Virgin Media 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 24

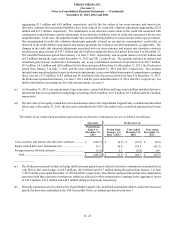

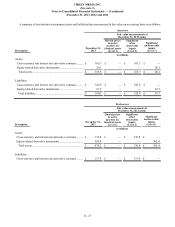

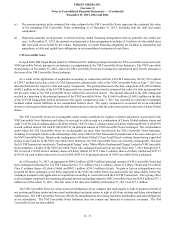

Cross-currency and Interest Rate Derivative Contracts

Cross-currency Swaps:

The terms of our outstanding cross-currency swap contracts at December 31, 2013 which are held by our subsidiary, Virgin

Media Investment Holdings Limited (VMIH), are as follows:

Final maturity date (a)

Notional

amount

due from

counterparty

Notional

amount

due to

counterparty Interest rate due from

counterparty Interest rate due to

counterparty

in millions

February 2022...................... $ 1,400.0 £ 873.6 5.01% 5.35%

June 2020 ............................. $ 1,384.6 £ 901.4 6 mo. US LIBOR + 2.75% 6 mo. LIBOR + 3.18%

October 2020........................ $ 1,370.4 £ 881.6 6 mo. US LIBOR + 2.75% 6 mo. LIBOR + 3.10%

January 2018........................ $ 1,000.0 £ 615.7 6.50% 7.05%

October 2019........................ $ 500.0 £ 302.3 8.38% 9.07%

April 2019............................ $ 291.5 £ 186.2 5.38% 5.49%

November 2016 (b).............. $ 55.0 £ 27.7 6.50% 7.03%

______________

(a) The notional amount of multiple derivative instruments that mature within the same calendar month are shown in the

aggregate and interest rates are presented on a weighted average basis.

(b) Unlike the other cross-currency swaps presented in this table, the identified cross-currency swap does not involve the

exchange of notional amounts at the inception and maturity of the instruments. Accordingly, the only cash flows associated

with this instrument are interest payments and receipts.

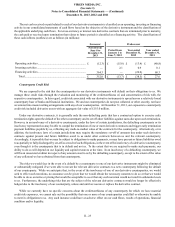

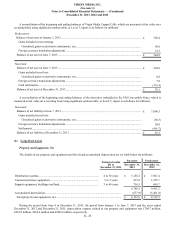

Cross-currency Interest Rate Swaps:

The terms of our outstanding cross-currency interest rate swap contracts at December 31, 2013, which are held by VMIH, are

as follows:

Final maturity date (a)

Notional

amount

due from

counterparty

Notional

amount due to

counterparty Interest rate due from

counterparty Interest rate due to

counterparty

in millions

January 2021....................................... $ 500.0 £ 308.9 5.25% 6 mo. LIBOR + 1.94%

______________

(a) The notional amount of multiple derivative instruments that mature within the same calendar month are shown in the

aggregate and interest rates are presented on a weighted average basis.