Vodafone 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Business

review Performance Governance Financials Additional

information

Revenue increased by 2.7% including a -4.1 percentage point negative

impact from foreign exchange rate movements and a 6.8 percentage

point positive impact from M&A and other activity. On an organic

basis service revenue declined by -0.2%*, driven by challenging

macroeconomic conditions in some markets, increased competition

and the impact of MTR cuts, partially offset by continued growth in data

revenue. Organic growth in Germany and Turkey was more than offset

by declines in all other markets.

EBITDA declined by -3.7%, including a -4.3 percentage point negative

impact from foreign exchange rate movements and a 3.0 percentage

point positive impact from M&A and other activity. On an organic basis

EBITDA decreased by -2.4%*, resulting from a reduction in service

revenue in most markets, the impact of restructuring costs, and higher

customer investment due to the increased penetration of smartphones.

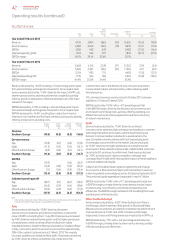

Organic

change

%

Other

activity1

pps

Foreign

exchange

pps

Reported

change

%

Revenue –

Northern and

CentralEurope – 6.8 (4.1) 2.7

Service revenue

Germany 0.5 (0.1) (5.5) (5.1)

UK (4.0) 0.3 – (3.7)

Other Northern and

CentralEurope 2.2 23.1 (6.4) 18.9

Northern and

CentralEurope (0.2) 7.1 (4.1) 2.8

EBITDA

Germany (2.6) 0.2 (5.4) (7.8)

UK (6.9) 0.3 – (6.6)

Other Northern and

CentralEurope 1.9 9.8 (6.1) 5.6

Northern and

CentralEurope (2.4) 3.0 (4.3) (3.7)

Adjusted operating prot

Germany (7.5) 0.3 (5.3) (12.5)

UK (27.7) 0.8 – (26.9)

Other Northern and

CentralEurope 4.3 (23.9) (4.7) (24.3)

Northern and

CentralEurope (8.1) (5.4) (4.2) (17.7)

Note:

1 “Other activity” includes the impact of M&A activity and the revision to intra-group roaming charges from

1October 2011. Refer to “Organic growth” on page 188 for further detail.

Germany

Service revenue increased by 0.5%*, driven by a 1.3%* increase in mobile

service revenue. Growth in enterprise and wholesale revenue, despite

intense price competition, was offset by lower prepaid revenue.

Data revenue increased by 13.6%* driven by higher penetration

of smartphones and an increase in those sold with a data bundle.

Vodafone Red, introduced in October 2012, performed in line with

expectations and had a positive impact on customer perception.

Enterprise revenue grew by 3.0%*, despite the competitive environment.

The roll out of LTE services continued and was available in 81 cities, with

population coverage of 61% at 31 March 2013.

EBITDA declined by -2.6%*, with a -1.3* percentage point reduction

in EBITDA margin, driven by higher customer and restructuring costs,

partially offset by operating cost efciencies and a one-off benet from

a legal settlement during Q2.

UK

Service revenue declined by -4.0%* driven by the impact of MTR

cuts effective from April 2012, intense price competition and

macroeconomic weakness, which led to lower out-of-bundle

usage. Data revenue grew by 4.2%* driven by higher penetration

of smartphones. Vodafone Red plans, launched in September 2012,

performed well, with over one million customers at 31 March 2013.

Following the purchase of additional spectrum in February 2013,

preparation for LTE roll-out is underway.

The network sharing joint venture between Telefónica UK and

Vodafone UK, announced in June 2012, is now operational and

the integration of the CWW enterprise businesses into Vodafone

UK is proceeding successfully.

EBITDA declined by -6.9%*, with a -0.5* percentage point reduction

in EBITDA margin, driven by higher retention activity and the impact

of restructuring costs.

Other Northern and Central Europe2

Service revenue increased by 2.2%* as growth in Turkey more than

offset declines in the rest of the Other Northern and Central Europe

region. Service revenue in Turkey grew by 17.3%*, primarily driven

by growth in the contract customer base and an increase in data

revenue due to mobile internet and higher smartphone penetration.

Revenue also beneted from enterprise growth and the success

of commercial initiatives. In the Netherlands service revenue declined

by -2.7%* due to more challenging macroeconomic conditions and

lower out-of-bundle usage. CWW contributed £1,234 million of revenue

since it was acquired on 27 July 2012.

EBITDA increased by 1.9%*, with a -0.3* percentage point reduction

in the EBITDA margin, as margin improvement in Turkey, driven by the

increase in scale and cost management, were partially offset by declines

in most other markets primarily resulting from lower revenue. Turkey

reported positive operating free cash ow for the rst time this year.

Note:

2 The results of CWW are included within the reported results from the date of acquisition, however, they are

excluded from the organic results. Refer to denitions of terms on page 188 for more details.

41 Vodafone Group Plc

Annual Report 2013