Vodafone 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

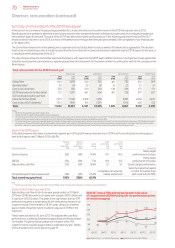

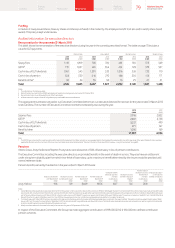

Summary of remuneration for the 2013 nancial year

In this section we summarise the pay packages awarded to our executive directors for performance in the 2013 nancial year versus 2012.

Specically we have provided a table that shows all remuneration that was earned by each individual during the year and computed a single total

remuneration gure for the year. The value of the GSTIP was earned during the year but paid out in the following year and the value of the GLTI

shows that which will vest in June 2013 as a result of the performance through the three year period ended at the completion of our nancial year

on 31 March 2013.

The Committee reviews all incentive awards prior to payment and has full discretion to reduce awards if it believes this is appropriate. The decision

need not be on objective grounds. It should be noted that the Committee did not exercise discretion in determining the GSTIP payout for this year, or

in deciding the nal vesting level of the GLTI.

The only instance where the Committee exercised discretion is with respect to the GSTIP paid to Michel Combes on his departure. It was agreed that

Vodafone would pay him a pro-rata bonus, assuming target level of achievement, for the seven months he continued to work for the company in the

nancial year.

Total remuneration for the 2013 nancial year

Vittorio Colao Andy Halford Michel Combes1Stephen Pusey

2013

£’000

2012

£’000

2013

£’000

2012

£’000

2013

£’000

2012

£’000

2013

£’000

2012

£’000

Salary/fees 1,110 1,099 700 700 461 785 575 569

Benets/other230 24 35 30 16 25 21 21

Cash in lieu of pension 333 330 210 210 138 236 173 171

GSTIP (see below for further detail) 731 1,037 461 654 461 728 379 537

GLTI vesting during the year3 (see

below for further detail) 7,515 11,316 4,368 7,450 –5,861 2,404 4,227

Cash in lieu of GLTI dividends41,313 1,961 763 1,291 –1,016 420 733

Total 11,032 15,767 6,537 10,335 1,076 8,651 3,972 6,258

Notes:

1 Michel Combes was employed until 31 October 2012.

2 Includes amounts in respect of private healthcare and car allowance.

3 The value shown in the 2012 column is the award which vested on 30 June 2012 and is valued using the execution share price on 2 July 2012 of 177.29 pence. The value shown in the 2013 column is the award which vests

on 28 June 2013 and is valued using the closing share price on 31 March 2013 of 186.60 pence. Includes the vesting of an All Share award in 2012.

4 Participants also receive a cash award, equivalent in value to the dividends that would have been paid during the vesting period on any shares that vest. The cash in lieu of dividend value shown in 2012 relates to the award

which vested on 30 June 2012, and the value for 2013 relates to the award which vests on 28 June 2013. We believe this is in line with the future government guidelines issued for reporting a single gure of remuneration

per director. However, it is worth noting that this differs from how the values are reported in the audited tables on page 79, which show the values in the columns in the year they were paid.

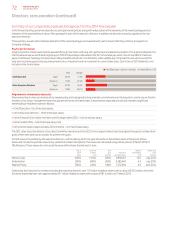

Details of the GSTIP payout

In the table below we describe our achievement against each of the performance measures in our GSTIP and the resulting total incentive payout

level for the year ended 31 March 2013 of 65.9%.

Performance measure

Payout at

target

performance

100%

Payout at

maximum

performance

200%

Actual

payout

%

Target

performance

level

£bn

Actual

performance

level1

£bn Commentary

Service revenue 25% 50% 14.4% 41.1 40.3

Below target

performance in Europe.

EBITDA 25% 50% 7.7% 14.0 13.3

Below target

performance in Europe.

Adjusted free cash ow 20% 40% 18.4% 5.7 5.7 Close to target performance.

Competitive performance assessment 30% 60% 25.4%

Compilation of market by

market assessment

Varies by market but overall

on track for market share

with more to do for NPS.

Total incentive payout level 100% 200% 65.9%

Note:

1 These gures are adjusted to include the removal of the impact of M&A, foreign exchange movements and any changes in accounting treatment.

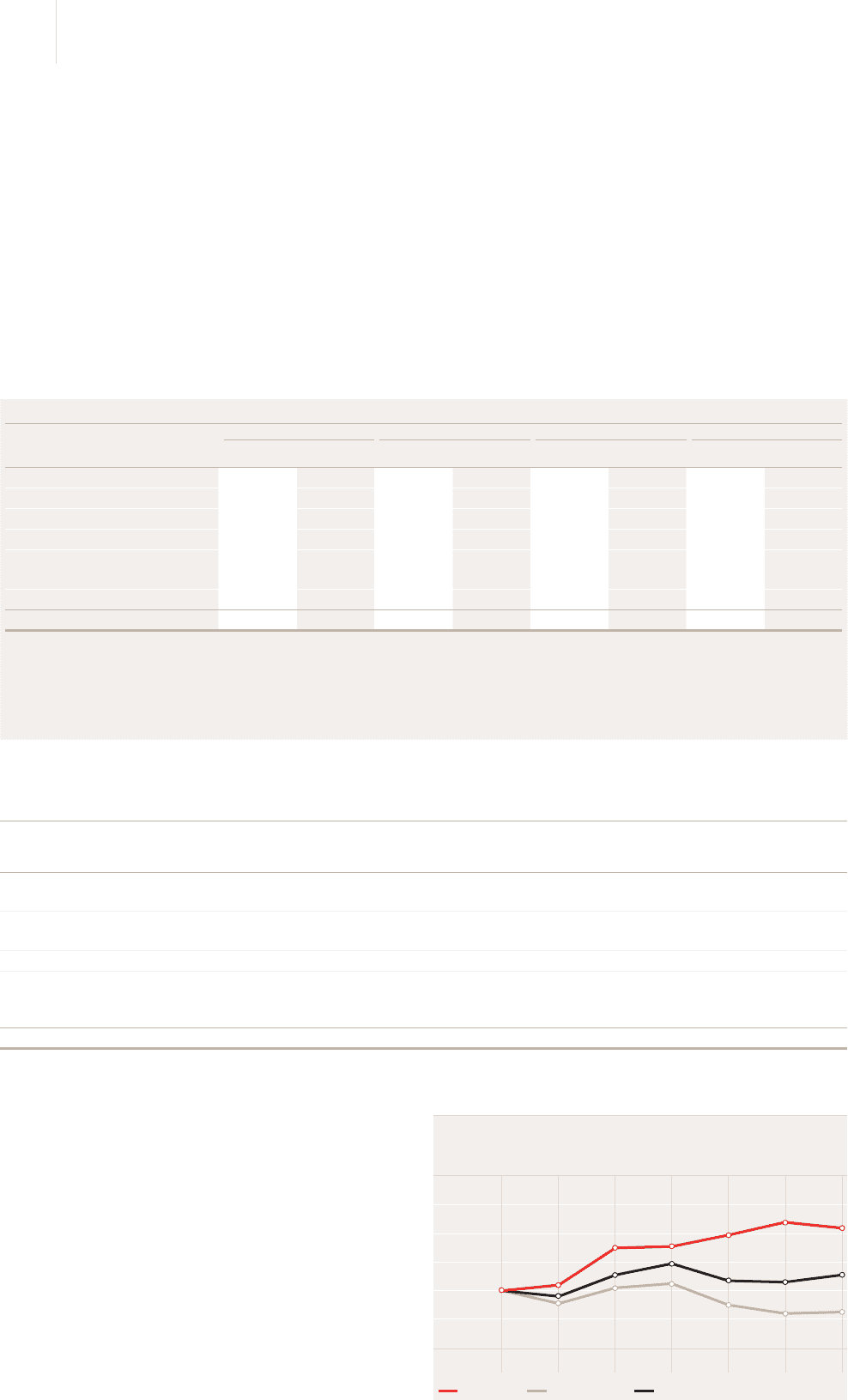

Details of the GLTI vesting in June 2013

Adjusted free cash ow for the three-year period ended on 31 March

2013 was £20.8 billion which compares with a target of £20.5 billion and

amaximum of £23.0 billion. The graph to the right shows that our TSR

performance against our peer group for the same period resulted in an

outperformance of the median by 18.3% a year. Using our combined

payout matrix, this performance resulted in a payout of 56.9% of the

maximum.

These shares will vest on 28 June 2013. The adjusted free cash ow

performance is audited by Deloitte and approved by the Remuneration

Committee. The performance assessment in respect of the TSR

outperformance of a peer group median is undertaken by pwc. Details

of how the plan works can be found on page 76.

2010 GLTI award: TSR performance (growth in the value

of a hypothetical US$100 holding over the performance period,

six month averaging)

160

140

120

100

80

60

03/10 09/10 03/11 09/11 03/12 09/12 03/13

Vodafone Group Median of peer group Outperformance of median of 9% p.a.

100

104

96

91

130

111

102

131

119

105

139

107

90

148

106

84

144

111

85

70 Vodafone Group Plc

Annual Report 2013

Directors’ remuneration (continued)