Vodafone 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

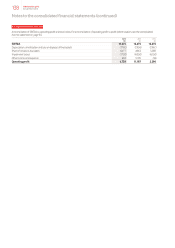

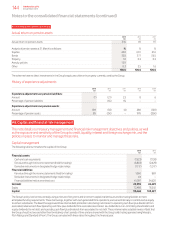

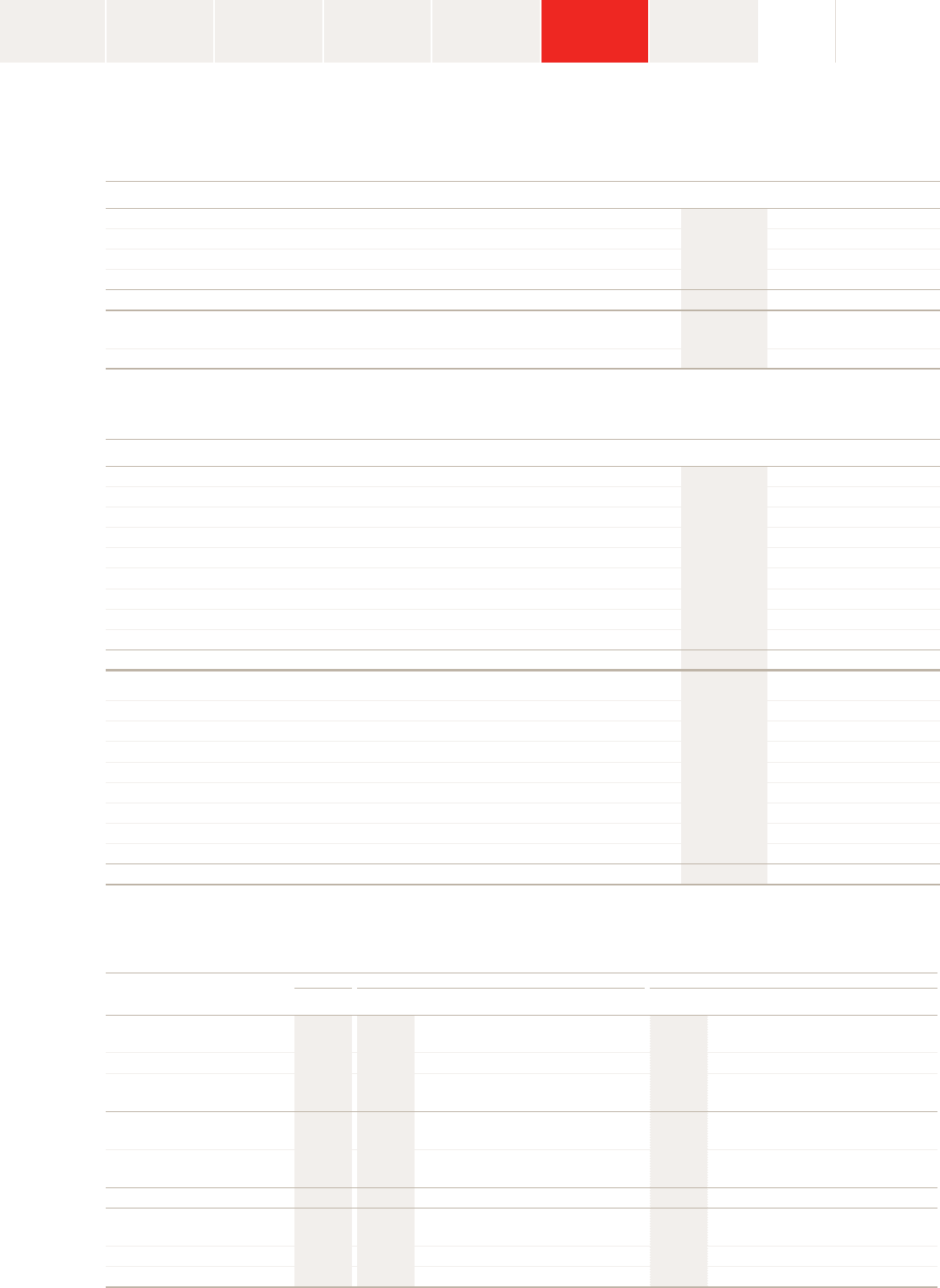

Charges made to the consolidated income statement and consolidated statement of comprehensive income (‘SOCI’) on the basis of the

assumptions stated above are:

2013 2012 2011

£m £m £m

Current service cost 28 11 12

Interest cost 139 85 95

Expected return on pension assets (146) (99) (103)

Curtailment/settlement (1) 1 –

Total included within staff costs 20 (2) 4

Actuarial losses/(gains) recognised in the SOCI 259 365 (190)

Cumulative actuarial losses recognised in the SOCI 930 671 306

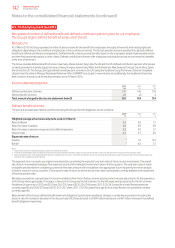

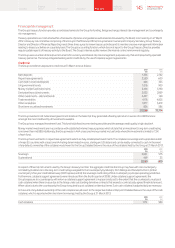

Fair value of the assets and present value of the liabilities of the schemes

The amount included in the statement of nancial position arising from the Group’s obligations in respect of its dened benet schemes is as follows:

2013 2012 2011

£m £m £m

Movement in pension assets:

1 April 1,604 1,558 1,487

Exchange rate movements 6 (22) (2)

Expected return on pension assets 146 99 103

Actuarial gains/(losses) 189 (30) (6)

Employer cash contributions 103 34 24

Member cash contributions 8 6 5

Benets paid (63) (42) (51)

Other movements11,730 1 (2)

31 March 3,723 1,604 1,558

Movement in pension liabilities:

1 April 1,910 1,548 1,690

Exchange rate movements 9 (33) (4)

Current service cost 28 11 12

Interest cost 139 85 95

Member cash contributions 8 6 5

Actuarial losses/(gains) 448 335 (196)

Benets paid (63) (42) (51)

Other movements11,821 – (3)

31 March 4,300 1,910 1,548

Note:

1 Other movements mainly comprise the addition of the CWWRP as a result of the acquisition of CWW (see note 11).

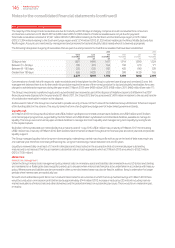

An analysis of net (decit)/assets is provided below for the Group’s two largest dened benet pension scheme in the UK and for the Group

as a whole.

CWWRP Vodafone UK plan Group

2013 2013 2012 2011 2010 2009 2013 2012 2011 2010 2009

£m £m £m £m £m £m £m £m £m £m £m

Analysis of net

(decit)/assets:

Total fair value of scheme assets 1,827 1,328 1,218 1,180 1,131 755 3,723 1,604 1,558 1,487 1,100

Present value of funded

schemeliabilities (1,874) (1,647) (1,444) (1,127) (1,276) (815) (4,238) (1,852) (1,488) (1,625) (1,196)

Net (deficit)/assets for

funded schemes (47) (319) (226) 53 (145) (60) (515) (248) 70 (138) (96)

Present value of unfunded

scheme liabilities – – – – – (8) (62) (58) (60) (65) (136)

Net (decit)/assets (47) (319) (226) 53 (145) (68) (577) (306) 10 (203) (232)

Net (decit)/assets are

analysed as:

Assets – – – 53 – – 52 31 97 34 8

Liabilities (47) (319) (226) – (145) (68) (629) (337) (87) (237) (240)

It is expected that contributions of £62 million will be paid into the Group’s dened benet retirement schemes during the year ending 31 March 2014.

The assets of the schemes are held in external trustee administered funds.

143 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information