Vodafone 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other unaudited nancial information (continued)

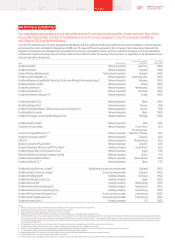

Prior year operating results (continued)

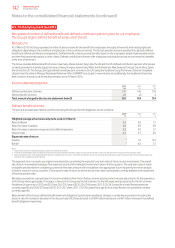

Northern and Central Europe

Germany

£m

UK

£m

Other

Northern and

Central Europe

£m

Eliminations

£m

Northern and

Central Europe

£m

% change

£m Organic

Year ended 31 March 2012

Revenue 8,233 5,397 6,042 (97) 19,575 3.6 3.7

Service revenue 7,669 4,996 5,695 (95) 18,265 2.2 2.5

EBITDA 2,965 1,294 1,675 –5,934 2.7 2.1

Adjusted operating prot 1,491 402 637 –2,530 2.2 0.8

EBITDA margin 36.0% 24.0% 27.7% 30.3%

Year ended 31 March 2011

Revenue 7,9 0 0 5,271 5,846 (117) 18,900

Service revenue 7, 471 4,931 5,589 (115) 17,876

EBITDA 2,952 1,233 1,594 –5,779

Adjusted operating prot 1,548 348 580 –2,476

EBITDA margin 37.4% 23.4% 27.3% 30.6%

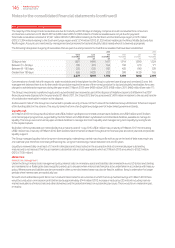

Revenue increased by 3.6% including a -0.2 percentage point impact

from unfavourable foreign exchange rate movements. On an organic

basis service revenue increased by 2.5%* primarily due growth in data

revenue, partially offset by the impact of MTR cuts and competitive

pricing pressures. Growth was seen in the UK, Germany, the Netherlands

and Turkey.

EBITDA increased by 2.7% including a 0.7 percentage point favourable

impact from foreign exchange rate movements. On an organic basis

EBITDA increased by 2.1%*, resulting from higher service revenue and

direct cost efciencies, partially offset by higher customer investment

due to the increased penetration of smartphones.

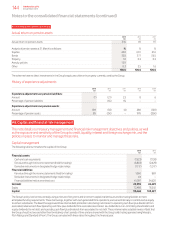

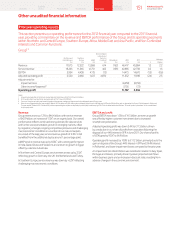

Organic

change

%

Other

activity1

pps

Foreign

exchange

pps

Reported

change

%

Revenue –

Northern and

CentralEurope 3.7 0.1 (0.2) 3.6

Service revenue

Germany 1.2 (0.1) 1.6 2.7

UK 1.6 (0.3) –1.3

Other Northern and

Central Europe 5.1 (0.3) (2.9) 1.9

Northern and

Central Europe 2.5 (0.1) (0.2) 2.2

EBITDA

Germany (1.1) –1.5 0.4

UK 5.0 (0.1) –4.9

Other Northern and

Central Europe 6.0 (0.7) (0.2) 5.1

Northern and

Central Europe 2.1 (0.1) 0.7 2.7

Adjusted operating prot

Germany (5.3) 0.1 1.5 (3.7)

UK 15.7 (0.2) –15.5

Other Northern and

Central Europe 7.9 (2.2) 4.1 9.8

Northern and

Central Europe 0.8 (0.5) 1.9 2.2

Note:

1 “Other activity” includes the impact of M&A activity and the revision to intra-group roaming charges from

1October 2011. Refer to “Organic growth” on page 188 for further detail.

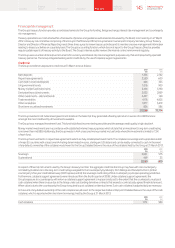

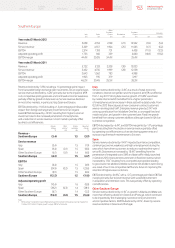

Germany

Service revenue increased by 1.2%* as strong growth in data and

enterprise revenue more than offset the impact of an MTR cut effective

from 1 December 2010 and increasing competitive pressures. Data

revenue grew by 21.3%* driven by a higher penetration of smartphones,

an increase in those sold with a data bundle and the launch of prepaid

integrated tariffs. Enterprise revenue grew by 5.6%* driven by signicant

customer wins and the success of converged service offerings.

A number of innovative products were launched during the second half

of the 2012 nancial year, including OfceNet, a cloud based solution.

The roll out of LTE has continued, following the launch of services

inthe2011 nancial year. Nearly 2,700 base stations had been

upgradedto LTE at 31 March 2012, providing approximately 35%

householdcoverage.

EBITDA declined by -1.1%* as the higher revenue was offset

by restructuring costs and regulation changes.

UK

Service revenue increased by 1.6%* driven by an increase in data and

consumer contract revenue supported by the success of integrated

offerings. This was partially offset by the impact of an MTR cut effective

from 1 April 2011 and lower consumer condence leading to reduced

out-of-bundle usage. Data revenue grew by 14.5%* due to higher

penetration of smartphones and an increase in those sold with

a data bundle.

EBITDA increased by 5.0%* and EBITDA margin improved by 0.6*

percentage points, due to a number of cost saving initiatives, including

acquisition and retention efciencies.

Other Northern and Central Europe

Service revenue increased by 5.1%* as growth in the Netherlands and

Turkey more than offset a decline in the rest of the region, particularly

in Ireland, which continued to be impacted by the challenging

macroeconomic environment and competitive factors. Service revenue

in Turkey grew by 25.1%* driven by strong growth in consumer contract

and data revenue resulting from an expanding contract customer base

and the launch of innovative propositions. In the Netherlands service

revenue increased by 2.1%*, driven by an increase in the customer

base, partially offset by MTR cuts, price competition and customers

optimising tariffs.

EBITDA grew by 6.0%*, with strong growth in Turkey, driven

by a combination of service revenue growth and cost efciencies,

partially offset by declines in the majority of the other markets.

152 Vodafone Group Plc

Annual Report 2013