Vodafone 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

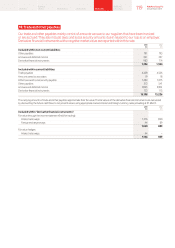

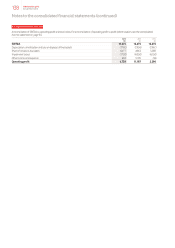

24. Borrowings (continued)

Borrowing facilities

Committed facilities expiry

2013 2012

Drawn Undrawn Drawn Undrawn

£m £m £m £m

Within one year 2,518 837 2,130 451

In one to two years 1,546 50 3,294 592

In two to three years 1,288 3,569 1,746 –

In three to four years 1,14 2 2,794 904 3,527

In four to ve years – – 571 23

In more than ve years 1,188 422 794 3,272

31 March 7,682 7,672 9,439 7,865

At 31 March the Group’s most signicant committed facilities comprised two revolving credit facilities which remain undrawn throughout the period

of €4,230 million (£3,569 million) and US$4,245 million (£2,794 million) maturing in three and ve years respectively. Under the terms of these bank

facilities, lenders have the right, but not the obligation, to cancel their commitment 30 days from the date of notication of a change of control of the

Company and have outstanding advances repaid on the last day of the current interest period. The facility agreements provide for certain structural

changes that do not affect the obligations of the Company to be specically excluded from the denition of a change of control. This is in addition

to the rights of lenders to cancel their commitment if the Company has committed an event of default.

The terms and conditions of the drawn facilities in the Group’s Turkish and Italian operating companies of €400 million and €350 million respectively

and in the Group’s German, Turkish and Romanian xed line operations of €410 million, €150 million and €150 million respectively in addition

to the undrawn facilities in the Group’s xed line operations in Italy and Turkey of €400 million and €100 million respectively, are similar to those

of the US dollar and euro revolving credit facilities. In addition, should the Group’s Turkish operating company spend less than the equivalent

of US$800 million on capital expenditure the Group will be required to repay the drawn amount of the facility that exceeds 50% of the capital

expenditure and should the Group’s Italian operating company spend less than the equivalent of €1,500 million on capital expenditure, the Group

will be required to repay the drawn amount of the facility that exceeds 18% of the capital expenditure. Similarly should the Group’s German,

Italian or Romanian xed line operations spend less that the equivalent of €824 million, €1,252 million and €1,246 million on capital expenditure

respectively, the Group will be required to repay the drawn amount of the facility that exceeds 50% of the capital expenditure.

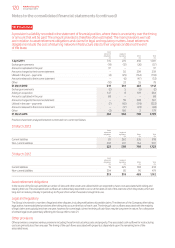

25. Called up share capital

Called up share capital is the number of shares in issue at their par value of 113/7 US cents each. A number

of shares were allotted during the year in relation to employee share option schemes.

2013 2012

Number £m Number £m

Ordinary shares of 113/7 US cents each allotted, issued and fully paid:1

1 April 5 3 , 815 , 0 07, 2 8 9 3,866 56,811,123,429 4,082

Allotted during the year 5,379,020 – 3,883,860 –

Cancelled during the year – – (3,000,000,000) (216)

31 March 53,820,386,309 3,866 53,815,007,289 3,866

Note:

1 At 31 March 2013 the Group held 4,901,767,844 (2012: 4,169,067,107) treasury shares with a nominal value of £352 million (2012: £299 million). The market value of shares held was £9,147 million (2012: £7,179 million).

Duringthe year 161,289,620 (2012: 166,003,556) treasury shares were reissued under Group share option schemes.

Allotted during the year

Nominal Net

value proceeds

Number £m £m

UK share awards and option scheme awards 9,210 – –

US share awards and option scheme awards 5,369,810 – 8

Total for share awards and option scheme awards 5,379,020 – 8

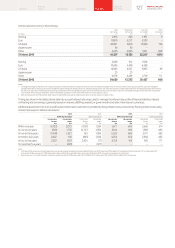

26. Subsequent events

Detailed below are the signicant events that happened after our year end date of 31 March 2013 and before

the signing of this annual report on 21 May 2013.

On 13 May 2013 VZW declared a dividend of US$7.0 billion (£4.6 billion). As a 45% shareholder in VZW, Vodafone’s share of the dividend

is US$3.2billion (£2.1 billion). The dividend will be received by the end of June 2013.

Notes to the consolidated nancial statements (continued)

128 Vodafone Group Plc

Annual Report 2013