Virgin Media 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 39

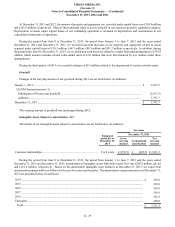

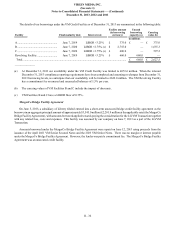

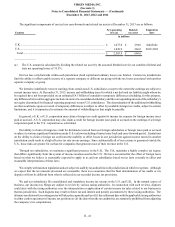

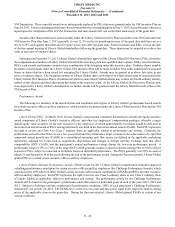

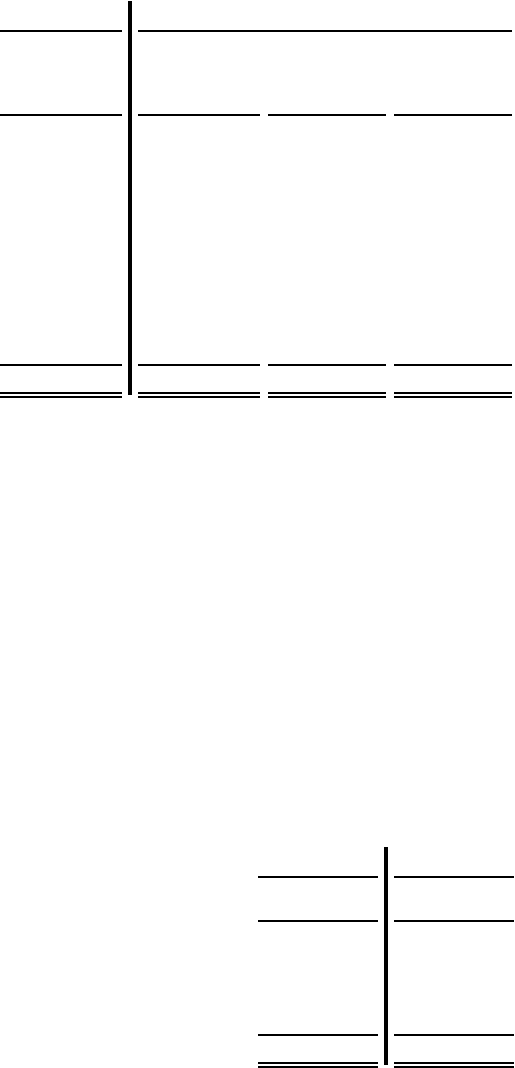

Income tax benefit (expense) attributable to our earnings (loss) from continuing operations before income taxes differs from

the amounts computed using the U.S. federal income tax rate of 35%, as a result of the following (in millions):

Successor Predecessor

Period from

June 8 to

December 31,

2013

Period from

January 1 to

June 7, 2013

Year ended

December 31,

2012 (a)

Year ended

December 31,

2011

Computed “expected” tax benefit (expense).............................. £ 101.7 £ (41.3) £ (91.5) £ (32.6)

Enacted tax law and rate changes (b)......................................... (227.1) — — —

Change in valuation allowances (c) ........................................... (28.8)(29.8) 2,675.7 78.1

Non-deductible or non-taxable interest and other expenses....... 8.9 31.9 52.8 (31.8)

Basis and other differences in the treatment of items

associated with investments in subsidiaries............................ (38.6) — (7.2)(23.4)

International rate differences (d)................................................ (13.1) 22.0 22.8 (5.7)

Other, net.................................................................................... (0.5)(0.9)(0.6)(0.6)

Total......................................................................................... £(197.5) £ (18.1) £ 2,652.0 £ (16.0)

______________

(a) As retrospectively revised - see note 2.

(b) During the first quarter of 2013, it was announced that the U.K. corporate income tax rate will change to 21% in April 2014

and 20% in April 2015. This change in law was enacted in July 2013, and accordingly, the amount presented for 2013

reflects the impact of these future rate changes.

(c) The 2012 amount primarily relates to the reversal of valuation allowances on certain of our U.K. deferred tax assets as these

tax assets were deemed realizable in the period. The reversal of the valuation allowance is attributable to the accumulation

of positive evidence on the realizability of these deferred tax assets, including (i) pre-tax income generated for the each of

the two years ended December 31, 2012, (ii) capital allowances and net operating losses that do not expire, (iii) improved

financial performance and (iv) our then forecasted projections of future taxable income, which, as of the fourth quarter of

2012, outweighed the negative evidence, which was primarily a history of taxable losses in periods prior to 2011.

(d) Amounts reflect statutory rates in the U.K., which are lower than the U.S. federal income tax rate.

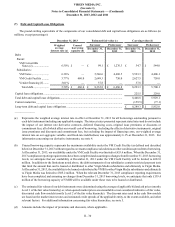

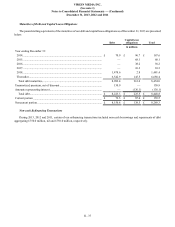

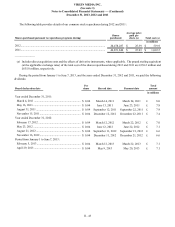

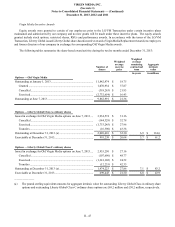

The current and non-current components of our deferred tax assets (liabilities) are as follows (in millions):

Successor Predecessor

December 31,

2013 December 31,

2012 (a)

Current deferred tax assets (b)....................................................................................................... £ 29.1 £ 58.1

Non-current deferred tax assets..................................................................................................... 1,407.4 2,641.7

Non-current deferred tax liabilities (b).......................................................................................... (81.5) —

Net deferred tax asset................................................................................................................. £ 1,355.0 £ 2,699.8

_______________

(a) As retrospectively revised - see note 2.

(b) Our current deferred tax assets are included in other current assets and our non-current deferred tax liabilities are included

in other long-term liabilities in our consolidated balance sheets.