Vodafone 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

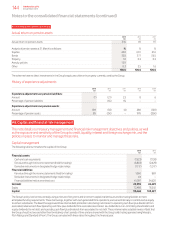

Financial risk management

The Group’s treasury function provides a centralised service to the Group for funding, foreign exchange, interest rate management and counterparty

risk management.

Treasury operations are conducted within a framework of policies and guidelines authorised and reviewed by the Board, most recently on 27 March

2012. A treasury risk committee comprising of the Group’s Chief Financial Ofcer, Group General Counsel and Company Secretary, Group Treasury

Director and Director of Financial Reporting meets three times a year to review treasury activities and its members receive management information

relating to treasury activities on a quarterly basis. The Group’s accounting function, which does not report to the Group Treasury Director, provides

regular update reports of treasury activity to the Board. The Group’s internal auditor reviews the internal control environment regularly.

The Group uses a number of derivative instruments for currency and interest rate risk management purposes only that are transacted by specialist

treasury personnel. The Group mitigates banking sector credit risk by the use of collateral support agreements.

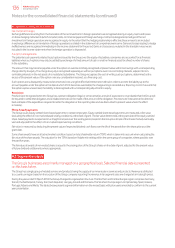

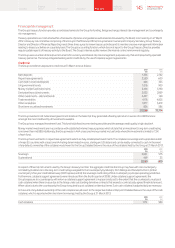

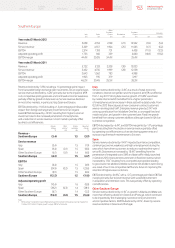

Credit risk

The Group considers its exposure to credit risk at 31 March to be as follows:

2013 2012

£m £m

Bank deposits 1,396 2,762

Repurchase agreements 2,550 600

Cash held in restricted deposits 404 333

UK government bonds 1,076 900

Money market fund investments 3,494 3,190

Derivative nancial instruments 3,032 2,959

Other investments – debt and bonds 3,427 160

Trade receivables 4 ,176 4,005

Other receivables 1,877 3,219

Short term securitised investments 826 586

22,258 18,714

The Group invested in UK index linked government bonds on the basis that they generated a oating rate return in excess of £ LIBOR and are

amongst the most creditworthy of investments available.

The Group has a managed investment fund. This fund holds xed income sterling securities and the average credit quality is high double A.

Money market investments are in accordance with established internal treasury policies which dictate that an investment’s long-term credit rating

is no lower than mid BBB. Additionally, the Group invests in AAA unsecured money market mutual funds where the investment is limited to 7.5%

of each fund.

The Group has investments in repurchase agreements which are fully collateralised investments. The collateral is sovereign and supranational debt

of major EU countries with at least one AAA rating denominated in euros, sterling and US dollars and can be readily converted to cash. In the event

of any default, ownership of the collateral would revert to the Group. Detailed below is the value of the collateral held by the Group at 31 March 2013.

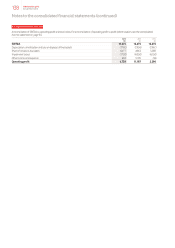

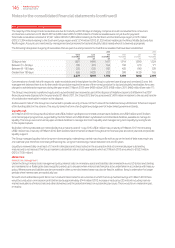

2013 2012

£m £m

Sovereign 2,081 575

Supranational 469 25

2,550 600

In respect of nancial instruments used by the Group’s treasury function, the aggregate credit risk the Group may have with one counterparty

is limited by (i) reference to the long-term credit ratings assigned for that counterparty by Moody’s, Fitch Ratings and Standard & Poor’s, (ii) that

counterparty’s ve year credit default swap (‘CDS’) spread, and (iii) the sovereign credit rating of that counterparty’s principal operating jurisdiction.

Furthermore, collateral support agreements were introduced from the fourth quarter of 2008. Under collateral support agreements the

Group’s exposure to a counterparty with whom a collateral support agreement is in place is reduced to the extent that the counterparty must post

cash collateral when there is value due to the Group under outstanding derivative contracts that exceeds a contractually agreed threshold amount.

When value is due to the counterparty the Group is required to post collateral on identical terms. Such cash collateral is adjusted daily as necessary.

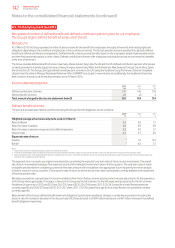

In the event of any default ownership of the cash collateral would revert to the respective holder at that point. Detailed below is the value of the cash

collateral, which is reported within short-term borrowings, held by the Group at 31 March 2013:

2013 2012

£m £m

Cash collateral 1,151 980

145 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information