Vodafone 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

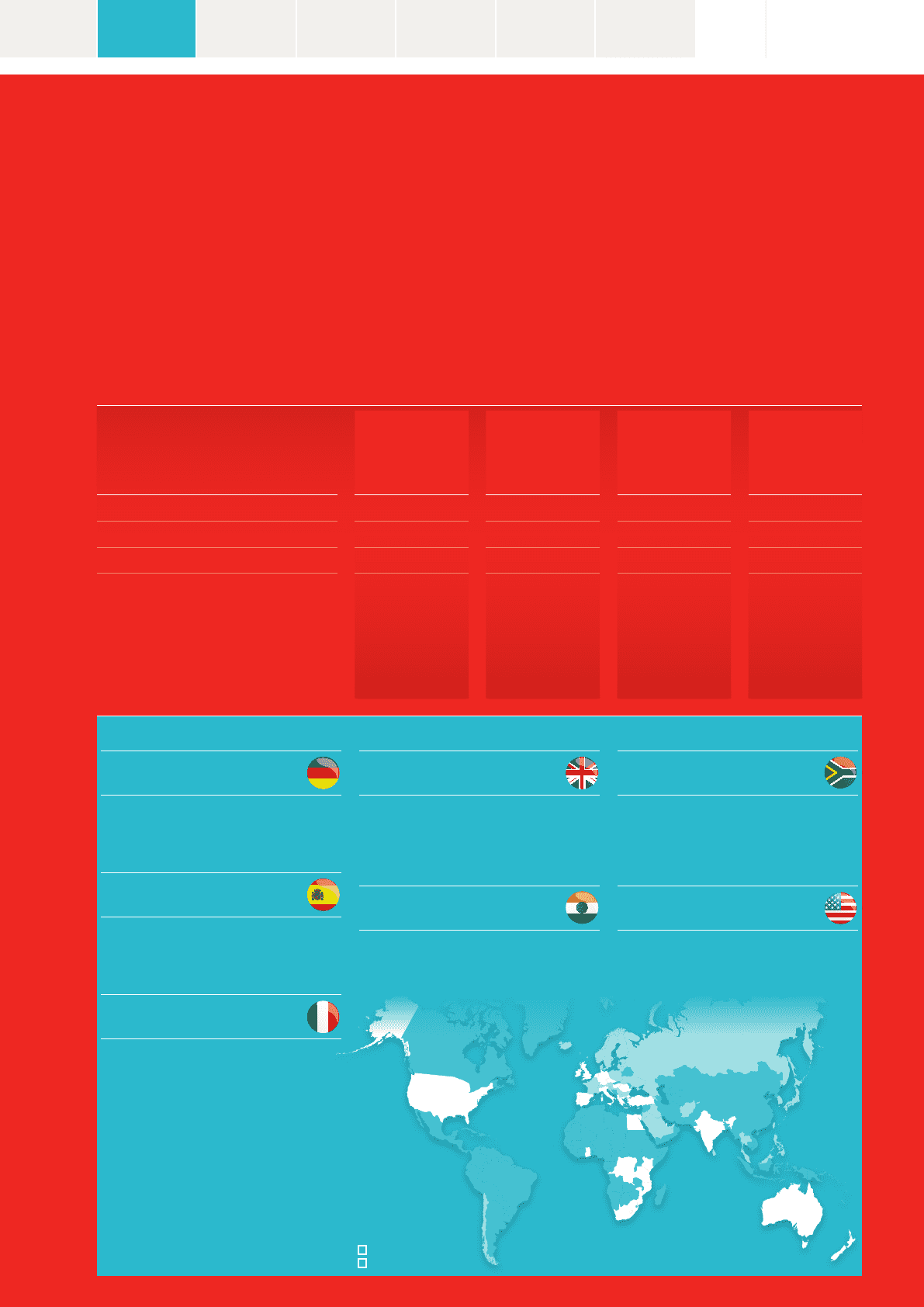

Equity interests

Northern

and Central

Europe Southern

Europe

Africa,

Middle East and

AsiaPacic

(‘AMAP’)

Non-Controlled

Interests and

Common

Functions

Revenue1£20.1bn £10.5bn £13.5bn £0.5bn

Operating free cash ow £3.3bn £2.3bn £2.5bn -£0.5bn

Adjusted operating prot £2.1bn £1.8bn £1.7bn £6.4bn

Countries Czech Republic

Germany

Hungary

Ireland

Netherlands

Romania

Turkey

United Kingdom

Albania

Greece

Italy

Malta

Portugal

Spain

Australia

Egypt

Fiji

Ghana

India

Safaricom (Kenya)2

New Zealand

Qatar

Vodacom3

Verizon Wireless2

Global footprint

Our main markets

n Equity interests

n Partner interests

Notes:

1 The sum of these amounts do not equal Group

totals due to inter-company eliminations.

2 Associate.

3 Includes South Africa, Tanzania, Mozambique,

Lesotho, and the Democratic Republic of Congo.

4 At December 2012.

5 Represents the Group’s interest on a 100%

owned basis. Based on equity interests the

Group’s customer base is 22 million in Italy

and45 million in VZW.

To see more information on our markets follow this link

vodafone.com/investor

Germany

32 million mobile customers

Our largest market, generating annual revenue

of £7.9billion. We have a leading position with 35%

service revenue market share. This was our rst market

to launch our ultra-fast 4G services which are now

available to around 61% of the population.

Spain

14 million mobile customers

The severe recession combined with intense competition

has led to falling revenue in Spain. However we remain

condent in the country’s future prospects and therefore

we plan to co-invest €1 billion with another operator,

to deploy a high speed bre network.

Italy

29 million mobile customers5

We are the largest mobile operator in Italy with a 35%

service revenue share. A combination of economic,

competitive and regulatory pressures has led to a decline

in revenue during the year, but due to careful cost control

we have maintained a good level of protability.

UK

19 million mobile customers

We have a 25% service revenue market share in the UK,

and are a leading player among enterprise customers.

Duringtheyear we acquired Cable & Wireless Worldwide

plc (‘CWW’); and we invested £803 million in spectrum

to support the launch of ultra-fast 4Gservices later

in 2013.

India

152 million mobile customers

Our largest market measured by customers. We have

a strong brand position, an extensive range of distribution

outlets and nationwide network coverage. As a result,

our revenue market share has increased every year over

the last four years and now stands at over 21%4.

Vodacom3

59 million mobile customers

We own 65% of Vodacom which covers ve countries

inAfrica – South Africa, Tanzania, Mozambique, Lesotho,

and the Democratic Republic of Congo. In South

Africa, which accounts for 84% of Vodacom’s revenue,

we launched the country’s rst commercial 4G service

in October 2012.

Verizon Wireless (‘VZW’)2

99 million mobile customers5

We own 45% of VZW, the largest mobile operator in the

US by revenue. Its leading 4G network now covers around

90% of the US population. VZW continued to trade well

delivering further market share gains and strong service

revenue growth of 8.1%*.

05 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information