Vodafone 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

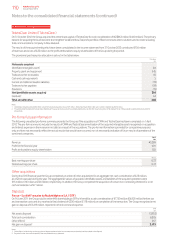

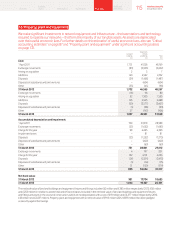

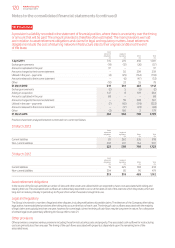

19. Provisions

A provision is a liability recorded in the statement of nancial position, where there is uncertainty over the timing

or amount that will be paid. The amount provided is therefore often estimated. The main provisions we hold

are in relation to asset retirement obligations and claims for legal and regulatory matters. Asset retirement

obligations include the cost of returning network infrastructure sites to their original condition at the end

of the lease.

Asset

retirement Legal and

obligations regulatory Other Total

£m £m £m £m

1 April 2011 315 270 456 1,041

Exchange movements (19) (12) (26) (57)

Amounts capitalised in the year 37 – – 37

Amounts charged to the income statement – 50 209 259

Utilised in the year − payments (4) (25) (164) (193)

Amounts released to the income statement – (6) (47) (53)

Other (10) 33 55 78

31 March 2012 319 310 483 1,112

Exchange movements (2) 5 (5) (2)

Arising on acquisition 147 8 109 264

Amounts capitalised in the year 68 – – 68

Amounts charged to the income statement – 59 308 367

Utilised in the year − payments (7) (42) (174) (223)

Amounts released to the income statement – (17) (23) (40)

Other (3) 180 2 179

31 March 2013 522 503 700 1,725

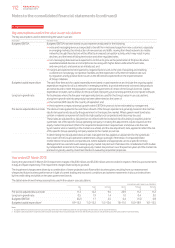

Provisions have been analysed between current and non-current as follows:

31 March 2013

Asset

retirement Legal and

obligations regulatory Other Total

£m £m £m £m

Current liabilities 20 262 536 818

Non-current liabilities 502 241 164 907

522 503 700 1,725

31 March 2012

Asset

retirement Legal and

obligations regulatory Other Total

£m £m £m £m

Current liabilities 15 225 393 633

Non-current liabilities 304 85 90 479

319 310 483 1,112

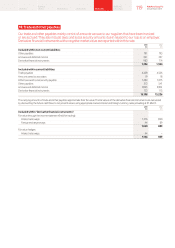

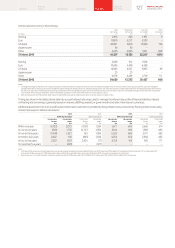

Asset retirement obligations

In the course of the Group’s activities a number of sites and other assets are utilised which are expected to have costs associated with exiting and

ceasing their use. Theassociated cash outows are substantially expected to occur at the dates of exit of the assets to which they relate, which are

long-term in nature, primarily in periods up to 25 years from when the asset is brought into use.

Legal and regulatory

The Group is involved in a number of legal and other disputes, including notications of possible claims. The directors of the Company, after taking

legal advice, have established provisions after taking into account the facts of each case. The timing of cash outows associated with the majority

of legal claims are typically less than one year, however, for some legal claims the timing of cash ows may be long-term in nature. For a discussion

of certain legal issues potentially affecting the Group refer to note 21.

Other provisions

Other provisions comprises various provisions including those for restructuring costs and property. The associated cash outows for restructuring

costs are primarily less than one year. The timing of the cash ows associated with property is dependent upon the remaining term of the

associated lease.

Notes to the consolidated nancial statements (continued)

120 Vodafone Group Plc

Annual Report 2013