Vodafone 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

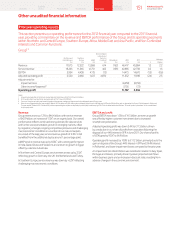

Other unaudited nancial information (continued)

Liquidity and capital resources (continued)

Furthermore, certain of our subsidiaries are funded by external facilities which are non-recourse to any member of the Group other than

the borrower. These facilities may only be used to fund their operations. At 31 March 2013 Vodafone India had facilities of INR 215 billion

(£2.6 billion) of which INR 207 billion (£2.5 billion) is drawn. Vodafone Egypt has partly drawn EGP 1.1 billion (£104 million) from a syndicated

bank facility of EGP 3.67 billion (£355 million) that matures in March 2014. Vodacom had fully drawn facilities of ZAR 5.2 billion (£370 million),

US$60 million (£40 million) and TZS 29 billion (£12 million). Vodafone Americas has a US$1.4 billion (£921 million) US private placement with

a maturity of 17 August 2015 as well as a US$850 million (£559 million) US private placement with a maturity of 11 July 2016. Ghana had a facility

of US$240 million (£158 million) which was fully drawn.

We believe that we have sufcient funding for our expected working capital requirements for at least the next 12 months. Further details regarding

the maturity, currency and interest rates of the Group’s gross borrowings at 31 March 2013 are included in note 24.

Dividends from associates and to non-controlling shareholders

Dividends from our associates are generally paid at the discretion of theBoard of directors or shareholders of the individual operating and holding

companies and we have no rights to receive dividends except where specied within certain of the Group’s shareholders’ agreements. Similarly,

we do not have existing obligations under shareholders’ agreements to pay dividends to non-controlling interest partners of our subsidiaries or joint

ventures, except as specied below.

During the year we received distributions totalling £4.8 billion (2012: £3.8 billion) from VZW, which included a one-off US$3.8billion (£2.4 billion)

(2012: US$4.5 billion, £2.9 billion) income dividend received in December 2012 and tax distributions of £2.4 billion (2012: £965 million) which

is included in dividends received from associates and investments in the cash ows reconciliation as shown on page 97. Until April 2005

VZW’s distributions were determined by the terms of the partnership agreement distribution policy and comprised income distributions and tax

distributions. SinceApril 2005 only tax distributions have been issued, with the exception of the one-off income dividends received in January and

December 2012. Following the announcement ofVZW’s acquisition of Alltel, certain additional tax distributions were agreed in addition to the tax

distributions required by the partnership agreement. These additional distributions will continue until December 2014. Current projections forecast

that tax distributions will cover the US tax liabilities arising from our partnership interest in VZW.

Under the terms of the partnership agreement the VZW board has no obligation to effect additional distributions above the level of the tax

distributions. However, the VZW board has agreed that it will review distributions from VZW on a regular basis. When considering whether

distributions will be made each year, the VZW board will take into account its debt position, the relationship between debt levels and maturities,

and overall market conditions in the context of the ve year business plan.

Verizon Communications Inc. has an indirect 23.1% shareholding in Vodafone Italy and under the shareholders’ agreement the shareholders have

agreed to take steps to cause Vodafone Italy to pay dividends at least annually, provided that such dividends will not impair the nancial condition

or prospects of Vodafone Italy including, without limitation, itscredit standing. During the 2013 nancial year Vodafone Italy paiddividends net

of withholding tax totalling €245 million (2012: €289million) to Verizon Communications Inc.

Potential cash outows from option agreements and similar arrangements

In respect of our interest in the VZW partnership, an option granted to Price Communications, Inc. by Verizon Communications Inc. was exercised

on 15 August 2006. Under the option agreement Price Communications, Inc. exchanged its preferred limited partnership interest in VZW of the

East LP for 29.5 million shares ofcommon stock in Verizon Communications Inc. Verizon Communications Inc. has the right, but not the obligation,

to contributethe preferred interest to the VZW partnership diluting our interest. However, we also have the right to contribute further capital to the

VZW partnership in order to maintain our percentage partnership interest. Such amount, if contributed, wouldbe US$0.8 billion.

In respect of our interest in Vodafone India Limited (‘VIL’), Piramal Healthcare (‘Piramal’) acquired approximately 11% shareholding in VIL from

Essar during the 2012 nancial year. The agreements contemplate various exit mechanisms for Piramal including participating in an initial public

offering by VIL or, if such initial public offering has not completed by 18 August 2013 or 8 February 2014 respectively or Piramal chooses not

to participate in such initial public offering, Piramal selling its shareholding to the Vodafone Group in two tranches of 5.485% for an aggregate price

of approximately INR 83 billion (£1.0 billion).

Off-balance sheet arrangements

We do not have any material off-balance sheet arrangements as dened in item 5.E.2. of the SEC’s Form 20-F. Please refer to notes 20 and 21 for

a discussion of our commitments and contingent liabilities.

158 Vodafone Group Plc

Annual Report 2013