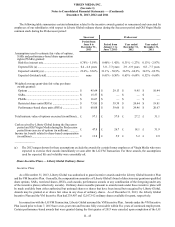

Virgin Media 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 52

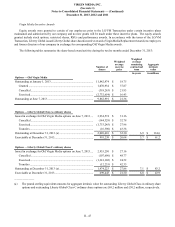

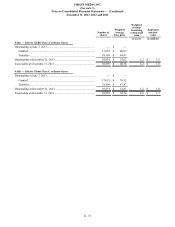

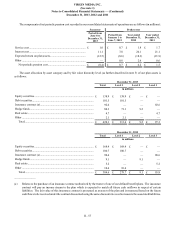

(11) Related-Party Transactions

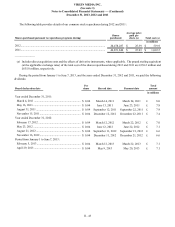

Our related-party transactions are as follows (in millions):

Successor Predecessor

Period from

June 8 to

December 31,

2013

Period from

January 1 to

June 7, 2013

Year ended

December 31,

2012

Year ended

December 31,

2011

Allocated share-based compensation expense.......................... £(85.5) £ — £ — £ —

Interest expense ........................................................................ (5.8) — — —

Interest income.......................................................................... 107.0 — — —

Included in net earnings (loss)............................................. £ 15.7 £ — £ — £ —

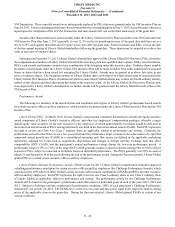

Allocated share-based compensation expense. As further described in note 10, Liberty Global allocates share-based

compensation expense to our company.

Interest expense. Related-party interest expense relates to a related-party note with LGI in connection with the LG/VM

Transaction, which bore interest at a rate of 7.5%. During the Successor period, repayments were made on the note aggregating

£832.3 million and, as of December 31, 2013, the note was fully repaid.

Interest income. These amounts relate to related-party notes as further described below.

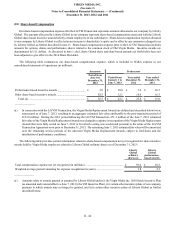

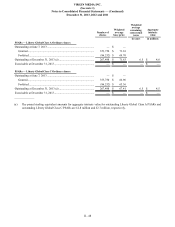

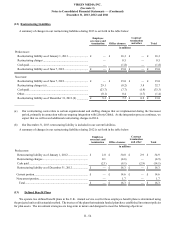

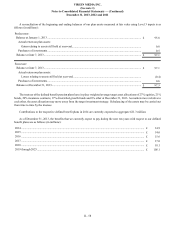

The following table provides details of our related-party balances (in millions):

Successor Predecessor

December 31,

2013 December 31,

2012

Receivables (a).......................................................................................................................... £ 88.1 £ —

Long-term notes receivable (b)................................................................................................. 2,373.5 —

Total..................................................................................................................................... £ 2,461.6 £ —

Other payables (c) (d)............................................................................................................... £ 87.6 £ —

______________

(a) Represents (i) employee withholding taxes collected by LGI on our behalf of £43.3 million (equivalent), (ii) accrued interest

on Virgin Media Finco Limited’s notes receivable from Lynx Europe 2 of £40.2 million (equivalent) and (iii) certain

receivables from other Liberty Global subsidiaries arising in the normal course of business. The accrued interest is payable

semi-annually on April 15 and October 15 and may be cash settled or, if mutually agreed, loan settled. The withholding

taxes and other receivables are settled periodically.

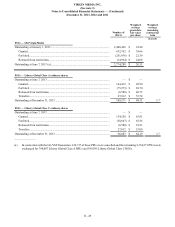

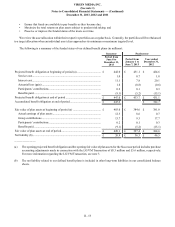

(b) Represents:

(i) notes receivable from Lynx Europe 2 that are owed to our subsidiary, Virgin Media Finco Limited. At December 31,

2013, these notes, which mature on April 15, 2023, had an aggregate principal balance of £2,297.3 million and

bore interest at a rate of 8.5%. During the fourth quarter of 2013, a portion of these notes (£947.3 million) was

redenominated from U.S. dollars to pound sterling. The net increase during the period from June 8 to December

31, 2013 primarily relates to a cash loan of £2,290.6 million (equivalent at the transaction date) and a non-cash

loan relating to deferred financing costs of £40.6 million (equivalent at the transaction date) that were paid by us

on behalf of Lynx Europe 2 and reflected as an increase to the loan balance. Lynx Europe 2 subsequently contributed

the amount related to the deferred financing costs to us. These increases were somewhat offset by declines from

foreign exchange rate movements. The cash loan funded a transaction that occurred shortly after the LG/VM