Vodafone 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

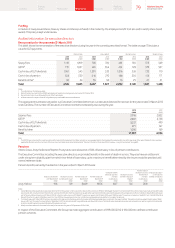

Funding

A mixture of newly issued shares, treasury shares and shares purchased in the market by the employee benet trust are used to satisfy share-based

awards. This policy is kept under review.

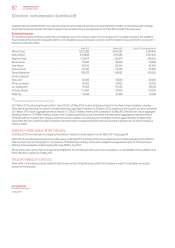

Audited information for executive directors

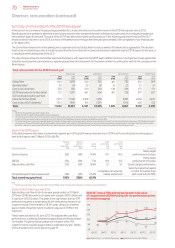

Remuneration for the year ended 31 March 2013

This table1 shows the remuneration of the executive directors during the year in the currently prescribed format. The table on page 70 includes a

value for GLTI payments.

Vittorio Colao Andy Halford Michel Combes Stephen Pusey

2013

£’000

2012

£’000

2013

£’000

2012

£’000

20132

£’000

2012

£’000

2013

£’000

2012

£’000

Salary/fees 1,110 1,099 700 700 461 785 575 569

GSTIP3731 1,037 461 654 461 728 379 537

Cash in lieu of GLTI dividends 1,961 545 1,291 333 1,016 326 733 110

Cash in lieu of pension 333 330 210 210 138 236 173 171

Benets /other430 24 35 30 16 25 21 21

Total 4,165 3,035 2,697 1,927 2,092 2,100 1,881 1,408

Notes:

1 The information in this table is audited.

2 Michel Combes’ payments for the 2013 nancial year are based on his employment which ended 31 October 2012.

3 Payments are made in June following the end of the nancial year.

4 Includes amounts in respect of cost of living allowance, private healthcare and car allowance.

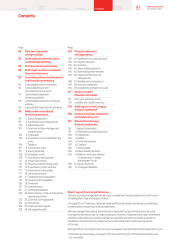

The aggregate remuneration we paid to our Executive Committee (other than our executive directors) for services for the year ended 31 March 2013

is set out below. The number of Executive Committee members increased by two during the year.

2013

£’000

2012

£’000

Salaries/fees 3,916 2,822

GSTIP12,987 2,758

Cash in lieu of GLTI dividends 3,037 490

Cash in lieu of pension 871 747

Benets/other 1,096 169

Total 11,907 6,986

Note:

1 The GSTIP gure comprises the incentive scheme information for the Executive Committee members on an equivalent basis to that disclosed for executive directors at the beginning of the report. Details of share incentives

awarded to directors and other members of the Executive Committee are included in footnotes to “Directors’ interests in the shares of the Company – Long-term incentives” on page 80.

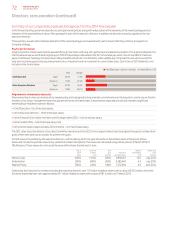

Pensions

Vittorio Colao, Andy Halford and Stephen Pusey take a cash allowance of 30% of base salary in lieu of pension contributions.

The Executive Committee, including the executive directors, are provided benets in the event of death in service. They also have an entitlement

under a long-term disability plan from which two-thirds of base salary, up to a maximum benet determined by the insurer, would be provided until

normal retirement date.

Pension benets earned by the director in the year ended 31 March 2013 were:

Total accrued benet

at 31 March 20131

£’000

Change in accrued

benet over the year1

£’000

Transfer value at 31

March 20122

£’000

Transfer value at 31

March 20132

£’000

Change in transfer

value over year less

member

contributions

£’000

Change in accrued

benet in excess of

ination3

£’000

Transfer value of

change in accrued

benet net of

member

contributions

£’000

Employer allocation/

contribution to

dened contribution

plans

£’000

Andy Halford 19.6 0.9 846.9 907.6 60.7 0.4 20.8 –

Notes:

1 Andy Halford took the opportunity to take early retirement from the pension scheme due to the closure of the scheme on 31 March 2010 (aged 51 years). In accordance with the scheme rules, his accrued pension at this date

was reduced with an early retirement factor for four years to reect the fact that his pension is being paid before age 55 and is therefore expected to be paid out for a longer period of time. In addition, Andy Halford exchanged

part of his early retirement pension at 31 March 2010 for a tax-free cash lump sum of £118,660. The pension in payment at 31 March 2010 was £17,800 per year. The pension increased on 1 April 2011 and 1 April 2012 by 5%, in

line with the scheme rules, to £19,624 per year from 1 April 2012 as shown above. No member contributions are payable as Andy Halford is in receipt of his pension.

2 The transfer value at 31 March 2013 has been calculated on the basis and methodology set by the trustees after taking actuarial advice, as set out in the papers entitled “Calculation of cash equivalent transfer values” dated

January 2011 and “Sex-specic actuarial factor” dated March 2011. No director elected to pay additional voluntary contributions. The transfer value disclosed above does not represent a sum paid or payable to the individual

director. Instead it represents a potential liability of the pension scheme.

3 Ination has been taken as the increase in the retail price index over the year to 30 September 2012 of 2.6%.

In respect of the Executive Committee, the Group has made aggregate contributions of £99,000 (2012: £100,000) into dened contribution

pension schemes.

79 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information