchanan stepped down from

his role as Deputy Chairman and Senior

Independent Director in July 2012, after nine

years of dedicated service to the Vodafone

Board. His experience was invaluable

to me personally in my rst year as Chairman,

and I would like to thank him for his wisdom

and commitment. I am delighted that

LucVandevelde agreed to become Senior

Independent Director in Sir John’s place.

Luc has also served on the Board for nine

years, and has therefore reached the

milestone after which the UK Corporate

Governance Code recommends Boards

take account of a director’s period of service

when considering whether or not he remains

independent. The Board considers that

it is not in the best interests of shareholders

to lose the experience of two such

distinguished international business leaders

in close succession.

My medium-term ambitions for the

composition of the Board are to bring in further

marketing expertise, and achieve a greater

gender balance towards our ambition of 25%

of Board members being women by 2015.

Take a lead in nancial reporting

This year’s annual report incorporates a

number of new features to make our strategy

and performance easier to understand, such

as our innovative move to incorporate a high

level business review with our primary nancial

statements (pages 90 to 97). In addition, we

have adopted a number of aspects of the

revised UK Corporate Governance Code a year

earlier than required. These include the Board’s

conrmation that the report presents a fair,

balanced and understandable assessment

of Vodafone’s position and prospects, and an

enhanced audit report. We have also adopted

some of the new disclosure requirements on

directors’ remuneration a year early.

Strong capital discipline

The Board considers the ordinary dividend

to be the core element of shareholder

remuneration, and something on which

shareholders should be able to depend. This

year we raised our ordinary dividend per share

by 7% for the third year in a row, and remain

focused on at least maintaining the dividend

per share at this level in the future.

In addition, during the year we completed

a £6.8 billion share buyback programme,

funded by the disposal of non-controlling

interests, and committed an additional

£1.5 billion to share buybacks on receipt

of a further dividend from VZW in December

2012. We have demonstrated a highly

disciplined approach to capital allocation,

and will continue to manage our portfolio

of assets in the best interest of shareholders.

Taking ordinary and special dividends,

and the buyback programmes, total cash

returns to shareholders have been equivalent

to approximately 34% of our average market

capitalisation over the last four years.

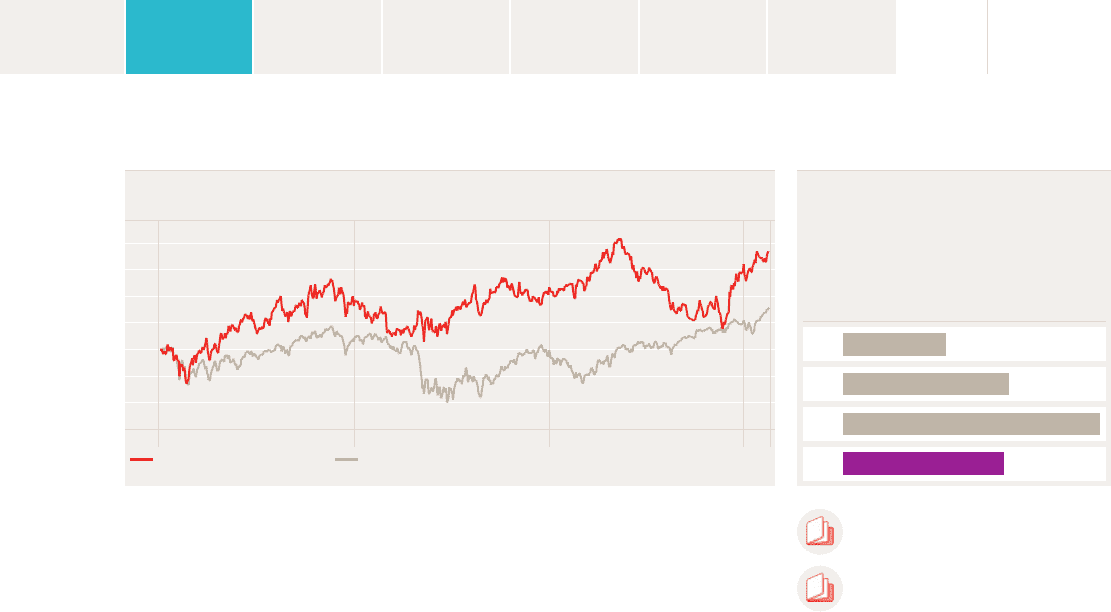

Furthermore, in the period from 1 April

2010 to 20 May 2013, our share price has

outperformed the STOXX Europe 600 Index

by 20.9%.

Aligning management’s interests

to shareholders’

Our incentive schemes have a bias towards

long-term, share-based plans, which

incentivise our leaders to prioritise multi-year

investment decisions and align their interests

closely with those of institutional shareholders.

We deepened this alignment last year

by introducing shareholding requirements

throughout the senior leadership team.

The Executive Committee owns Vodafone

shares worth around 500% of their combined

salaries in total.

You can nd more information on our

remuneration policies on pages 67 to 82.

Vodafone’s role in society

Mobile technology is a massive driver

of economic and social improvement.

Our vision is to unleash the power of Vodafone

to help transform societies and enable

sustainable living for all. Whether through

low cost mobile banking services, mobile

agriculture solutions or mobile health

initiatives, we are making a real difference

to people’s lives. We have also stepped

up our commitment to responsible and

ethical business practices in our new Code

of Conduct, published during the year.

You can nd more information on our

sustainability programme on pages 36 and 37.

Gerard Kleisterlee

Chairman

Cash returns to shareholders

Strong cash returns to shareholders are an established

priority for Vodafone. The ordinary dividend is the

core element of shareholder remuneration, with any

surplus capital distributed via special dividend or share

buybacks.

Vodafone share price vs STOXX Europe 600 Index

1 April 2010 to 20 May 2013, in €, rebased to 100

2011 £6.6bn

2010 £4.1bn

£10.2bn

£6.4bn

2012

2013

You can nd more information on our

remuneration policies on pages 67 to 82

You can nd more information on our

sustainability programmes on pages 36 and 37

140

100

110

120

130

90

80

70

April 2010 April 2011 April 2012 April 2013

Vodafone share price STOXX Europe 600 Index

For legal reasons it should be noted that past performance cannot be relied on as a guide to future performance.

13 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information