Vodafone 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

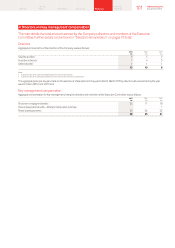

1. Basis of preparation

The consolidated nancial statements are prepared in accordance with IFRS as issued by the International Accounting Standards Board and are

also prepared in accordance with IFRS adopted by the European Union (‘EU’), the Companies Act 2006 and Article 4 of the EU IAS Regulations.

The consolidated nancial statements are prepared on a going concern basis.

The preparation of nancial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the nancial statements and the reported amounts

of revenue and expenses during the reporting period. For a discussion on the Group’s critical accounting estimates see “Critical accounting

estimates” on pages 86 and 87. Actual results could differ from those estimates. The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in the period in which the estimate is revised if the revision affects only that period

or in the period of the revision and future periods if the revision affects both current and future periods.

Amounts in the consolidated nancial statements are stated in pounds sterling.

Vodafone Group Plc is registered in England (No. 1833679).

2. Signicant accounting policies

Detailed below are new accounting pronouncements that we will adopt in future years and our current

view of the impacts they will have on our nancial reporting. There have been no signicant changes to the

signicant accounting policies that we applied in the year; for full details refer to note A1. This note should

be read in conjunction with “Critical accounting estimates” on pages 86 and 87.

New accounting pronouncements to be adopted on 1 April 2013

The following pronouncements have been issued by the IASB or the IFRIC, are effective for annual periods beginning on or after 1 January 2013 and

have been endorsed for use in the EU unless otherwise stated:

a Amendments to IAS 1, “Presentation of items of other comprehensive income”, effective for annual periods beginning on or after 1 July 2012.

a Amendments to IAS 19, “Employee benets”, requires revised accounting and disclosures for dened benet pension schemes, including

a different measurement basis for asset returns, replacing the expected return on plan assets and interest cost currently recorded in the

consolidated income statement with net interest. This results in a revised allocation of costs between the income statement and other

comprehensive income. The “corridor approach” method of spreading the recognition of actuarial gains and losses, which is not used by the

Group, is prohibited. The amendments also include a revised denition of short- and long-term benets to employees and revised criteria for the

recognition of termination benets.

a Amendment to IFRS 1, “Government loans”, effective for annual periods beginning on or after 1 January 2013.

a Amendments to IFRS 7, “Disclosures – offsetting nancial assets and nancial liabilities”, effective for annual periods beginning on or after

1 January 2013.

a IFRS 10, “Consolidated Financial Statements”, which replaces parts of IAS 27, “Consolidated and Separate Financial Statements” and all of SIC-12,

“Consolidation – Special Purpose Entities”, builds on existing principles by identifying the concept of control as the determining factor in whether

an entity should be included within the consolidated nancial statements of the parent company. The Group’s principal subsidiaries (see note A8)

will continue to be consolidated upon adoption of IFRS 10.

a IAS 27, “Separate Financial Statements”, now contains accounting and disclosure requirements for investments in subsidiaries, joint ventures

and associates only when an entity prepares separate nancial statements and is therefore not applicable in the Group’s consolidated

nancial statements.

a IFRS 11,”Joint Arrangements”, which replaces IAS 31, “Interests in Joint Ventures” and SIC-13, “Jointly Controlled Entities – Non-monetary

Contributions by Venturers”, requires a single method, known as the equity method, to account for interests in jointly controlled entities which

is consistent with the accounting treatment currently applied to investments in associates. Under IFRS 11, the Group’s principal joint ventures,

excluding Cornerstone Telecommunications Infrastructure Limited (see note 14), will be incorporated into the consolidated nancial statements

using the equity method of accounting.

a IAS 28, “Investments in Associates and Joint Ventures”, was amended as a consequence of the issuance of IFRS 11. In addition to prescribing the

accounting for investment in associates, it now sets out the requirements for the application of the equity method when accounting for joint

ventures. The application of the equity method has not changed as a result of this amendment.

a IFRS 12, “Disclosure of Interest in Other Entities”, is a new and comprehensive standard on disclosure requirements for all forms of interests

in other entities, including joint arrangements, associates, special purpose vehicles and other off balance sheet vehicles. The standard includes

disclosure requirements for entities within the scope of IFRS 10 and IFRS 11.

a Amendments to IFRS 10, IFRS 11 and IFRS 12, “Consolidated Financial Statement, Joint Arrangements and Disclosure of Interests in Other Entities:

Transition Guidance”; claries the disclosures required on adoption of these standards.

a “Investment Entities”, amendments to IFRS 10, IFRS 12 and IAS 27, effective for annual periods beginning on or after 1 January 2014, but will

be early-adopted by the Group on 1 January 2013. This standard has not yet been endorsed for use in the EU.

a IFRS 13, “Fair Value Measurement”, effective for annual periods beginning on or after 1 January 2013.

a “Improvements to IFRS 2009–2011 Cycle”, effective for annual periods beginning on or after 1 January 2013.

a IFRIC 20, “Stripping costs in the production phase of a surface mine”, effective for annual periods beginning on or after 1 January 2013.

Notes to the consolidated nancial statements

98 Vodafone Group Plc

Annual Report 2013