Vodafone 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

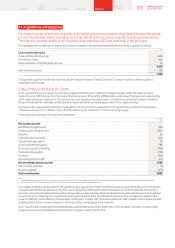

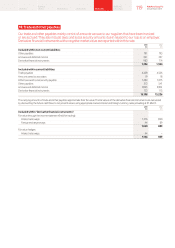

16. Other investments (continued)

2013 2012

£m £m

Included within current assets:

Public debt and bonds 1,130 900

Other debt and bonds 3,816 90

Cash held in restricted deposits 404 333

5,350 1,323

Other debt and bonds includes £3,812 million of assets held for trading which include £3,000 million (2012: £nil) of assets held in managed

investment funds with liquidity of up to 90 days, £643 million (2012: £nil) of short-term securitised investments with original maturities of up to eight

months, and collateral paid on derivative nancial instruments of £169 million (2012: £87 million).

Current public debt and bonds include government bonds of £1,076 million (2012: £900 million) which consist of highly liquid index linked gilts with

less than six years to maturity held on an effective oating rate basis.

For public debt and bonds, other debt and bonds and cash held in restricted deposits, the carrying amount approximates fair value.

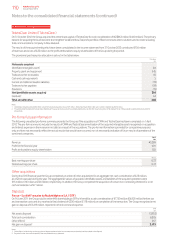

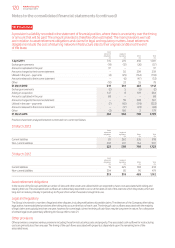

17. Trade and other receivables

Our trade and other receivables mainly consist of amounts owed to us by customers and amounts that

we pay to our suppliers in advance. Trade receivables are shown net of an allowance for bad or doubtful debts.

Derivative nancial instruments with a positive market value are reported within this note.

2013 2012

£m £m

Included within non-current assets:

Trade receivables 181 120

Other receivables 675 235

Prepayments and accrued income 502 326

Derivative nancial instruments 2,944 2,801

4,302 3,482

Included within current assets:

Trade receivables 3,995 3,885

Amounts owed by associates 21 15

Other receivables 1,202 2,984

Prepayments and accrued income 4,106 3,702

Derivative nancial instruments 88 158

9,412 10,744

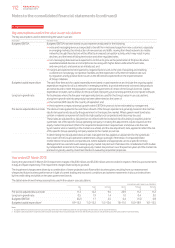

The Group’s trade receivables are stated after allowances for bad and doubtful debts based on management’s assessment of creditworthiness,

an analysis of which is asfollows:

2013 2012 2011

£m £m £m

1 April 1,014 1,006 929

Exchange movements (3) (64) (30)

Amounts charged to administrative expenses 458 458 460

Trade receivables written off (504) (386) (353)

31 March 965 1,014 1,006

The carrying amounts of trade and other receivables approximate their fair value. Trade and other receivables are predominantly

non-interest bearing.

2013 2012

£m £m

Included within “Derivative nancial instruments”:

Fair value through the income statement (held for trading):

Interest rate swaps 1,508 1,196

Cross currency interest rate swaps 319 318

Foreign exchange swaps 88 128

1,915 1,642

Fair value hedges:

Interest rate swaps 1,117 1,317

3,032 2,959

The fair values of these nancial instruments are calculated by discounting the future cash ows to net present values using appropriate market

interest and foreign currency rates prevailing at 31 March.

Notes to the consolidated nancial statements (continued)

118 Vodafone Group Plc

Annual Report 2013