Vodafone 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Group prepares its consolidated nancial statements in accordance

with IFRS as issued by the IASB and IFRS as adopted by the EU,

the application of which often requires judgements to be made by

management when formulating the Group’s nancial position and

results. Under IFRS, the directors are required to adopt those accounting

policies most appropriate to the Group’s circumstances for the purpose

of presenting fairly the Group’s nancial position, nancial performance

and cash ows.

In determining and applying accounting policies, judgement is often

required in respect of items where the choice of specic policy,

accounting estimate or assumption to be followed could materially

affect the reported results or net asset position of the Group; it may later

be determined that a different choice would have been more appropriate.

Management considers that certain accounting estimates and

assumptions relating to revenue, taxation, business combinations,

intangible assets (goodwill and nite lived assets), property, plant and

equipment, provisions and contingent liabilities, and impairment are its

critical accounting estimates.

A discussion of these critical accounting estimates is provided

below and should be read in conjunction with the disclosure of the

Group’s signicant IFRS accounting policies provided in note A2 to the

consolidated nancial statements.

Management has discussed its critical accounting estimates and

associated disclosures with the Company’s Audit and Risk Committee.

Revenue recognition

Arrangements with multiple deliverables

In revenue arrangements including more than one deliverable,

the deliverables are assigned to one or more separate units

of accounting and the arrangement consideration is allocated to each

unit of accounting based on its relative fair value.

Determining the fair value of each deliverable can require complex

estimates due to the nature of the goods and services provided.

The Group generally determines the fair value of individual elements

based on prices at which the deliverable is regularly sold on a standalone

basis after considering volume discounts where appropriate.

Gross versus net presentation

When deciding the most appropriate basis for presenting revenue

or costs of revenue, both the legal form and substance of the agreement

between the Group and its business partners are reviewed to determine

each party’s respective role in the transaction.

Where the Group’s role in a transaction is that of principal, revenue

is recognised on a gross basis. This requires revenue to comprise

the gross value of the transaction billed to the customer, after trade

discounts, with any related expenditure charged as an operating cost.

Where the Group’s role in a transaction is that of an agent, revenue

is recognised on a net basis with revenue representing the margin earned.

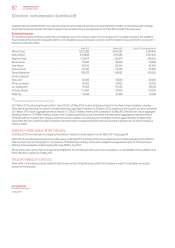

Taxation

The Group’s tax charge on ordinary activities is the sum of the total current

and deferred tax charges. The calculation of the Group’s total taxcharge

necessarily involves a degree of estimation and judgement inrespect

of certain items whose tax treatment cannot be finally determined

until resolution has been reached with the relevant tax authority or,

as appropriate, through a formal legal process. The final resolution of some

of these items may give rise to material profits, losses and/or cash flows.

The complexity of the Group’s structure makes the degree of estimation

and judgement more challenging. The resolution of issues is not

alwayswithin the control of the Group and it is often dependent on the

efciency of the legal processes in the relevant taxing jurisdictions

in which the Group operates. Issues can, and often do, take many years

to resolve. Payments in respect of tax liabilities for an accounting period

are made by payments on account and on the nal resolution of open

items. As a result there can be substantial differences between the tax

charge in the consolidated income statement and tax payments.

Recognition of deferred tax assets

The recognition of deferred tax assets is based upon whether it is more

likely than not that sufcient and suitable taxable prots will be available

in the future against which the reversal of temporary differences can

be deducted. To determine the future taxable prots, reference is made

to the latest available prot forecasts. Where the temporary differences

arerelated to losses, relevant tax law is considered to determine the

availability of the losses to offset against the future taxable prots.

Signicant items on which the Group has exercised accounting

judgement include recognition of deferred tax assets in respect of losses

in Germany and Luxembourg and the recognition of a deferred tax asset

in respect of capital allowances in the United Kingdom. Theamounts

recognised in the consolidated nancial statements in respect of each

matter are derived from the Group’s best estimation andjudgement

as described above. See note 7 to the consolidated nancial statements.

Recognition therefore involves judgement regarding the future nancial

performance of the particular legal entity or tax group in which the

deferred tax asset has been recognised.

Historical differences between forecast and actual taxable profits have not

resulted in material adjustments to the recognition of deferred taxassets.

Business combinations

The recognition of business combinations requires the excess of the

purchase price of acquisitions over the net book value of assets acquired

to be allocated to the assets and liabilities of the acquired entity.

TheGroup makes judgements and estimates in relation to the fair value

allocation of the purchase price. If any unallocated portion is positive

itisrecognised as goodwill and if negative, it is recognised in the

incomestatement.

Goodwill

The amount of goodwill initially recognised as a result of a business

combination is dependent on the allocation of the purchase price to the

fair value of the identiable assets acquired and the liabilities assumed.

The determination of the fair value of the assets and liabilities is based,

toa considerable extent, on management’s judgement.

Allocation of the purchase price affects the results of the Group as nite

lived intangible assets are amortised, whereas indenite lived intangible

assets, including goodwill, are not amortised and could result in differing

amortisation charges based on the allocation to indenite lived and

nite lived intangible assets.

On transition to IFRS the Group elected not to apply IFRS 3, “Business

combinations”, retrospectively as the difculty in applying these

requirements to the large number of business combinations completed

by the Group from incorporation through to 1 April 2004 exceeded

anypotential benets. Goodwill arising before the date of transition

to IFRS,after adjusting for items including the impact of proportionate

consolidation of joint ventures, amounted to £78,753 million.

If the Group had elected to apply the accounting for business

combinations retrospectively it may have led to an increase or decrease

in goodwill and increase in licences, customer bases, brands and related

deferred tax liabilities recognised on acquisition.

Finite lived intangible assets

Other intangible assets include the Group’s aggregate amounts spent

on the acquisition of licences and spectrum, computer software,

customer bases, brands and development costs. These assets

arisefromboth separate purchases and from acquisition as part

of businesscombinations.

On the acquisition of mobile network operators the identiable

intangible assets may include licences, customer bases and brands.

Thefair value of these assets is determined by discounting estimated

future net cash ows generated by the asset where no active market for

the assets exists. The use of different assumptions for the expectations

of future cash ows and the discount rate would change the valuation

ofthe intangible assets.

Critical accounting estimates

86 Vodafone Group Plc

Annual Report 2013