Virgin Media 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.III - 16

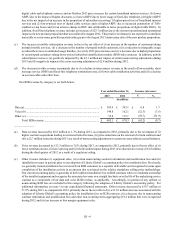

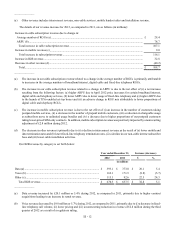

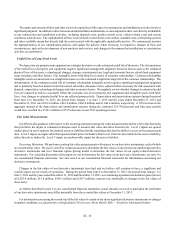

Income tax benefit (expense)

We recognized income tax benefit of £2,652.0 million and income tax expense of £16.0 million during 2012 and 2011,

respectively.

The income tax benefit during 2012 differs from the expected income tax expense of £91.5 million (based on the U.S. federal

income tax rate of 35%) due primarily to the positive impacts of (i) a net decrease in valuation allowances of £2,675.7 million

primarily related to the reversal of valuation allowances on certain of our U.K. deferred tax assets as these tax assets were deemed

realizable in the period and (ii) certain permanent differences between the financial and tax accounting treatment of interest and

other items. The reversal of the valuation allowance is attributable to the accumulation of positive evidence on the realizability

of these deferred tax assets, including (i) pre-tax income generated for the each of the two years ended December 31, 2012, (ii)

capital allowances and net operating losses that do not expire, (iii) improved financial performance and (iv) our then forecasted

projections of future taxable income, which, as of the fourth quarter of 2012, outweighed the negative evidence, which was primarily

a history of taxable losses in periods prior to 2011.

The income tax expense during 2011 differs from the expected income tax expense of £32.6 million (based on the U.S. federal

income tax rate of 35%) due primarily to the positive impact of a net decrease in valuation allowances. The positive impact of

this item was partially offset by the negative impacts of (i) certain permanent differences between the financial and tax accounting

treatment of interest and other items and (ii) certain permanent differences between the financial and tax accounting treatment of

items associated with investments in subsidiaries.

For additional information concerning our income taxes, see note 8 to our consolidated financial statements.

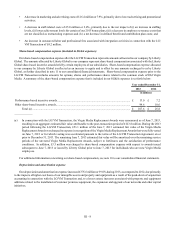

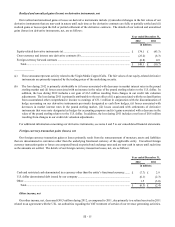

Earnings (loss) from continuing operations

During 2012 and 2011, we reported earnings from continuing operations of £2,913.4 million and £77.1 million, respectively,

including (i) operating income of £698.8 million and £536.7 million, respectively, (ii) non-operating expense of £437.4 million

and £443.6 million, respectively, and (iii) income tax benefit (expense) of £2,652.0 million and (£16.0 million), respectively.

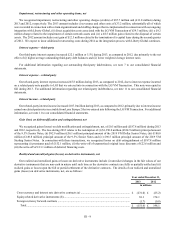

Liquidity and Capital Resources

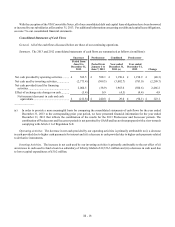

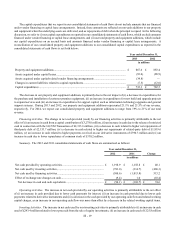

Sources and Uses of Cash

Cash and cash equivalents

Although our consolidated subsidiaries have generated cash from operating activities, the terms of the instruments governing

the indebtedness of certain of these subsidiaries may restrict our ability to access the assets of these subsidiaries. At December 31,

2013, we had cash and cash equivalents of £343.0 million, of which £29.7 million was held by our subsidiaries. In addition, our

ability to access the liquidity of our subsidiaries may be limited by tax and legal considerations and other factors.

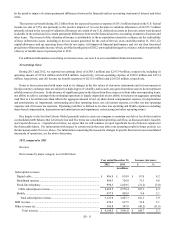

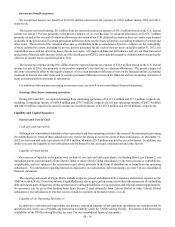

Liquidity of Virgin Media

Our sources of liquidity at the parent level include (i) our cash and cash equivalents, (ii) funding from Lynx Europe 2, our

immediate parent, (and ultimately from Liberty Global or other Liberty Global subsidiaries) in the form of loans or contributions,

as applicable, and (iii) subject to the restrictions noted above, proceeds in the form of distributions or loans from our operating

subsidiaries. For information regarding limitations imposed by our subsidiaries’ debt instruments, see note 7 to our consolidated

financial statements.

The ongoing cash needs of Virgin Media include corporate general and administrative expenses and interest expense on the

VM Convertible Notes. From time to time, Virgin Media may also require cash in connection with (a) the repayment of outstanding

debt and related-party obligations, (b) the satisfaction of contingent liabilities or (c) acquisitions and other investment opportunities.

No assurance can be given that funding from Lynx Europe 2 (and ultimately from Liberty Global or other Liberty Global

subsidiaries), our subsidiaries or external sources would be available on favorable terms, or at all.

Liquidity of our Operating Subsidiaries

In addition to cash and cash equivalents, the primary sources of liquidity of our operating subsidiaries are cash provided by

operations and, in the case of VMIH, any borrowing availability under the VM Revolving Facility. For details of the borrowing

availability of the VM Revolving Facility, see note 7 to our consolidated financial statements.