Vodafone 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

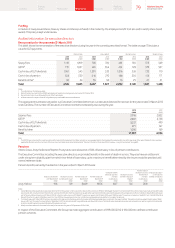

represent the principal business units of the Group and account for

83% of the Group’s total assets, 70% of the Group’s revenue and 78%

of the Group’s operating profit. Audits of these locations are performed

at a materiality level calculated by reference to a proportion of Group

materiality appropriate to the relative scale of the business concerned.

In addition, audits are performed for local statutory purposes at a further

18 locations, which represent a further 12% of the Group’s total assets,

29% of the Group’s revenue and 21% of the Group’s operating profit. Audits

of these locations are performed at a local materiality level calculated

by reference to the scale of the business concerned.

The Group audit team follows a programme of planned site visits that

is designed to ensure that the Senior Statutory Auditor or his designate

visits each of the seven full scope locations at least once a year. This year,

the Group audit team visited all seven of the full scope locations.

The way in which we scoped our response to the signicant risks

identied above was as follows:

a we challenged management’s assumptions used in the impairment

model for goodwill and intangible assets, described in note 12 to the

nancial statements, including specically the cash ow projections,

discount rates, perpetuity rates and sensitivities used, particularly

in respect of the Group’s interests in southern Europe;

a we considered the legal advice in connection with

management’s disclosure in note 21 of contingent liabilities,

including the impact of the introduction by the Indian government

of legislation which amends Indian tax law with retrospective effect

to overturn a judgement in the Group’s favour;

a we considered the appropriateness of management’s assumptions

and estimates in relation to the likelihood of generating suitable

future taxable prots to support the recognition of deferred tax assets

described in note 7, challenging those assumptions and considering

supporting forecasts and estimates;

a we carried out testing relating to controls over revenue recognition,

including the timing of revenue recognition, the recognition

of revenue on a gross or net basis, the treatment of discounts,

incentives and commissions and the accounting for multiple element

arrangements, as well as substantive testing, analytical procedures

and assessing whether the revenue recognition policies adopted

complied with IFRS; and

a we carried out analytical procedures and journal entry testing

in order to identify and test the risk of fraud arising from management

override of control.

The Audit and Risk Committee’s consideration of these judgements

is set out on page 62.

Opinions on matters prescribed by the Companies Act 2006

In our opinion:

a the information given in the Directors’ Report for the nancial year

for which the nancial statements are prepared is consistent with the

nancial statements; and

a the part of the Directors’ Remuneration Report to be audited has

been properly prepared in accordance with the Companies Act 2006.

Other matters on which we are required to report by exception

Adequacy of explanations received

Under the Companies Act 2006 we are required to report to you if, in our

opinion, we have not received all the information and explanations

we require for our audit. We have nothing to report in respect of this matter.

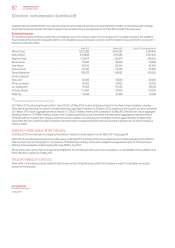

Directors’ remuneration

Under the Companies Act 2006 we are also required to report if in our

opinion certain disclosures of directors’ remuneration have not been

made or the part of the Directors’ Remuneration Report to be audited

is not in agreement with the accounting records and returns. Under the

Listing Rules we are required to review certain elements of the Directors’

Remuneration Report. We have nothing to report arising from these

matters or our review.

Corporate Governance Statement

Under the Listing Rules we are also required to review the part of the

Corporate Governance Statement relating to the company’s compliance

with nine provisions of the UK Corporate Governance Code. We have

nothing to report arising from our review.

Our duty to read other information in the Annual Report

We have been asked by the Board to report the results of our having

read the entire annual report, for the purposes of identifying any material

inconsistencies with the audited nancial statements or information

that is apparently incorrect based on, or materially inconsistent with,

the knowledge of the Group we acquired in the course of performing

the audit. Such inconsistencies would include any that we may have

identied in relation to the directors’ statement that the annual report

is fair, balanced and understandable and provides the information

necessary for users to assess the entity’s performance, business

model and strategy and any that we may have identied because the

section of the annual report describing the work of the Audit and Risk

Committee does not, in our judgment, appropriately disclose matters

that we communicated to the Audit and Risk Committee.

We conrm that we have not identied information in the annual report

that is materially inconsistent with the audited nancial statements

or that is apparently incorrect based on, or materially inconsistent with,

the knowledge of the Group we acquired in the course of performing

the audit. However, we have not audited this other information and

accordingly do not express an audit opinion on it.

Respective responsibilities of directors and auditor

Responsibility of directors for the nancial statements

As explained more fully in the Directors’ statement of responsibility set

out on page 84 the directors are responsible for the adequacy of the

accounting records, the preparation of the nancial statements from

those records and for being satised that the nancial statements give

a true and fair view.

Auditor’s responsibility

Our responsibility is to audit and express an opinion on the nancial

statements, and to provide other reports and communications arising

from our audit, in accordance with applicable law and International

Standards on Auditing (UK and Ireland).

This report is made solely to the company’s members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

company’s members those matters we are either required to state

to them in an auditor’s report and/or those further matters we have

expressly agreed to report to them on in our engagement letter and

for no other purpose. To the fullest extent permitted by law, we do not

accept or assume responsibility to anyone other than the company and

the company’s members as a body, for our audit work, for this report,

or for the opinions we have formed.

Other matter

We have reported separately on the parent company nancial

statements of Vodafone Group Plc for the year ended 31 March 2013.

Panos Kakoullis FCA (Senior Statutory Auditor)

for and on behalf of Deloitte LLP

Chartered Accountants and Statutory Auditor

London

United Kingdom

21 May 2013

89 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information