Vodafone 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Revenue decreased by -16.0% including a -5.0 percentage point impact

from adverse foreign exchange rate movements. On an organic basis

service revenue declined by -11.6%*, driven by the impact of MTR cuts,

severe macroeconomic weakness and intense competition, partially

offset by growth in data revenue. Revenue declined in all of the major

markets in the region.

EBITDA declined by -21.5%, including a -4.9 percentage point impact

from adverse foreign exchange rate movements. On an organic basis

EBITDA decreased by -16.4%*, resulting from a reduction in service

revenue in most markets and the impact of restructuring costs, partially

offset by a reduction in operating costs.

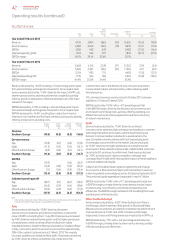

Organic

change

%

Other

activity1

pps

Foreign

exchange

pps

Reported

change

%

Revenue –

Southern Europe (10.8) (0.2) (5.0) (16.0)

Service revenue

Italy (12.8) (0.1) (4.9) (17.8)

Spain (11.5) (0.2) (5.0) (16.7)

Other Southern Europe (8.2) (0.4) (5.1) (13.7)

Southern Europe (11.6) (0.1) (5.0) (16.7)

EBITDA

Italy (19.5) – (4.6) (24.1)

Spain (15.4) (0.6) (5.0) (21.0)

Other Southern Europe (7.1) (0.4) (5.9) (13.4)

Southern Europe (16.4) (0.2) (4.9) (21.5)

Adjusted operating prot

Italy (28.7) (0.1) (4.2) (33.0)

Spain (34.3) (0.9) (4.4) (39.6)

Other Southern Europe (10.4) (0.9) (6.0) (17.3)

Southern Europe (27.5) (0.3) (4.5) (32.3)

Note:

1 “Other activity” includes the impact of M&A activity and the revision to intra-group roaming charges from

1October 2011. Refer to “Organic growth” on page 188 for further detail.

Italy

Service revenue declined by -12.8%* driven by the severe

macroeconomic weakness and intense competition, as well as the

impact of MTR cuts starting from 1 July 2012. Data revenue increased

by 4.4%* driven by mobile internet growth and the higher penetration

of smartphones, which more than offset the decline in mobile

broadband revenue. Vodafone Red plans, branded as “Vodafone Relax”

in Italy, continued to perform well and now account for approximately

30% of the contract customer base at 31 March 2013. The majority

of contract additions are Vodafone Relax tariffs. Fixed revenue declined

by -6.8%* driven by intense competition and a reduction in the

customer base due to the decision to stop consumer acquisitions

in areas where margins are impacted by unfavourable regulated

wholesale prices.

LTE commercial services were launched in October 2012 and were

available in 21 cities at 31 March 2013.

EBITDA declined by -19.5%*, with a -4.3* percentage point fall

in the EBITDA margin, driven by the decline in service revenue and

an increase in commercial costs, partially offset by operating cost

efciencies such as site sharing agreements and the outsourcing

of network maintenance.

Spain

Service revenue declined by -11.5%* driven by continued

macroeconomic weakness, high unemployment leading to customers

optimising their spend, and a lower customer base following our

decision to remove handset subsidies for a period earlier in the

year. Competition remains intense with the increased popularity

of converged consumer offers in the market. Data revenue grew

by 16.5%* driven by the higher penetration of smartphones and

an increase in those sold with a data bundle. Vodafone Red, which was

launched in Q3, continues to perform well. Fixed revenue declined

by -2.9%*, primarily due to intense competition, although new

converged xed/mobile tariffs had a positive impact on xed broadband

customer additions during Q4.

In March 2013 Vodafone Spain signed an agreement with Orange

to co-invest in a bre network in Spain, with the intention to reach six

million households and workplaces across 50 cities by September 2017.

The combined capital expenditure is expected to reach €1 billion.

EBITDA declined by -15.4%*, with a -0.7* percentage point reduction

in EBITDA margin, primarily driven by lower revenue and the impact

of restructuring costs offset by commercial and operating cost

efciencies. The EBITDA margin stabilised in H2, beneting from lower

operating and commercial costs.

Other Southern Europe

Service revenue declined by -8.2%*, driven by declines in Greece

and Portugal, which more than offset growth in Albania and Malta.

Macroeconomic weakness and intense competition resulted in service

revenue declines of -13.4%* and -8.2%* in Greece and Portugal,

respectively. Greece and Portugal were also impacted by an MTR cut.

EBITDA declined by -7.1%*, with a -0.4* percentage point reduction

in EBITDA margin, primarily driven by lower service revenue, partially

offset by operating cost efciencies.

Southern Europe

Italy

£m

Spain

£m

Other

Southern

Europe

£m

Eliminations

£m

Southern

Europe

£m

% change

£m Organic

Year ended 31 March 2013

Revenue 4,755 3,904 1,883 (20) 10,522 (16.0) (10.8)

Service revenue 4,380 3,629 1,644 (18) 9,635 (16.7) (11.6)

EBITDA 1,908 942 633 – 3,483 (21.5) (16.4)

Adjusted operating prot 1,163 342 297 – 1,802 (32.3) (27.5)

EBITDA margin 40.1% 24.1% 33.6% 33.1%

Year ended 31 March 2012

Revenue 5,658 4,763 2,128 (27) 12,522 (3.9) (5.4)

Service revenue 5,329 4,357 1,904 (25) 11,565 (4.7) (6.2)

EBITDA 2,514 1,193 731 –4,438 (11.0) (12.5)

Adjusted operating prot 1,735 566 359 –2,660 (16.8) (18.2)

EBITDA margin 44.4% 25.0% 34.4% 35.4%

Operating results (continued)

42 Vodafone Group Plc

Annual Report 2013