Vodafone 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Business

review Performance Governance Financials Additional

information

Please see page 179 for “Use of non-GAAP nancial information”,

page 187 for “Denition of terms” and page 185 for “Forward-

looking statements”.

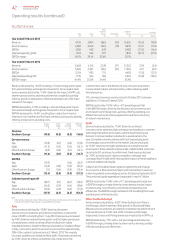

Performance against 2013 nancial year guidance

Based on guidance foreign exchange rates1, and excluding M&A and

restructuring costs, our adjusted operating prot for the 2013 nancial

year was £12.3 billion, above the £11.1 billion to £11.9 billion range set

in May 2012.

On the same basis our free cash ow was £5.8 billion, at the top of the

range of £5.3 billion to £5.8 billion.

2014 nancial year guidance2

Adjusted

operating prot

£bn

Free cash ow

£bn

2014 nancial year guidance 12.0–12.8 Around 7.0

We expect adjusted operating prot to be in the range of £12.0 billion

to £12.8 billion. We expect free cash ow to be around £7.0 billion,

including the £2.1 billion VZW dividend due in June 2013. We expect

capex to remain broadly steady on a constant currency basis.

We expect the Group EBITDA margin, excluding M&A and restructuring

costs, to decline slightly year-on-year, reecting the ongoing weak

macroeconomic environment in Europe.

Dividend policy

After over 22% growth in the ordinary dividend per share over the last

three years, the Board is focused on continuing to balance the long-

term needs of the business with ongoing shareholder remuneration,

and going forward aims at least to maintain the ordinary dividend per

share at current levels.

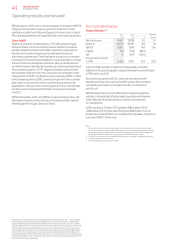

Assumptions

We have based guidance for the 2014 nancial year on our current

assessment of the global macroeconomic outlook and assume foreign

exchange rates of £1:€1.17 and £1:US$1.52. It excludes the impact

of licences and spectrum purchases, additional income dividends from

VZW, material one-off tax-related payments, restructuring costs and

any fundamental structural change to the eurozone. It also assumes

no material change to the current structure of the Group.

Actual foreign exchange rates may vary from the foreign exchange rate

assumptions used. A 1% change in the euro to sterling exchange rate

would impact adjusted operating prot by £30 million and free cash

ow by approximately £20 million. A 1% change in the dollar to sterling

exchange rate would impact adjusted operating prot by approximately

£70 million.

Notes:

1 Guidance foreign exchange rates for the year ended 31 March 2013 were £1:€1.23 and £1:US$1.62.

2 For consistency with the basis of presentation of joint ventures in previous years, guidance does not take

into account the impact on the Group’s nancial results of adopting IFRS 11, Joint Arrangements, for the

year ending 31 March 2014.

Guidance

45 Vodafone Group Plc

Annual Report 2013