Vodafone 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192

|

|

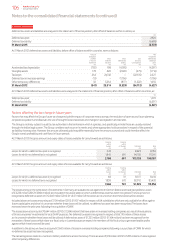

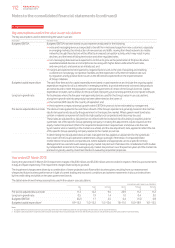

12. Impairment review (continued)

Sensitivity analysis

The table below shows, for India and Romania, the amount by which each key assumption must change in isolation in order for the estimated

recoverable amount to be equal to its carrying value.

Change required for carrying value

to equal the recoverable amount

India Romania

pps pps

Pre-tax risk adjusted discount rate 1.1 0.3

Long-term growth rate (1.6) (0.4)

Budgeted EBITDA1(3.3) (0.6)

Budgeted capital expenditure23.6 1.0

Notes:

1 Budgeted EBITDA is expressed as the compound annual growth rates in the initial ve years for all cash-generating units of the plans used for impairment testing.

2 Budgeted capital expenditure is expressed as a percentage of revenue in the initial ve years for all the cash generating units of the plans used for impairment testing.

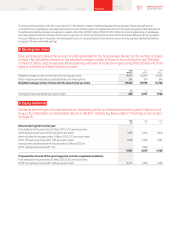

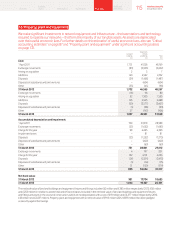

Year ended 31 March 2011

During the year ended 31 March 2011 impairment charges of £1,050 million, £2,950 million, £800 million, £1,000 million and £350 million were

recorded in respect of the Group’s investments in Italy, Spain, Greece, Ireland and Portugal, respectively. The impairment charges related solely

to goodwill.

The impairment charges were primarily driven by increased discount rates as a result of increases in government bond rates. In addition, business

valuations were negatively impacted by lower cash ows within business plans, reecting weaker country-level macroeconomic environments.

The table below shows the pre-tax adjusted discount rates used in the value in use calculations.

Assumptions used in value in use calculation

Italy Spain Greece Ireland Portugal

% % % % %

Pre-tax risk adjusted discount rate 11.9 11. 5 14.0 14.5 14.0

Notes to the consolidated nancial statements (continued)

114 Vodafone Group Plc

Annual Report 2013