Virgin Media 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC.

(See note 1)

Notes to Consolidated Financial Statements — (Continued)

December 31, 2013, 2012 and 2011

II - 20

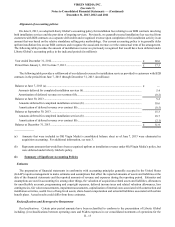

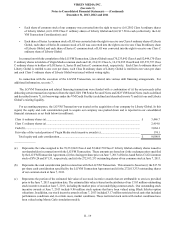

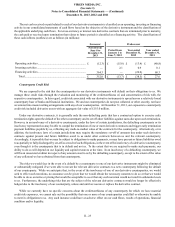

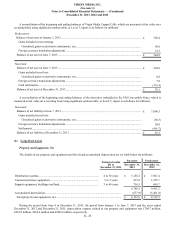

A reconciliation of the purchase consideration pushed down to amounts recorded in the opening additional paid-in capital of

our company is set forth below (in millions):

Purchase consideration ......................................................................................................................................... £ 9,098.9

Contributed debt (a).............................................................................................................................................. (3,096.5)

Other net assets (b) ............................................................................................................................................... 144.9

Opening push-down equity.............................................................................................................................. £ 6,147.3

______________

(a) Amount consists of obligations pursuant to (i) a £2,281.9 million third-party bridge loan that was subsequently repaid during

June 2013 following the LG/VM Transaction and (ii) an £814.6 million related-party loan payable to a subsidiary of Liberty

Global, both of which were assumed by our company as a part of the LG/VM Transaction. The proceeds from these loans

were used by Liberty Global prior to the LG/VM Transaction to fund the cash portion of the purchase consideration and

other related costs.

(b) In connection with the LG/VM Transaction, certain subsidiaries of Liberty Global were contributed to or merged into our

company immediately following the LG/VM Transaction. The opening equity of our company after the LG/VM Transaction

includes equity of these entities, which included (i) an accumulated deficit of £107.3 million on the contribution date and

(ii) cash of £107.7 million on the contribution date.

Direct transaction costs associated with the LG/VM Transaction of £54.3 million, including professional fees and other related

costs, have been expensed as incurred. With the exception of £0.7 million, these transaction costs were incurred prior to June 8,

2013.

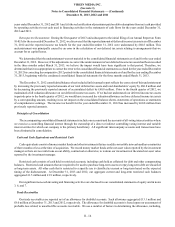

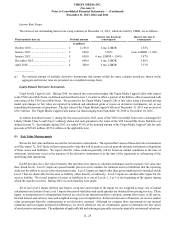

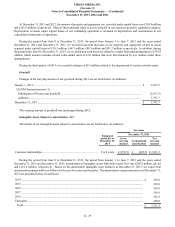

The LG/VM Transaction has been accounted for using the acquisition method of accounting, whereby the total purchase price

was allocated to the acquired identifiable net assets based on assessments of their respective fair values, and the excess of the

purchase price over the fair values of these identifiable net assets was allocated to goodwill. A summary of the purchase price and

opening balance sheet pushed down to our company as of the June 7, 2013 acquisition date is presented in the following table.

The opening balance sheet presented below reflects our final purchase price allocation (in millions).

Cash and cash equivalents (a)............................................................................................................................... £ 447.1

Other current assets............................................................................................................................................... 598.4

Property and equipment, net................................................................................................................................. 6,348.7

Goodwill (b).......................................................................................................................................................... 5,793.7

Intangible assets subject to amortization (c)......................................................................................................... 2,527.0

Other assets, net.................................................................................................................................................... 2,098.0

Current portion of debt and capital lease obligations........................................................................................... (762.4)

Other accrued and current liabilities (d) (e) (f)..................................................................................................... (2,284.8)

Long-term debt and capital lease obligations....................................................................................................... (5,456.8)

Other long-term liabilities (f)................................................................................................................................ (210.0)

Total purchase price......................................................................................................................................... £ 9,098.9

______________

(a) Excludes £107.7 million of cash balances of certain subsidiaries of Liberty Global that were contributed to or merged into

our company immediately following the LG/VM Transaction, as discussed above.

(b) The goodwill recognized in connection with the LG/VM Transaction is primarily attributable to (i) the ability to take

advantage of Virgin Media’s existing advanced broadband communications network to gain immediate access to potential

customers and (ii) substantial synergies that are expected to be achieved through the integration of Virgin Media with Liberty

Global’s other broadband communications operations in Europe.