Vodafone 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

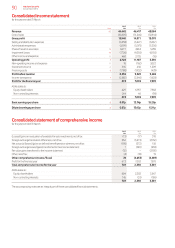

Commentary on the consolidated income statement

and statement of comprehensive income

The consolidated income statement includes the

majority of our income and expenses for the year

with the remainder recorded in the statement

of comprehensive income.

Further details on the major movements in the year are set out below:

Revenue

Revenue fell by 4.2% to £44.4 billion. The decrease was primarily due

to the negative impact of adverse foreign exchange rate movements,

as much of the Group’s revenue is generated in currencies other than

sterling, and the challenging economic conditions in southern Europe.

Our operating results on pages 40 to 44 explain in more detail the

geographical split of our revenue.

Share of result in associates

Share of results in associates increased 30.5% to £6.5 billion.

Thisis primarily due to the strong performance of VZW, in which

we have a 45% interest. For more information on what has driven

thegrowth at VZW, see page 44.

Impairment losses

An impairment loss of £7.7 billion was recorded in relation to Italy and

Spain, primarily driven by adverse performance against previous plans

and adverse movements in discount rates. Note 12 provides more

information on how we test for impairment.

Other income and expense

Other income and expense has decreased from a gain of £3.7 billion

in the prior year to a gain of £0.5 billion this year. The decrease

is primarily due to the £3.7 billion gain on disposal of the Group’s 44%

interest in SFR and 24.4% interest in Polkomtel recognised in the prior

year, whereas in the current year we recognised a gain on acquisition

of CWW of £0.5 billion. Note 11 provides more information on our

acquisitions and disposals.

Income tax expense

Our income tax expense was stable at £2.6 billion. Our adjusted effective

tax rate, a non-GAAP measure used by management to measure the

rate of tax on our adjusted prot before tax, continued to be in the

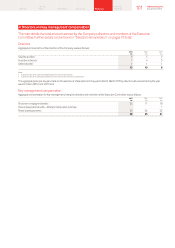

mid-twenties range and is calculated as set out below.

2013 2012

£m £m

Income tax expense 2,582 2,546

Tax on adjustments to derive adjusted

prot before tax 12 (242)

Adjusted income tax expense 2,594 2,304

Share of associates’ tax 11 302

Adjusted income tax expense for

calculating adjusted tax rate 2,605 2,606

Prot before tax 3,255 9,549

Adjustments to derive adjusted prot

before tax17,273 369

Adjusted prot before tax 10,528 9,918

Add: Share of associates’ tax and

non-controlling interest 105 382

Adjusted prot before tax for

calculating adjusted effective

taxrate 10,633 10,300

Adjusted effective tax rate 24.5% 25.3%

Note:

1 See “Earnings per share” opposite.

The Group’s share of associates’ tax has fallen as a result of a greater

share of the VZW prots being taxed at the partnership level.

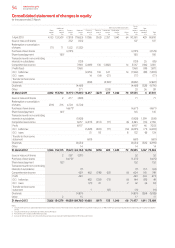

Earnings per share

Basic earnings per share was 0.87 pence, a reduction of 12.87 pence

from the prior year. This was driven by higher impairment losses in the

current year, whilst the prior year beneted from a gain on disposal

of our 44% interest in SFR and 24.4% interest in Polkomtel.

Adjusted earnings per share, which is a non-GAAP measure used

by management and which excludes the one-off items noted above

together with items that we do not view as being reective of our

performance, was 15.65 pence, an increase of 5.0% compared to the

prior year. The increase was primarily due to an increase in earnings

on higher adjusted operating prot. Our calculation of the adjusted

earnings on which we base our adjusted earnings per share calculation

is set out below. Note 8 provides information on the number of shares.

2013 2012

£m £m

Prot attributable to equity

shareholders 429 6,957

Pre-tax adjustments:

Impairment loss 7,700 4,050

Other income and expense1(468) (3,705)

Non-operating income and expense (10) 162

Investment income and nancing costs 51 (138)

7,273 369

Taxation2(12) 242

Non-controlling interests 6(18)

Adjusted prot attributable

to equityshareholders 7,696 7,550

Notes:

1 Other income and expense for the year ended 31 March 2013 included a £473 million gain on acquisition

of CWW. The year ended 31 March 2012 included a £3,419 million gain on disposal of the Group’s 44%

interest in SFR and a £296 million gain on disposal of the Group’s 24.4% interest in Polkomtel.

2 Taxation for the year ended 31 March 2012 included a £206 million charge in respect of the disposal of the

Group’s 24.4% interest in Polkomtel. The gain arising on our acquisition of CWW in the year ended 31 March

2013 and the disposal of our 44% interest in SFR in the 2012 nancial year did not give rise to a tax charge.

The impairment charges of £7,700 million and £4,050 million in the years ended 31 March 2013 and 2012

respectively did not result in any tax consequences.

The consolidated statement of comprehensive

income records all of the income and losses

generated for the year. Total comprehensive income

was over £0.7 billion, comprising a prot of £0.7 billion

and other comprehensive income of £0.1 billion.

Further details on the major movements in the year are set out below:

Foreign exchange differences, net of tax

Foreign exchange translation differences arise when we translate the

results and net assets of our operating companies and associates,

which transact their operations in foreign currencies including the euro,

South African rand and Indian rupee, as well as US dollars for VZW, into

our presentation currency of sterling. The net movement in foreign

exchange rates resulted in a gain of £0.4 billion for the year. In the prior

year there was a loss of £3.7 billion.

Net actuarial (losses)/gains on dened benet schemes

We incurred a loss of £0.2 billion from the revaluation of the

Group’s dened benet pension schemes after comparing the

outcomes to those anticipated by the Group’s actuary. In the prior year

there was a loss of £0.3 billion.

Foreign exchange losses/(gains) transferred to the

income statement

The prior year gains were a result of the recycling of foreign exchange

losses on the disposal of our investments in SFR and Polkomtel.

Prot for the nancial year

The reasons underlying the £6.3 billion decrease in prot for the

nancial year are provided above.

The nancial commentary on this page forms part of the business review and is unaudited.

91 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information