Virgin Media 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 30

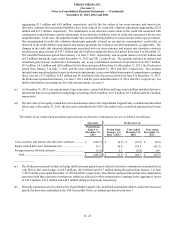

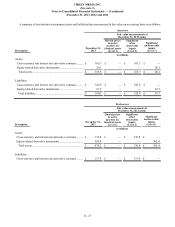

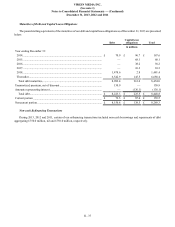

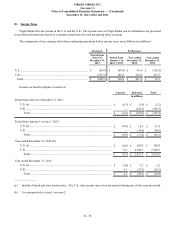

(7) Debt and Capital Lease Obligations

The pound sterling equivalents of the components of our consolidated debt and capital lease obligations are as follows (in

millions, except percentages):

December 31, 2013 Estimated fair value (c) Carrying value (d)

Weighted

average

interest rate (a)

Unused

borrowing

capacity (b)

Successor Predecessor Successor Predecessor

December 31,

2013 December 31,

2012 December 31,

2013 December 31,

2012

Debt:

Parent:

VM Convertible

Notes (e)....................... 6.50% £ — £ 99.1 £ 1,276.3 £ 34.7 £ 544.0

Subsidiaries:

VM Notes ........................ 6.36% — 5,546.6 4,660.5 5,523.3 4,406.1

VM Credit Facility .......... 3.77% 660.0 2,649.3 750.0 2,627.5 750.0

Vendor financing (f)........ 3.01% — 37.8 — 37.8 —

Total debt...................... 5.50% £ 660.0 £ 8,332.8 £ 6,686.8 8,223.3 5,700.1

Capital lease obligations .............................................................................................................. 225.5 229.0

Total debt and capital lease obligations....................................................................................... 8,448.8 5,929.1

Current maturities ........................................................................................................................ (159.5)(77.1)

Long-term debt and capital lease obligations .............................................................................. £ 8,289.3 £ 5,852.0

______________

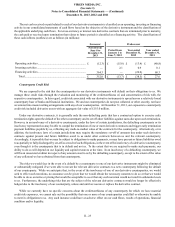

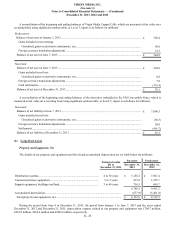

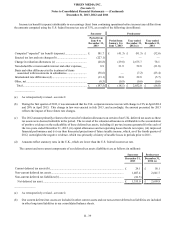

(a) Represents the weighted average interest rate in effect at December 31, 2013 for all borrowings outstanding pursuant to

each debt instrument including any applicable margin. The interest rates presented represent stated rates and do not include

the impact of our interest rate derivative contracts, deferred financing costs, original issue premiums or discounts or

commitment fees, all of which affect our overall cost of borrowing. Including the effects of derivative instruments, original

issue premiums and discounts and commitment fees, but excluding the impact of financing costs, our weighted average

interest rate on our aggregate variable- and fixed-rate indebtedness was approximately 6.1% at December 31, 2013. For

information concerning our derivative instruments, see note 4.

(b) Unused borrowing capacity represents the maximum availability under the VM Credit Facility (as defined and described

below) at December 31, 2013 without regard to covenant compliance calculations or other conditions precedent to borrowing.

At December 31, 2013, our availability under the VM Credit Facility was limited to £653.6 million. When the December 31,

2013 compliance reporting requirements have been completed and assuming no changes from December 31, 2013 borrowing

levels, we anticipate that our availability at December 31, 2013 under the VM Credit Facility will be limited to £622.0

million. In addition to the limitations noted above, the debt instruments of our subsidiaries contain restricted payment tests

that limit the amount that can be loaned or distributed to other Virgin Media subsidiaries and ultimately to Virgin Media.

At December 31, 2013, the availability to be loaned or distributed by VMIH to other Virgin Media subsidiaries and ultimately

to Virgin Media was limited to £305.2 million. When the relevant December 31, 2013 compliance reporting requirements

have been completed and assuming no changes from December 31, 2013 borrowing levels, we anticipate that only £139.4

million of the borrowing capacity of VMIH will be available under these tests to be loaned or distributed.

(c) The estimated fair values of our debt instruments were determined using the average of applicable bid and ask prices (mostly

Level 1 of the fair value hierarchy) or, when quoted market prices are unavailable or not considered indicative of fair value,

discounted cash flow models (mostly Level 2 of the fair value hierarchy). The discount rates used in the cash flow models

are based on the market interest rates and estimated credit spreads of the applicable entity, to the extent available, and other

relevant factors. For additional information concerning fair value hierarchies, see note 5.

(d) Amounts include the impact of premiums and discounts, where applicable.