Vodafone 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

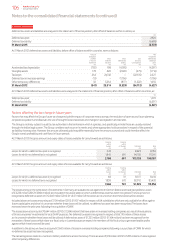

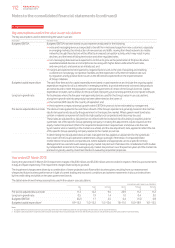

14. Investments in joint ventures

We hold interests in several joint ventures that are companies where we share control with one or more third

parties, with our business in Italy being the most signicant. The principal joint ventures at 31 March 2013,

as well as their impact on the Group’s consolidated nancial statements, are shown below. We record our share

of results, assets, liabilities and cash ows on a line by line basis in Group’s nancial statements.

Unless otherwise stated the Company’s principal joint ventures all have share capital consisting solely of ordinary shares, which are indirectly held,

and the country of incorporation or registration is also their principal place of operation.

Name Principal activity

Country

of incorporation

or registration

Percentage1

shareholdings

Indus Towers Limited Network infrastructure India 35.52

Vodafone Hutchison Australia Pty Limited3Network operator Australia 50.0

Vodafone Fiji Limited Network operator Fiji 49.04

Cornerstone Telecommunications Infrastructure Limited Network infrastructure UK 50.0

Vodafone Omnitel N.V.5Network operator Netherlands 76.96

Notes:

1 Effective ownership percentages of Vodafone Group Plc at 31 March 2013, rounded to the nearest tenth of one percent.

2 42% of Indus Towers Limited is held by Vodafone India Limited (‘VIL’) in which, as discussed in note A8, footnote 5, the Group had a 64.4% interest through wholly-owned subsidiaries and a further 20.1% indirectly through less

than 50% owned entities.

3 Vodafone Hutchison Australia Pty Limited has a year end of 31 December.

4 The Group holds substantive participating rights which provide it with a veto over the signicant nancial and operating policies of Vodafone Fiji Limited and which ensure it is able to exercise joint control over Vodafone Fiji

Limited with the majority shareholder.

5 The principal place of operation of Vodafone Omnitel N.V. is Italy.

6 The Group considered the existence of substantive participating rights held by the non-controlling shareholder provide that shareholder with a veto right over the signicant nancial and operating policies of Vodafone

Omnitel N.V., and determined that, as a result of these rights, the Group does not have control over the nancial and operating policies of Vodafone Omnitel N.V., despite the Group’s 76.9% ownership interest.

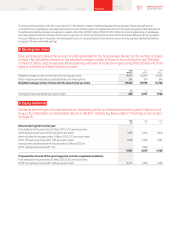

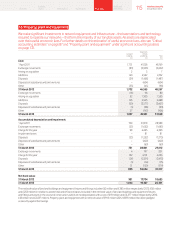

Effect of proportionate consolidation of joint ventures

The following table presents, on a condensed basis, the effect on the consolidated nancial statements of including joint ventures using

proportionate consolidation. The results of Polkomtel are included until its disposal on 9 November 2011.

2013 2012 2011

£m £m £m

Revenue 6,431 7,436 7,849

Cost of sales (3,976) (4,483) (4,200)

Gross prot 2,455 2,953 3,649

Selling, distribution and administrative expenses (1,459) (1,231) (1,624)

Impairment losses (4,500) (2,450) (1,050)

Other income and expense (3) 296 –

Operating (loss)/prot (3,507) (432) 975

Net nancing costs (137) (141) (146)

(Loss)/prot before tax (3,644) (573) 829

Income tax expense (374) (552) (608)

(Loss)/prot for the nancial year (4,018) (1,125) 221

2013 2012

£m £m

Non-current assets 11, 0 41 15,707

Current assets 1,733 911

Total assets 12,774 16,618

Total shareholders’ funds and total equity 8,246 12,574

Non-current liabilities 1,595 1,721

Current liabilities 2,933 2,323

Total liabilities 4,528 4,044

Total equity and liabilities 12,774 16,618

Notes to the consolidated nancial statements (continued)

116 Vodafone Group Plc

Annual Report 2013