Vodafone 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

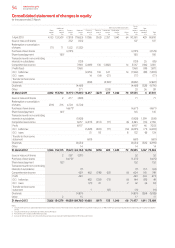

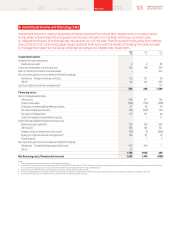

Commentary on the consolidated statement of changes in equity

The consolidated statement of changes in equity

shows the movements in equity shareholders’ funds

and non-controlling interests. Equity shareholders

funds decreased by -7.1% to £71.5 billion as the

prot for the year was more than offset by the

purchase of our own shares under the share buyback

programmes and equity dividends paid.

Further details on the major movements in the year are set out below:

Acquisition of non-controlling interest

We did not acquire any signicant non-controlling interests in the

current year. In the year ended 31 March 2012 we acquired an additional

stake in Vodafone India.

Purchase of own shares

We acquired 894 million of our own shares at a cost of £1.5 billion in the

year. These arose from the two share buyback programmes that were

in place.

a We initiated a £4.0 billion share buyback programme following

the disposal of our entire 44% interest in SFR to Vivendi on 16 June

2011. Under this programme, which was completed in August 2012,

we purchased a total of 2,330,039,575 shares at an average price per

share, including transaction costs, of 171.67 pence.

a Following the receipt of a US$3.8 billion (£2.4 billion) income

dividend from VZW in December 2012, we initiated a £1.5 billion

share buyback programme. The Group placed irrevocable purchase

instructions with a third party to enable shares to be repurchased

on our behalf when we may otherwise have been prohibited from

buying in the market.

The aggregate number of shares and the amount of consideration paid

by the Company in relation to the £1.5 billion buyback programme

at 20 May 2013 was 406 million and £0.7 billion respectively.

The maximum value of shares that may yet be purchased under the

programme at 20 May 2013 is £0.8 billion.

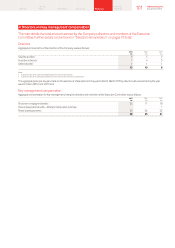

The movement in treasury shares during the year is shown below:

Number

Million £m

1 April 2012 4,169 7,841

Reissue of shares (161) (287)

Purchase of shares 894 1,475

31 March 2013 4,902 9,029

The reissue of shares in the year was to satisfy obligations under

employee share schemes.

Comprehensive income

The Group generated over £0.7 billion of comprehensive income in the

year, primarily a result of the prot for the year attributable to equity

shareholders of £0.4 billion. The reasons underlying the £0.1 billion

increase (2012: £4.7 billion decrease) in comprehensive income are

provided on page 91.

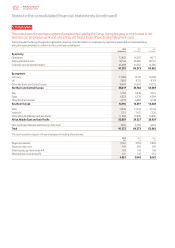

Dividends

We provide returns to shareholders through dividends and have

historically generally paid dividends twice a year in February and

August. The directors expect that we will continue to pay dividends

semi-annually.

The £4.8 billion equity dividend reduction in the current year comprises

£3.2 billion in relation to the nal dividend for the year ended 31 March

2012 and £1.6 billion for the interim dividend for the year ended

31 March 2013. This is reduced from the total £6.7 billion charge

in theprior year primarily due to the special dividend of £2.0 billion

paidin relation to a VZW income dividend received in the prior year.

The interim dividend of 3.27 pence per share announced by the

directors in November 2012 represented a 7.2% increase over last

year’s interim dividend. The directors are proposing a nal dividend

of 6.92 pence per share. Total dividends for the year, excluding the

second interim dividend paid in the prior year, increased by 7.0%

to 10.19pence per share, in line with our dividend per share growth

target of at least 7% per annum for each of the nancial years in the

period ending 31 March 2013, issued in May 2010.

The nancial commentary on this page forms part of the business review and is unaudited.

95 Vodafone Group Plc

Annual Report 2013

Overview Business

review Performance Governance Financials Additional

information