Virgin Media 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 17

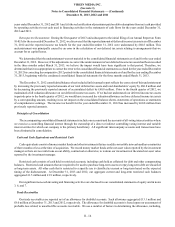

Income Taxes

Income taxes are accounted for under the asset and liability method. We recognize deferred tax assets and liabilities for the

future tax consequences attributable to differences between the financial statement carrying amounts and income tax basis of assets

and liabilities and the expected benefits of utilizing net operating loss and tax credit carryforwards, using enacted tax rates in effect

for each taxing jurisdiction in which we operate for the year in which those temporary differences are expected to be recovered

or settled. We recognize the financial statement effects of a tax position when it is more-likely-than-not, based on technical merits,

that the position will be sustained upon examination. Net deferred tax assets are then reduced by a valuation allowance if we

believe it is more-likely-than-not such net deferred tax assets will not be realized. The effect on deferred tax assets and liabilities

of a change in tax rates is recognized in earnings in the period that includes the enactment date. Deferred tax liabilities related to

investments in foreign subsidiaries and foreign corporate joint ventures that are essentially permanent in duration are not recognized

until it becomes apparent that such amounts will reverse in the foreseeable future. Interest and penalties related to income tax

liabilities are included in income tax expense. For additional information on our income taxes, see note 8.

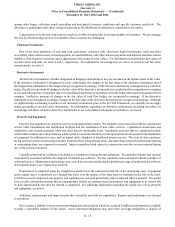

Defined Benefit Plans

We maintain employee defined benefit plans. Certain assumptions and estimates must be made in order to determine the costs

and future benefits that will be associated with these plans. These assumptions include (i) the estimated long-term rates of return

to be earned by plan assets, (ii) the estimated discount rates used to value the projected benefit obligations and (iii) estimated wage

increases. We estimate discount rates annually based upon the yields on high-quality fixed-income investments available at the

measurement date and expected to be available during the period to maturity of the benefits under the defined benefit plan. For

the long-term rates of return, we use a model portfolio based on our targeted asset allocation. To the extent that net actuarial gains

or losses exceed 10% of the greater of plan assets or plan liabilities, such gains or losses are amortized over the average future

service period of plan participants. For additional information, see note 13.

Foreign Currency Translation and Transactions

The reporting currency of our company is the pound sterling. The functional currency of our foreign operations generally is

the applicable local currency for each foreign subsidiary. Assets and liabilities of foreign subsidiaries (including intercompany

balances for which settlement is not anticipated in the foreseeable future) are translated at the spot rate in effect at the applicable

reporting date. With the exception of certain material transactions, the amounts reported in our consolidated statements of operations

are translated at the average exchange rates in effect during the applicable period. The resulting unrealized cumulative translation

adjustment, net of applicable income taxes, is recorded as a component of accumulated other comprehensive earnings or loss in

our consolidated statements of equity. With the exception of certain material transactions, the cash flows from our operations in

foreign countries are translated at the average rate for the applicable period in our consolidated statements of cash flows. The

impacts of material transactions generally are recorded at the applicable spot rates in our consolidated statements of operations

and cash flows. The effect of exchange rates on cash balances held in foreign currencies are separately reported in our consolidated

statements of cash flows.

Transactions denominated in currencies other than our subsidiaries’ functional currencies are recorded based on exchange

rates at the time such transactions arise. Changes in exchange rates with respect to amounts recorded in our consolidated balance

sheets related to these non-functional currency transactions result in transaction gains and losses that are reflected in our consolidated

statements of operations as unrealized (based on the applicable period end exchange rates) or realized upon settlement of the

transactions.

Revenue Recognition

Service Revenue — Cable Networks. We recognize revenue from the provision of digital cable, broadband internet and fixed-

line telephony services over our cable network to customers in the period the related services are provided. Installation revenue

(including reconnect fees) related to services provided over our cable network is recognized as revenue in the period during which

the installation occurs to the extent these fees are equal to or less than direct selling costs, which costs are expensed as incurred.

To the extent installation revenue exceeds direct selling costs, the excess revenue is deferred and amortized over the average

expected subscriber life.