Vodafone 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

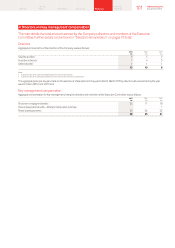

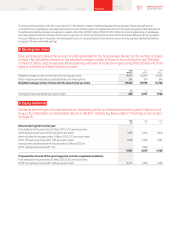

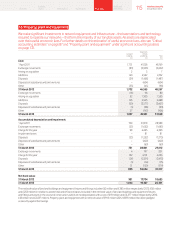

10. Intangible assets

Our statement of nancial position contains signicant intangible assets, mainly in relation to goodwill. Goodwill

arises when we acquire a business and pay a higher amount than the fair value of the net assets of that business

primarily due to the synergies we expect to gain from the acquisition. Goodwill is not amortised but is subject

to annual impairment reviews. We also spend a signicant amount on licences and spectrum which is usually

amortised over the life of the licence. Refer to “Critical accounting estimates” on pages 86 and 87 for further

information on how we calculate the carrying value of our goodwill and intangible assets and our processes for

impairment testing.

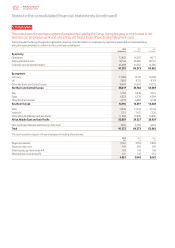

Licences and Computer

Goodwill spectrum software Other Total

£m £m £m £m £m

Cost:

1 April 2011 103,900 30,159 9,949 3,269 147,277

Exchange movements (6,398) (1,804) (539) (306) (9,047)

Arising on acquisition 87 – 19 33 139

Additions – 1,263 1,653 10 2,926

Disposals – – (653) (18) (671)

Disposals of subsidiaries and joint ventures (358) (139) (52) (24) (573)

Other – – 81 32 113

31 March 2012 97,231 29,479 10,458 2,996 140,164

Exchange movements 712 (15) 100 (207) 590

Arising on acquisition 59 28 63 335 485

Additions – 2,440 1,578 – 4,018

Disposals – (9) (603) – (612)

Disposals of subsidiaries and joint ventures – – (4) – (4)

Other (25) (5) – (11) (41)

31 March 2013 97,977 31,918 11,592 3,113 144,600

Accumulated impairment losses and amortisation:

1 April 2011 58,664 10,623 7,135 2,297 78,719

Exchange movements (3,601) (645) (371) (220) (4,837)

Amortisation charge for the year – 1,891 1,298 307 3,496

Impairment losses 3,818 121 – – 3,939

Disposals – – (634) (16) (650)

Disposals of subsidiaries and joint ventures – (34) (23) (20) (77)

Other – – 55 5 60

31 March 2012 58,881 11,956 7,460 2,353 80,650

Exchange movements 1,024 53 81 (145) 1,013

Amortisation charge for the year – 1,782 1,399 266 3,447

Impairment losses 7,700 – – – 7,700

Disposals – (5) (589) – (594)

Disposals of subsidiaries and joint ventures – – (3) – (3)

Other – – – (10) (10)

31 March 2013 67,605 13,786 8,348 2,464 92,203

Net book value:

31 March 2012 38,350 17,523 2,998 643 59,514

31 March 2013 30,372 18,132 3,244 649 52,397

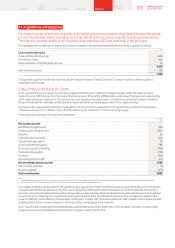

For licences and spectrum and other intangible assets, amortisation is included within the cost of sales line within the consolidated income

statement. Licences and spectrum with a net book value of £2,702 million (2012: £2,991 million) have been pledged as security against borrowings.

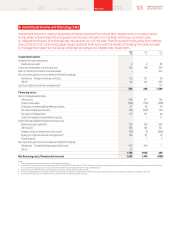

The net book value and expiry dates of the most signicant licences are as follows:

2013 2012

Expiry date £m £m

Germany December 2020/2025 4,329 4,778

UK December 2021/March 2033 3,782 3,250

India December 2026/September 2030 1,493 1,455

Qatar June 2028 1,111 1,125

Italy December 2021/2029 1,717 1,771

Netherlands December 2016/February 2030/May 2030 1,329 234

The remaining amortisation period for each of the licences in the table above corresponds to the expiry date of the respective licence. A summary

of the Group’s most signicant mobile licences can be found on page 178.

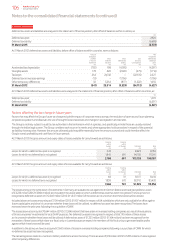

Notes to the consolidated nancial statements (continued)

108 Vodafone Group Plc

Annual Report 2013