Virgin Media 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.III - 21

______________

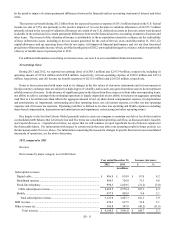

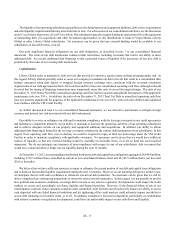

(a) The commitments reflected in this table do not reflect any liabilities that are included in our December 31, 2013 consolidated

balance sheet other than debt and capital lease obligations.

(b) Amounts are based on interest rates, interest payment dates and contractual maturities in effect as of December 31, 2013.

These amounts are presented for illustrative purposes only and will likely differ from the actual cash payments required in

future periods. In addition, the amounts presented do not include the impact of our interest rate derivative contracts, deferred

financing costs, discounts or premiums, all of which affect our overall cost of borrowing.

Network and connectivity commitments include only the fixed minimum commitments associated with our MVNO agreement.

As such, the commitments shown in the above table may be significantly less than the actual amounts we ultimately pay in these

periods.

Programming commitments consist of obligations associated with certain of our programming contracts that are enforceable

and legally binding on us in that we have agreed to pay minimum fees without regard to (i) the actual number of subscribers to

the programming services, (ii) whether we terminate service to a portion of our subscribers or dispose of a portion of our distribution

systems or (iii) whether we discontinue our premium film or sports services. The amounts reflected in the table with respect to

these contracts are significantly less than the amounts we expect to pay in these periods under these contracts. Payments to

programming vendors have in the past represented, and are expected to continue to represent in the future, a significant portion

of our operating costs. In this regard, during the period from June 8 to December 31, 2013, the period from January 1 to June 7,

2013, and the year ended December 31, 2012, and 2011, the programming costs incurred aggregated £307.9 million, £232.3 million,

£505.9 million, and £481.2 million respectively. The ultimate amount payable in excess of the contractual minimums of our content

contracts is dependent upon the number of subscribers to our service.

Purchase commitments include unconditional purchase obligations associated with commitments to purchase customer

premises and other equipment that are enforceable and legally binding on us.

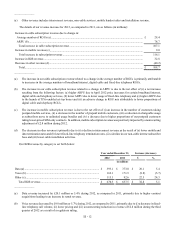

In addition to the commitments set forth in the table above, we have significant commitments under (i) derivative instruments

and (ii) defined benefit plans and similar arrangements, pursuant to which we expect to make payments in future periods. For

information concerning our derivative instruments, including the net cash paid or received in connection with these instruments

during 2013, 2012 and 2011, see note 4. For information concerning our defined benefit plans, see note 13.

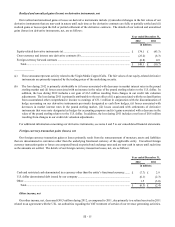

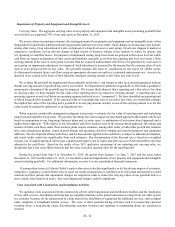

Critical Accounting Policies, Judgments and Estimates

In connection with the preparation of our consolidated financial statements, we make estimates and assumptions that affect

the reported amounts of assets and liabilities, revenue and expenses and related disclosure of contingent assets and liabilities.

Critical accounting policies are defined as those policies that are reflective of significant judgments, estimates and uncertainties,

which would potentially result in materially different results under different assumptions and conditions. We believe the following

accounting policies are critical in the preparation of our consolidated financial statements because of the judgment necessary to

account for these matters and the significant estimates involved, which are susceptible to change:

• Impairment of property and equipment and intangible assets (including goodwill);

• Costs associated with construction and installation activities;

• Useful lives of long-lived assets;

• Fair value measurements; and

• Income tax accounting.

We have discussed the selection of the aforementioned critical accounting policies with the audit committee of Liberty Global’s

board of directors. For additional information concerning our significant accounting policies, see note 2 to our consolidated

financial statements.