Virgin Media 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

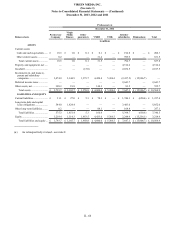

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 71

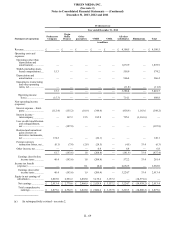

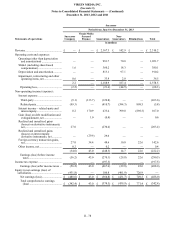

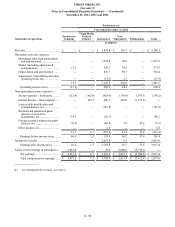

Successor

Period from June 8 to December 31, 2013

Statements of cash flows Successor

Company

Virgin

Media

Finance Other

guarantors VMIH VMIL

All

other

subsidiaries Total

in millions

Cash flows from operating activities:

Net cash provided (used) by operating

activities................................................. £ (98.4) £ (12.4) £ 0.1 £ (77.2) £ — £ 750.4 £ 562.5

Cash flows from investing activities:

Loan to related-party ................................... (65.7) — — — — (2,290.6)(2,356.3)

Capital expenditures.................................... — — — — — (418.9)(418.9)

Other investing activities, net...................... — — — — — 1.8 1.8

Net cash used by investing activities ........ (65.7) — — — — (2,707.7)(2,773.4)

Cash flows from financing activities:

Repayments and repurchases of debt and

capital lease obligations........................... (2,832.7) (1,116.8) — — — (101.3)(4,050.8)

Borrowings of debt...................................... — — — — — 1,983.4 1,983.4

Repayments of related-party notes.............. (1,819.6) — — — — — (1,819.6)

Capital contribution from parent ................. 3,278.0 — — — — — 3,278.0

Release of restricted cash from escrow ....... — 586.0 — — — 1,727.6 2,313.6

Investments from (loans to) parent and

subsidiary companies............................... 1,508.9 537.1 — 32.3 — (2,078.3) —

Net cash received related to derivative

instruments............................................... 343.2 — — 21.1 — — 364.3

Payment of financing costs and debt

premiums.................................................. (30.9) (16.6) — (0.6) — (16.2)(64.3)

Other financing activities, net...................... (0.1) — — — — — (0.1)

Net cash provided (used) by financing

activities................................................. 446.8 (10.3) — 52.8 — 1,515.2 2,004.5

Effect of exchange rates on cash and

cash equivalents................................ 3.2 (1.5) — 0.5 — (7.6)(5.4)

Net increase (decrease) in cash and

cash equivalents................................ 285.9 (24.2) 0.1 (23.9) — (449.7)(211.8)

Cash and cash equivalents:

Beginning of period................................ 27.4 24.3 0.1 24.2 — 478.8 554.8

End of period .......................................... £ 313.3 £ 0.1 £ 0.2 £ 0.3 £ — £ 29.1 £ 343.0