Vodafone 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

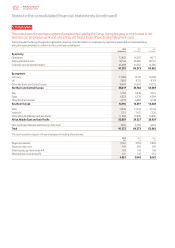

Commentary on the consolidated statement of nancial position

The consolidated statement of nancial position

shows all of our assets and liabilities at 31 March.

Total assets increased by 2.2% to £142.7 billion

driven by the increase in the carrying value of our

45% interest in VZW and higher cash and investment

balances following our bond issues during the year,

partially offset by the goodwill impairments recorded

for Italy and Spain. Total liabilities increased by 14.4%

to £70.2 billion driven by the £5.4 billion of long-term

debt issued.

Further details on the major movements in the year are set out below:

Assets

Goodwill and other intangible assets

Our intangible assets decreased to £52.4 billion (2012: £59.5 billion)

with goodwill comprising the largest element at £30.4 billion (2012:

£38.4 billion). The decrease primarily resulted from impairment losses

of £7.7 billion, amortisation of £3.4 billion and unfavourable foreign

exchange rate movements of £0.4 billion, partially offset by £4.0 billion

of additions and £0.5 billion arising on acquisitions. Further details of the

impairment loss are provided in note 12.

Property, plant and equipment

Property, plant and equipment increased to £20.3 billion (2012:

£18.7 billion) predominantly as a result of £4.7 billion of additions and

£1.6 billion arising from the acquisition of businesses, partially offset

by £4.3 billion of depreciation charges.

Investments in associates

Investments in associates increased to £38.6 billion (2012: £35.1 billion),

with VZW being our largest investment. The increase was driven by

our share of VZW’s results of £6.4 billion and £1.9 billion of favourable

exchange rate movements, partially offset by £4.8 billion of dividends

received from associates (see page 97).

Other non-current assets

Other non-current assets increased to £8.0 billion (2012: £6.3 billion)

mainly due to a £1.0 billion increase in our deferred tax asset and

an increase of £0.8 billion in trade and other receivables, both driven

by acquisitions during the year.

Current assets

Current assets increased to £23.3 billion (2012: £20.0 billion) primarily

due to a £4.5 billion increase in cash and short-term investments driven

by the £2.4 billion income dividend received from VZW in December

2012 and the £3.9 billion of bonds issued in February 2013.

Total equity and liabilities

Total equity

Total equity decreased to £72.5 billion (2012: £78.2 billion). The prot for

the year of £0.7 billion was more than offset by dividends paid to equity

shareholders and non-controlling interests of £5.2 billion and share

buybacks of £1.5 billion.

Borrowings

Borrowings increased to £41.4 billion (2012: £34.6 billion) mainly

as a result of issuing bonds, in September 2012 and February 2013,

and commercial paper. This was partially offset by the repayment

of certain borrowings which had reached maturity.

Taxation liabilities

Total tax liabilities were stable at £2.1 billion (2012: £2.1 billion).

Other current liabilities

Other current liabilities increased to £17.0 billion (2012: £15.9 billion).

Trade payables at 31 March 2013 were equivalent to 37 days (2012:

43 days) outstanding, calculated by reference to the amount owed

to suppliers as a proportion of the amounts invoiced by suppliers

during the year. It is our policy to agree terms of transactions, including

payment terms, with suppliers and it is our normal practice that

payment is made accordingly.

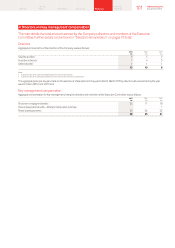

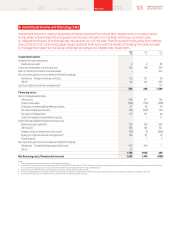

Contractual obligations and contingencies

A summary of our principal contractual nancial obligations is shown

below and details of the Group’s contingent liabilities are included

in note 21.

Payments due by period

£m

Contractual obligations1Total < 1 year 1–3 years 3–5 years >5 years

Borrowings250,308 13,002 11,627 8,679 17,000

Operating lease

commitments36,640 1,238 1,732 1,194 2,476

Capital

commitments3 4 1,959 1,785 159 15 –

Purchase

commitments 4,808 3,149 869 500 290

Total 63,715 19,174 14,387 10,388 19,766

Notes:

1 This table includes commitments in respect of options over interests inGroup businesses held by non-

controlling shareholders (see “Potential cash outows from option agreements and similar arrangements”

on page 158) and obligations to pay dividends to non-controlling shareholders (see “Dividends from

associates and to non-controlling shareholders” on page 158). The table excludes current and deferred

taxliabilities and obligations under post employment benet schemes, details of which are provided

in notes 7 and A5 respectively. The table also excludes the contractual obligations ofassociates.

2 See note 24.

3 See note 20.

4 Primarily related to network infrastructure.

The nancial commentary on this page forms part of the business review and is unaudited.

93 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information