Vodafone 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIHBV has not received any formal demand for taxation following the Finance Act 2012, but it did receive a letter on 3 January 2013 reminding

it of the tax demand raised prior to the Indian Supreme Court judgment and purporting to update the interest element of that demand in a total

amount of INR 142 billion (£1.6 billion). The separate proceedings taken against VIHBV to seek to treat it as an agent of HTIL in respect of its alleged

tax on the same transaction, as well as penalties of up to 100% of the assessed withholding tax for the alleged failure to have withheld such taxes,

remain pending despite the issue having been ruled upon by the Indian Supreme Court. Should a further demand for taxation be received by VIHBV

or any member of the Group as a result of the new retrospective legislation, the Group believes it is probable that it will be able to make a successful

claim under the BIT. Although this would not result in any outow of economic benet from the Group, it could take several years for VIHBV

to recover any deposit required by an Indian Court as a condition for any stay of enforcement of a tax demand pending the outcome of VIHBV’s BIT

claim. However, VIHBV expects that it would be able to recover any such deposit. VIHBV is exploring with the Indian Government whether

a mechanism exists under Indian law which would allow the parties to explore the possibility of a negotiated resolution of this dispute, but there

is no certainty that such a mechanism exists or that a resolution acceptable to both VIHBV and the Indian Government could be reached.

The Group did not carry a provision for this litigation or in respect of the retrospective legislation at 31 March 2013 or at previous reporting dates.

Indian regulatory cases

Litigation remains pending in the Telecommunications Dispute Settlement Appellate Tribunal (‘TDSAT’), High Courts and the Supreme Court

in relation to a number of signicant regulatory issues including mobile termination rates (‘MTRs’), spectrum and licence fees, licence extension and

3G intra-circle roaming (‘ICR’).

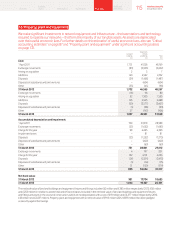

22. Reconciliation of net cash ow from operating activities

The table below shows how our prot for the year translates into cash ows generated from our

operating activities.

2013 2012 2011

£m £m £m

Prot for the nancial year 673 7,003 7,870

Adjustments for:

Share-based payments 134 143 156

Depreciation and amortisation 7, 70 0 7, 8 59 7, 876

Loss on disposal of property, plant and equipment 92 47 91

Share of result in associates (6,477) (4,963) (5,059)

Impairment losses 7,700 4,050 6,150

Other income and expense (468) (3,705) 16

Non-operating income and expense (10) 162 (3,022)

Investment income (305) (456) (1,309)

Financing costs 1,788 1,932 429

Income tax expense 2,582 2,546 1,628

Decrease/(increase) in inventory 72 24 (107)

Increase in trade and other receivables (184) (689) (387)

Increase in trade and other payables 430 871 1,060

Cash generated by operations 13,727 14,824 15,392

Tax paid (3,033) (2,069) (3,397)

Net cash ow from operating activities 10,694 12,755 11,995

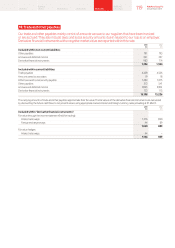

23. Cash and cash equivalents

The majority of the Group’s cash is held in bank deposits or in money market funds which have a maturity

of three months or less to enable us to meet our short-term liquidity requirements.

2013 2012

£m £m

Cash at bank and in hand 1,396 2,762

Money market funds 3,494 3,190

Repurchase agreements 2,550 600

Short-term securitised investments 183 586

Cash and cash equivalents as presented in the statement of nancial position 7,623 7,138

Bank overdrafts (25) (50)

Cash and cash equivalents as presented in the statement of cash ows 7,598 7,088

Cash and cash equivalents are held by the Group on a short-term basis with all having an original maturity of three months or less. The carrying

amount approximates their fair value.

123 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information