Vodafone 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

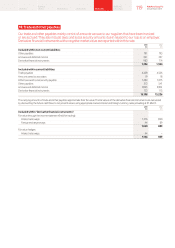

A1. Signicant accounting policies

Below we detail our signicant accounting policies applied in the current reporting period. These should be read

in conjunction with “Critical accounting estimates” on page 86 and 87.

Signicant accounting policies applied in the current reporting period

Accounting convention

The consolidated nancial statements are prepared on a historical cost basis except for certain nancial and equity instruments that have been

measured at fair value.

New accounting pronouncements adopted

On 1 April 2012 the Group adopted new accounting policies to comply with amendments to:

a IAS 12 “Income taxes”.

a IFRS 7 “Financial instruments: disclosures”.

These changes have no material impact on the consolidated results, nancial position or cash ows of the Group.

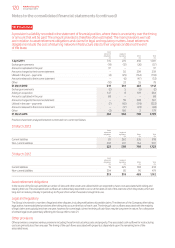

Basis of consolidation

The consolidated nancial statements incorporate the nancial statements of the Company and entities controlled, both unilaterally and jointly,

by the Company.

Accounting for subsidiaries

A subsidiary is an entity controlled by the Company. Control is achieved where the Company has the power to govern the nancial and operating

policies of an entity so as to obtain benets from its activities.

The results of subsidiaries acquired or disposed of during the year are included in the income statement from the effective date of acquisition

or up to the effective date of disposal, as appropriate. Where necessary, adjustments are made to the nancial statements of subsidiaries to bring

their accounting policies into line with those used by the Group.

All intra-group transactions, balances, income and expenses are eliminated onconsolidation.

Non-controlling interests in the net assets of consolidated subsidiaries are identied separately from the Group’s equity therein. Non-controlling

interests consist of the amount of those interests at the date of the original business combination and the non-controlling shareholder’s share

of changes in equity since the date of the combination. Total comprehensive income is attributed to non-controlling interests even if this results

in the non-controlling interests having a decit balance.

Business combinations

Acquisitions of subsidiaries are accounted for using the acquisition method. The cost of the acquisition is measured at the aggregate of the fair

values, at the date of exchange, of assets given, liabilities incurred or assumed, and equity instruments issued by the Group. Acquisition-related

costs are recognised in the income statement as incurred. The acquiree’s identiable assets and liabilities are recognised at their fair values at the

acquisition date.

Goodwill is measured as the excess of the sum of the consideration transferred, the amount of any non-controlling interests in the acquiree and

the fair value of the Group’s previously held equity interest in the acquiree, if any, over the net amounts of identiable assets acquired and liabilities

assumed at the acquisition date.

The interest of the non-controlling shareholders in the acquiree may initially be measured either at fair value or at the non-controlling shareholders’

proportion of the net fair value of the identiable assets acquired, liabilities and contingent liabilities assumed. The choice of measurement basis

is made on an acquisition-by-acquisition basis.

Acquisition of interests from non-controlling shareholders

In transactions with non-controlling parties that do not result in a change in control, the difference between the fair value of the consideration paid

or received and the amount by which the non-controlling interest is adjusted is recognised in equity.

Interests in joint ventures

A joint venture is a contractual arrangement whereby the Group and other parties undertake an economic activity that is subject to joint control; that

is, when the strategic nancial and operating policy decisions relating to the activities require the unanimous consent of the parties sharing control.

The Group reports its interests in jointly controlled entities using proportionate consolidation. The Group’s share of the assets, liabilities, income,

expenses and cash ows of jointly controlled entities are combined with the equivalent items in the nancial statements on a line-by-line basis.

Any goodwill arising on the acquisition of the Group’s interest in a jointly controlled entity is accounted for in accordance with the Group’s accounting

policy for goodwill arising on the acquisition of a subsidiary.

129 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information