Vodafone 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other AMAP

Organic service revenue, which included Australia, declined by

-1.8%*with both New Zealand and Australia being impacted by MTR

cutseffective from 6 May 2011 and 1 January 2012, respectively.

InAustralia, despite improvements in network and customer operations

performance, service revenue declined by -8.8%* driven by the

competitive market and weakness in brand perception following the

network and customer service issues experienced from late 2010

to early 2011 and further accelerated by MTR cuts. On 22 March

2012, Vodafone Hutchison Australia appointed Bill Morrow as its new

CEO. InEgypt service revenue was suppressed by the challenging

economic and political environment, however, organic growth of 1.4%*

was achieved as a result of an increased customer base and strong

data usage. In Qatar an increase in the customer base delivered service

revenue growth of 27.1%*, despite a competitive pricing environment.

Service revenue in Ghana grew by 29.2%* through strong gains in

customer market share.

EBITDA margin declined -2.2* percentage points, driven by the service

revenue decline in Australia and the challenging economic and

competitive environment in Egypt, partially offset by growth in Qatar

and Ghana.

Safaricom, Vodafone’s associate in Kenya, grew service revenue

by 13.6%*, driven by increases in customer base, voice usage and

M-Pesa activity. EBITDA margin improved in the second half of the 2012

nancial year through a tariff increase in October 2011, operating cost

efciencies and a strengthening of the local currency to take the margin

for the 2012 nancial year to 35.0%.

Non-Controlled Interests

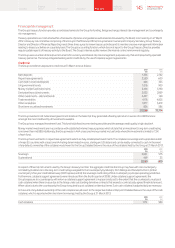

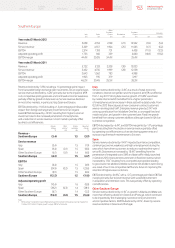

Verizon Wireless1 2 3

2012

£m

2011

£m

% change

£Organic

Service revenue 18,039 17,238 4.6 7.3

Revenue 20,187 18,711 7.9 10.6

EBITDA 7,689 7,313 5.1 7.9

Interest (212) (261) (18.8)

Tax2(287) (235) 22.1

Group’s share of result

in VZW 4,867 4,569 6.5 9.3

In the US VZW reported 4.6 million net mobile customer additions

bringing its closing mobile customer base to 93.0million, up 5.2%.

Service revenue growth of 7.3%* continued to be driven by the

expanding customer base and robust growth in data ARPU driven

byincreased penetration ofsmartphones.

EBITDA margin remained strong despite the competitive challenges

andmacroeconomic environment. Efciencies in operating expenses

and customer acquisition costs resulting from lower volumes were

partly offset by a higher level of customer retention costs reecting the

increased demand for smartphones.

VZW’s net debt at 31 March 2012 totalled US$6.4 billion4 (31March

2011: net debt US$9.8 billion4), after paying a dividend to its

shareholders of US$10 billion on 31 January 2012.

Notes:

1 All amounts represent the Group’s share based on its 45% equity interest, unless otherwise stated.

2 The Group’s share of the tax attributable to VZW relates only to the corporate entities held by the VZW

partnership and certain state taxes which are levied on the partnership. The tax attributable to the

Group’s share of the partnership’s pre-tax prot is included within the Group tax charge.

3 Organic growth rates include the impact of a non-cash revenue adjustment which was recorded to defer

previously recognised data revenue that will be earned and recognised in future periods. Excluding this

the equivalent organic growth rates for service revenue, revenue, EBITDA and the Group’s share of result

in VZW would have been 6.8%*, 10.1%*, 6.7%* and 7.5%* respectively.

4 Net debt excludes pending credit card receipts. Comparatives are presented on a comparable basis.

Liquidity and capital resources

This section includes an analysis of net debt and other disclosures in relation to liquidity and capital resources.

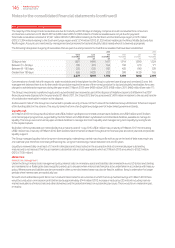

Net debt

Net debt increased by £2.5 billion to £27.0 billion primarily due to the purchase of CWW and TelstraClear, share buybacks, payments to acquire

spectrum, foreign exchange movements and dividend payments to equity holders, partially offset by cash generated by operations, the remaining

consideration from the Group’s disposal of SoftBank Mobile Corp. and the £2.4 billion income dividend from VZW.

Net debt represented 29.5% of our market capitalisation at 31 March 2013 compared to 28.6% at 31 March 2012. Average net debt at month end

accounting dates over the 12 month period ended 31 March 2013 was £24.6 billion and ranged between £22.5 billion and £27.7 billion during the year.

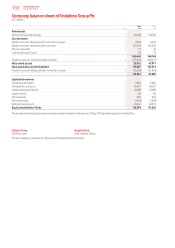

Our consolidated net debt position at 31 March was as follows:

2013 2012

£m £m

Cash and cash equivalents 7, 62 3 7,13 8

Short-term borrowings

Bonds (2,133) (1,289)

Commercial paper1(4,054) (2,272)

Put options over non-controlling interests (938) –

Bank loans (2,929) (1,635)

Other short-term borrowings2(2,235) (1,062)

(12,289) (6,258)

Long-term borrowings

Put options over non-controlling interests (77) (840)

Bonds, loans and other long-term borrowings (29,031) (27,522)

(29,108) (28,362)

Other nancial instruments36,816 3,057

Net debt (26,958) (24,425)

Notes:

1 At 31 March 2013 US$3,484 million was drawn under the US commercial paper programme, and €2,006 million, US$35 million, £10 million and JPY 5 billion were drawn under the euro commercial paper programme.

2 At 31 March 2013 the amount includes £1,151 million (2012: £980 million) in relation to cash received under collateral support agreements.

3 Comprises i) mark-to-market adjustments on derivative nancial instruments which are included as a component of trade and other receivables (2013: £3,032 million; 2012: £2,959 million) and trade and other payables

(2013: £1,104 million; 2012: £889 million) and ii) short-term investments primarily in index linked government bonds and managed investment funds included as a component of other investments (2013: £4,888 million;

2012: £987 million).

155 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information