Vodafone 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

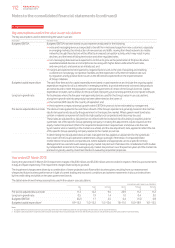

11. Acquisitions and disposals

We made a number of business acquisitions during the year, the two largest being Cable & Wireless Worldwide

plc and TelstraClear Limited. See below for further details of the net assets acquired and the goodwill arising.

The note also provides details of our disposals of our interests in SFR and Polkomtel in the prior year.

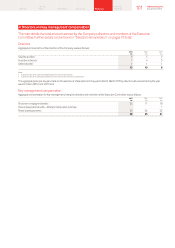

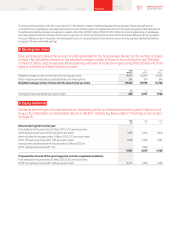

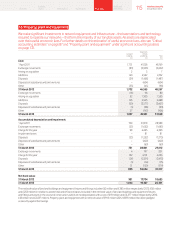

The aggregate cash consideration in respect of purchases of interests in subsidiaries and joint ventures, net of cash acquired, is as follows:

£m

Cash consideration paid:

Cable & Wireless Worldwide plc 1,050

TelstraClear Limited 440

Other acquisitions completed during the year 25

1,515

Net overdrafts acquired (83)

1,432

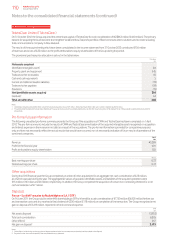

Total goodwill acquired was £59 million and included £44 million in relation to TelstraClear and £15 million in relation to other acquisitions

completed during the year.

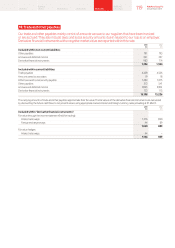

Cable & Wireless Worldwide plc (‘CWW’)

On 27 July 2012 the Group acquired the entire share capital of CWW for cash consideration of approximately £1,050 million before tax and

transaction costs. CWW de-listed from the London Stock Exchange on 30 July 2012. CWW provides a wide range of managed voice, data, hosting

and IP-based services and applications. The primary reasons for acquiring the business were to strengthen the enterprise business of Vodafone

Group in the UK and internationally, and the attractive network and other cost saving opportunities for the Vodafone Group.

The results of the acquired entity have been consolidated in the Group’s income statement from 27 July 2012 and contributed £1,234 million

of revenue and a loss of £151 million to the prot attributable to equity shareholders of the Group during the year.

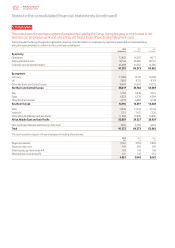

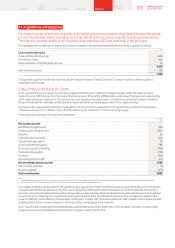

The purchase price allocation is set out in the table below:

Fair value

£m

Net assets acquired:

Identiable intangible assets1325

Property, plant and equipment 1,207

Inventory 34

Trade and other receivables 452

Cash and cash equivalents 78

Current and deferred taxation 788

Short and long-term borrowings (306)

Trade and other payables (754)

Provisions (249)

Post employment benets (47)

Net identiable assets acquired 1,528

Non-controlling interests (5)

Negative goodwill2(473)

Total consideration 1,050

Notes:

1 Identiable intangible assets of £325 million consisted of customer relationships of £225 million, CWW brand of £54 million and software of £46 million and are amortised in line with Group accounting policies.

2 Transaction costs of £11 million were charged in the Group’s consolidated income statement in the year ended 31 March 2013.

The negative goodwill primarily arose from an upward fair value adjustment in relation to acquired property, plant and equipment, the recognition

of acquired identiable intangible assets not previously recognised by CWW together with the recognition of a deferred tax asset resulting from

previously unclaimed UK capital allowances. The change in the purchase price allocation from that previously disclosed relates to further deferred

tax asset recognition following the completion of new long-term business plans. No deferred tax assets have been recognised in respect of the

losses of CWW (see “Factors affecting the tax charge in future years” on page 106). The income statement credit in respect of the negative goodwill

is reported within “Other income and expense” on the face of the consolidated income statement.

On 27 July 2012 the Group acquired convertible bonds issued by CWW amounting to £245 million which resulted in £6 million of interest being

charged to the Group’s consolidated income statement in the year ended 31 March 2013.

109 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information